Saving money isn’t just about utilizing discount vouchers or coupons or skipping coffee, it’s about maintaining a balance between spending, saving, and building potential for long-term financial security. Whether you’re living paycheck to paycheck or trying to build savings over time, having some tips and tricks can put you back in control. This article will help you explore the 17 best money-saving tips you can’t miss out on!

1. Track Every Dollar you Spend

Starting off on this tip involves writing down everything you buy in a week. Include the smallest of expenses as well, even that $2 coffee. You’ll likely be surprised to find out where your paycheck goes.

All you need is a diary or if you prefer a digital approach, go for budgeting apps like YNAB to get a vivid picture of your expenses. This tip keeps you informed with your spending habits, helping you make intentional and informed choices in the future.

2. Schedule a No-Spend Day Every Week

Schedule one day in a week where you commit to not spending a single dollar. This tip pushes you to be creative and challenges your problem-solving techniques like none other. With whatever resources you have, this tip helps you to be mindful and develops financial discipline.

Even skipping one takeout order a week can save you hundreds of dollars annually, teaching you how little you can spend.

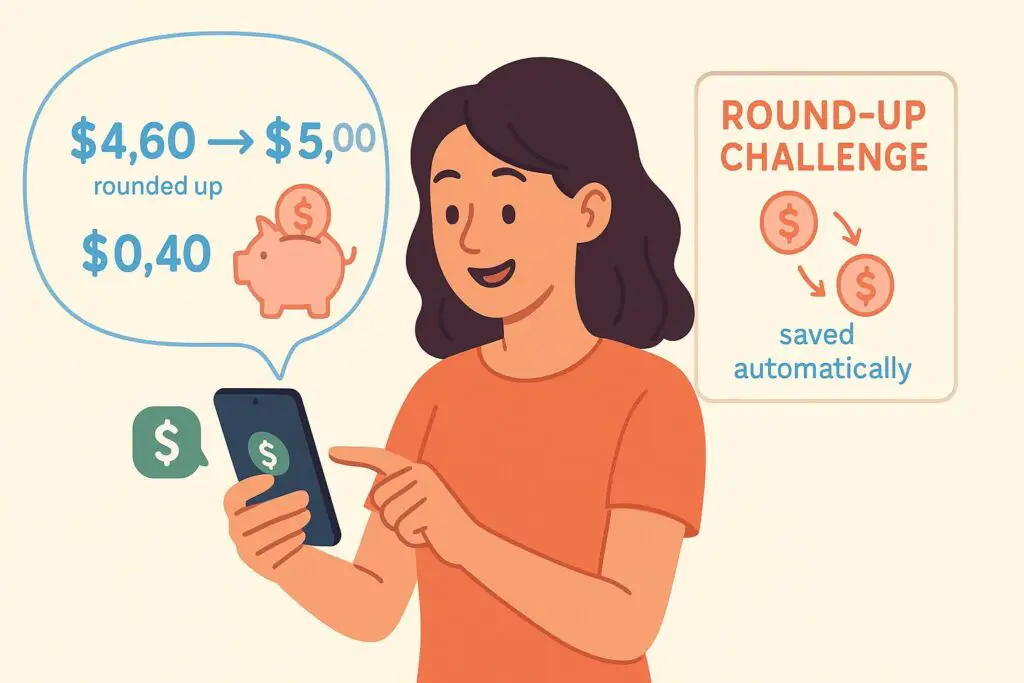

3. Automate Your Savings

Treat your savings like a non-negotiable bill, to help you stay consistent and develop discipline in your spending habits. Set up automatic transfers from your bank account to your savings account right after you get paid.

Even starting with $20 a week, transferred to savings can add up over time without having you feel the pinch. Smaller amounts building up to large savings is a highly fruitful approach, making it a considerable option if you desire to save in an effective yet effortless way.

4. Use the 24-Hour Rule Before Buying

Impulse purchases often happen in a moment of excitement or stress, especially when shopping is just a click away. You might come across something that feels like a must-have in the moment, but here’s a helpful habit: wait 24 hours before buying it.

This short pause gives you space and time to reflect, impacting your decisions. More often than not, the urge fades, and you’ll be glad you held off. Over time, this simple shift in behavior can save you hundreds and help you spend more wisely and intentionally.

5. Unsubscribe Tempting Emails

Retailers often flood your inbox with tempting emails like “limited-time offer” that attracts you to spend. Take 5 minutes of your time and unsubscribe from store newsletter or deal alerts and save yourself from impulsive future purchasing.

Fewer ads mean fewer unnecessary purchases. Simply put, out of sight, out of cart. Consider this fruitful tip to help you save money through a much more effective approach.

6. Buy Generic Whenever Possible

Store-brand products are often made in the same factories as name brands, just with different labels. This applies to everything, from medication to pantry staples.

So the next time you’re out shopping at Target or Walmart, check out their in-house brands, and you’ll save a few bucks without having to compromise over quality.

7. Set Clear and Realistic Financial Goals

Saving is easier when you have set clear and realistic goals and know what you’re saving for. Whether it’s for building an emergency fund, achieving a future financial goal, or getting into college, having a clear direction can help you stay motivated and make saving more rewarding.

A better way to approach this tip is to write down your goal, how you’re going to achieve it, how much amount would you need, and what would be the timeline.

8. Switch to a Cash-Only System for Daily Spending

Try using the actual cash system for daily spending like gas, takeouts, or groceries. Handing over cash from your hand makes you think twice before spending money.

Fix a certain amount allocated to particular categories, making you only use the designated amount and helping you avoid overspending. This is also the core idea behind the envelope budgeting system.

9. Prep Meals at Home

Instead of spending hundreds of dollars on takeout each monch, prepare meals in advance and save time, money and calories. Spend a few hours on Sunday chopping, portioning, and storing meals for the whole week.

Having stored food can make you resist DoorDash or UberEats when you’re tired, ultimately leading to less food wastage and reduced grocery trips.

10. Cancel Unused and Unnecessary Subscriptions

Keep a track of your streaming services, music, cloud storage, or fitness apps you’ve subscribed to. These subscriptions quietly consume your bank balance, making you wonder where your paycheck goes.

Take into consideration what subscriptions you actually use and cancel the rest. Even two to three cancelled subscriptions could free up around $50-$100 per month. Transfer that amount straight into your savings.

11. Build a Small Emergency Fund

Another effective way to save money is through setting up an emergency fund. Start with a small amount like $500 in one month and gradually increase the amount to help keep you motivated and consistent with the process.

Use a separate savings account and transfer the amount the day you get your paycheck to avoid any temptations to dip into the savings. Saving even a small amount can give you peace of mind and motivate you further to keep going.

12. Borrow Instead of Buying When Possible

Instead of buying, consider borrowing to make saving money a bit easy. Whether you need a ladder for a project or a formal dress for an event, consider asking friends or family before purchasing.

Borrowing not only makes saving money easy but also reduces clutter gathered through over-purchasing of items. This tip may sound a bit unnecessary, but considering borrowing expensive goods needed for a shorter duration of time may help you save a larger amount in less time.

13. Look for Discount Codes and Cashback Offers

Every time you go shopping or for fun dine outs with friends or family, look for cashback offers. Similarly, when purchasing online, look for discount codes or vouchers that could save you money over time.

You can also sign up for the store’s loyalty program or use apps like Ibotta to make little savings add up quickly with frequent online shopping.

14. Sell Things you Don’t Use

Clean your physical and mental space by getting rid of goods and items you no longer use. This could be clothes, gadgets, or old furniture. List them on Facebook marketplace or local WhatsApp groups and you’ll be surprised how fast things sell.

While you’re at decluttering, what better way than to earn through it? Save the money you get through selling the items by depositing it into your savings account or setting it aside in a jar or an envelope.

15. Reduce your Utility Bills

Energy costs are rising nationwide, but small changes can have a great impact. Turn off lights when not in use, use smart thermostats, and unplug appliances when you can. Wash clothes in cold water and limit the use of appliances as much as you can.

These tips can save you around $20-$50 or more per month, making them a considerable option if you’re looking for effective tips to save money.

16. Explore Fun That Doesn’t Cost a Dime

Explore your creative and problem-solving side through this tip that includes looking for entertainment that isn’t expensive. Look for free museum days, outdoor concerts, library events, or community fitness classes.

Arrange a game night or go on a hiking trip that doesn’t cost a lot. Moreover, U.S. cities and towns offer more free events than people realize. All you need to do is stay in touch with groups and communities arranging events and enjoy yourselves whenever an event comes around.

17. Review and Reset Monthly

End of month is the perfect time to take a breath and look back at where your money actually went. Open your banking app, take a peek at what made you feel good about your spending, and what made you wonder if you can hold back on this specific expense in future.

Use what you see to tweak things for next month, even if it’s just one small change. Think of it like a monthly check-in with the future-you.

Conclusion

Saving money isn’t about saying no to everything you enjoy doing, it’s about saying yes to much smarter decisions. Whether it’s scheduling a no-spending day in a week, selling unnecessary items, or unsubscribing tempting emails, each tip is helpful in its own unique way. By applying just a few of these tips and tricks consistently, you’ll start noticing real changes in your financial life. The key is to start small, stay consistent, and avoid waiting for the perfect time, the future-you will definitely thank you!