An every two weeks savings plan is a realistic and practical approach to save money without feeling pressurized or stressed. Instead of saving big amounts at once, a two weeks savings plan can help you save a small and manageable amount of money. By saving every two weeks, the process feels more manageable and realistic, especially when you have bills, daily expenses, and unexpected costs. This method works well for people who get paid bi-weekly or prefer a flexible routine that fits real life. You can start with any amount that feels comfortable and slowly increase it as your confidence grows. Over time, these small savings add up and help you develop better money habits. This article will help you explore the dynamics of a 2 weeks savings plan, allowing saving to become easier, more natural, and less overwhelming.

1. Start With an Amount You Can Afford

When starting an every two weeks savings plan, it is important to choose an amount that feels comfortable and does not interfere with your daily expenses or create unnecessary stress in your routine. Even a small amount works well in the beginning, because saving $10, $20, or $30 every two weeks is still meaningful progress toward building a habit.

The main goal is not to struggle or feel pressured, but to create a routine that feels manageable and realistic. When you save an amount you can truly afford, you are more likely to stay consistent and committed. As time passes and saving begins to feel normal, your confidence naturally grows, making it easier to slowly increase the amount without feeling overwhelmed.

2. Save on the Same Day Every Two Weeks

Choosing a fixed day for saving can make the entire process much easier and more organized, especially when that day matches your income schedule or payday. Saving on the same day every two weeks helps you set aside money before it gets spent on other things, which reduces the chances of skipping or delaying your savings.

Over time, this routine becomes automatic, and saving starts to feel like a normal part of your financial life rather than a task you have to think about. Treating your savings like an important bill builds discipline and control, while consistency allows your money to grow quietly and steadily in the background.

3. Keep Your Savings Separate

Keeping your savings in a separate account is a simple but powerful step that helps protect your money from accidental spending and impulse purchases. When your savings and spending money are mixed together, it becomes much easier to dip into savings for small and unnecessary expenses without realizing it.

A separate savings account creates a clear boundary, making it easier to track your progress and stay focused on your goal. Watching your savings balance grow over time builds motivation and confidence, and even small amounts begin to feel valuable and meaningful.

4. Make Saving Automatic

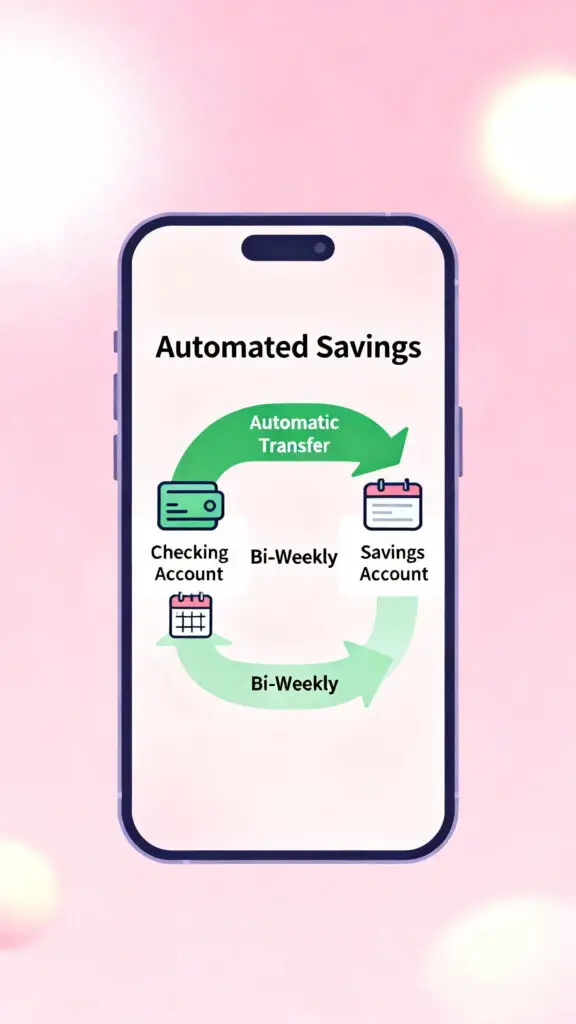

Making your savings automatic can remove much of the effort and stress that often comes with saving money regularly, because it allows you to set aside money without having to remember or make a decision every two weeks. When an automatic transfer is set up, the money moves into your savings account on its own, reducing the temptation to skip saving or spend that money elsewhere.

This method works especially well for busy schedules, since your savings continue to grow even when life gets hectic. Over time, automatic saving helps build consistency and discipline, turning saving into a natural habit that happens in the background without constant attention or effort.

5. Increase Your Savings Slowly

As you become more comfortable with saving every two weeks, you may reach a point where increasing your savings feels possible and less intimidating than it once did. Instead of making a large jump, increasing your savings slowly by a small amount allows you to adjust without putting pressure on your budget or daily expenses.

Even a small increase makes a difference over time, and these gradual changes feel more sustainable and realistic. Growing your savings at a steady pace helps you stay motivated while ensuring that saving continues to feel manageable rather than stressful.

6. Plan Around Your Monthly Expenses

Planning your savings around your monthly expenses helps create balance and prevents financial strain, especially when bills, groceries, and other responsibilities already take up a large portion of your income. By understanding where your money goes each month, you can decide how much to save every two weeks without affecting your ability to meet essential needs.

This approach makes saving feel safer and more controlled, while also reducing the risk of skipping deposits due to poor planning. When saving fits naturally into your budget, consistency becomes easier and stress becomes less common.

7. Use Extra Money to Boost Savings

Extra money can be a helpful way to strengthen your every two weeks savings plan without putting pressure on your regular income or budget. This extra money may come from bonuses, gifts, refunds, or small side earnings, and even saving a portion of it can make a noticeable difference over time.

Using extra money for savings feels easier because it does not affect your daily expenses, while also helping your savings grow faster. This approach allows you to stay flexible, feel rewarded for unexpected income, and make steady progress toward your goals without feeling restricted.

8. Do Not Quit If You Miss One Deposit

Missing one savings deposit does not mean your plan has failed, because unexpected expenses and difficult weeks are a normal part of real life. What matters most is continuing with your savings plan instead of giving up completely due to one missed step.

Saving is a long-term process, and progress is built through consistency over time rather than perfection.

9. Track Your Savings Progress

Tracking your savings progress helps you stay motivated and aware of how far you have come, even when the amounts seem small at first. Writing down each deposit or checking your savings balance regularly allows you to see your efforts turning into real results.

This awareness builds confidence and encourages consistency, making saving feel more rewarding and purposeful. When you can clearly see your progress, it becomes easier to stay focused on your goal and committed to your every two weeks savings plan.

10. Build an Emergency Fund First

An every two weeks savings plan is a great way to start building an emergency fund, which can protect you during unexpected situations like medical bills, repairs, or sudden expenses. Having even a small emergency fund can reduce stress and prevent you from relying on loans or credit during difficult times.

By focusing on this goal first, your savings begin to serve a clear purpose, which makes the habit feel more meaningful and motivating. Over time, this fund provides a sense of security and control, helping you feel more prepared and confident when life does not go as planned.

11. Stay Patient and Consistent

Saving money is a process that takes time, and it is normal if progress feels slow in the beginning. Staying patient helps you avoid frustration, while consistency ensures that your savings continue to grow steadily over time. Small deposits made every two weeks may not seem like much at first, but they add up quietly in the background.

When you trust the process and remain committed, saving becomes easier and less stressful, allowing good financial habits to form naturally without pressure or burnout.

12. Turn Saving Into a Long-Term Habit

The true value of an every two weeks savings plan lies in the habit it helps you build rather than the amount you save in a short period of time. Once saving becomes part of your routine, it no longer feels forced or difficult. This long-term habit stays with you even after reaching one goal, helping you continue saving for future needs and plans.

Over time, this mindset creates financial stability and confidence, making saving a natural part of your everyday life.

Conclusion

An every two weeks savings plan shows that saving money does not have to be stressful, confusing, or hard to follow when it is based on small and steady steps. By saving a manageable amount every two weeks, you build a routine that fits into real life without pressure. This method allows you to adjust when expenses change while still moving forward. Over time, these small savings turn into a helpful amount of money and build trust in your ability to manage your finances. The habit you create is often more important than the amount saved, because it teaches patience, control, and better money choices. As saving becomes part of your routine, you start to feel calmer and more prepared for future needs. With time, consistency, and a simple approach, this plan can bring long-term stability, confidence, and peace of mind in your daily life, helping you feel safe, secure, and proud of your progress.

Leave a Reply