In today’s digital-first world, the financial sector is constantly under the microscope when it comes to security. With cyberattacks growing in volume and sophistication, protecting customer data and ensuring secure communication has never been more critical. One of the silent warriors in this fight? Transactional emails.

[Read more…] about How Financial Services Use Transactional Emails to Combat Cyber ThreatsBanking Blog

Solution:“No Accounts Mapped For This Username” SBI Error

To solve “no accounts mapped for this username” SBI error login to your SBI Net banking, click on your Profile under “My Accounts & Profile” section and from there “Unhide” your Account.

A mapped account refers to the total number of accounts linked with your net banking user ID and enables you to associate two accounts with a single user ID, facilitating an effortless switch between accounts with a single click without multiple logouts and logins.

To link your SBI account online, log in to your account at www.onlinesbi.com. Once you’re in, navigate to the ‘My Accounts & Profile’ tab and select the ‘Profile‘ option. From there, proceed to the ‘PAN registration’ option under the ‘Profile‘ section and link all your accounts.

This article will guide you through the steps to fix “no account mapped for this username”, and also provide details on the causes of this error in SBI.

What Causes “No Accounts Mapped for This Username” SBI?

The error message “No Accounts Mapped for This Username” often occurs when users attempt to use net banking services after registering for SBI internet banking using the credentials provided in the bank’s internet banking kit.

Upon registration, these users do not have full access to the internet banking. The account assigned to internet banking services defaults to the hidden accounts list, which is why the server cannot identify the account with the given credentials and displays the error message.

During this period, the user access to profile changes are also limited since the account remains hidden.

To solve this issue, you have to make your primary account visible from the hidden accounts list. You must also grant full authentication and transaction permissions to the account user.

Once these steps are completed, the problem should be resolved within an hour, after which you can fully use your internet banking services.

Other Possible Causes of this Error in SBI

Inactive or Dormant Accounts

One of the most common reasons for this error is attempting to log into an account that has been marked as inactive or dormant by the bank. SBI, like many other financial institutions, adds a layer of security by temporarily suspending access to accounts that show prolonged periods of inactivity.

Non-Linked or Incorrectly Linked Username

If you’re setting up your username for the first time, or if you made changes to your existing username and it is not correctly linked to your account, you might encounter this error.

Also, when you try entering a username that does not exist within the SBI system, this error will prevent you from proceeding.

Technical Glitches and Internal Bank Issues

System updates, banking network services errors, and other technical issues can also lead to this error. While you may not have control over these, it’s good to know that they can also be a likely culprit.

How To Solve The “No Accounts Mapped for This Username” SBI Error?

If you’re experiencing the “no account mapped” error when trying to access your SBI Netbanking account for the first time, the following steps will guide you through the perfect solution:

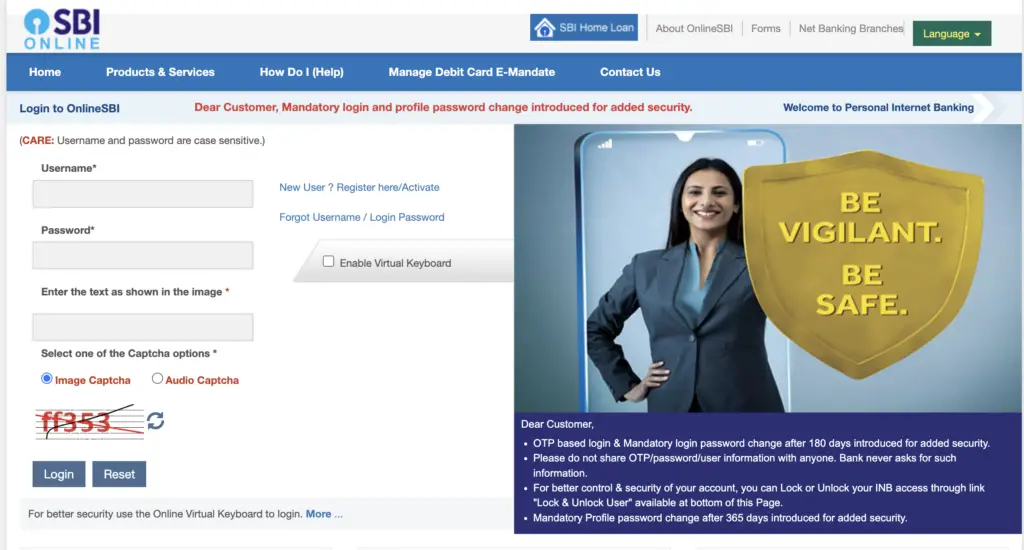

1. Open your preferred internet browser on your computer and navigate to the State Bank of India official net banking site – onlinesbi.com.

2. Use your login credentials (username and password) to access your internet banking account.

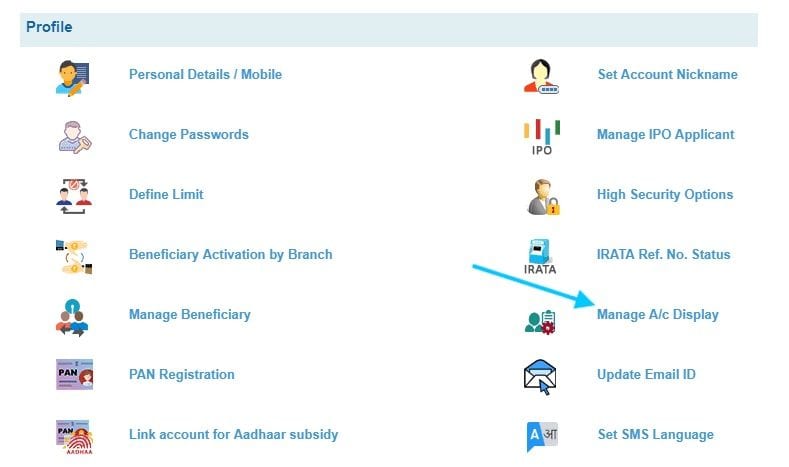

3. Once you’ve successfully logged in, go to “My Account & Profile.” Click on it and then select the “Profile” option from the list.

4. In the Profile Section, you’ll find various services and options such as Personal Details, Change Password, Set Account Nickname, Manage A/c Display, and PAN Registration. From these, select “Manage A/c Display.”

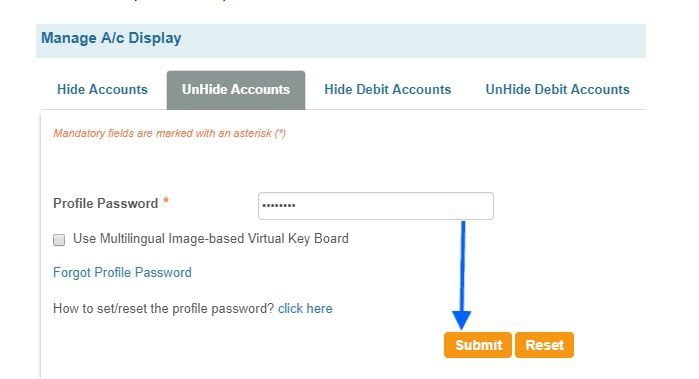

5. On clicking this option, several other options will appear, including Hide Accounts, Unhide Account, Hide Debit Accounts, and Unhide Debit Accounts. Choose the “Unhide Accounts” option, enter your profile password and click on “Submit”.

6. A new window will display all bank accounts linked to your internet banking credentials. Select the Account Number you wish to use for internet banking and click Submit.

Upon submitting, you’ll receive a notification, “You have successfully modified your account profile for inquiry and transaction access to the following accounts.”

Other Solutions To Fix “No Accounts Mapped for This Username” SBI Error

Confirming Active Account Status

1. Contact SBI Customer Service

First, reach out to SBI’s customer service team and confirm the status of your account and advise if any inactivity issues may be causing the problem.

2. Reactivate Dormant Account

If you discover that your account is inactive or dormant, work with customer service to understand the reactivation process for your specific circumstance. It may involve visiting a branch, or certain transactions that need to be completed to bring the account back into active status.

Username Verification and Setting Up Process

1. Check Username Linking Status

To solve an incorrectly linked or non-existent username, double-check with SBI that the username you are using is properly set up and linked to your actual bank account.

If it’s not, follow the instructions provided to link your username to your account or set up a new one and ensure it is linked correctly.

2. Follow SBI Online Procedures Carefully

When setting up a new username, follow the SBI online banking procedures carefully and enter your details accurately.

The system is highly sensitive and any inconsistencies can prevent successful setup and use of your username.

Technical Glitches and Internal Issues

1. Monitor SBI Announcements

Stay updated with any system maintenance or issues faced by SBI. You can often find these details on their official website or social media channels.

Knowing about these problems can give you peace of mind and insight into the issue you’re experiencing.

2. Wait and Retry

For technical glitches, your best bet can sometimes be to wait it out. The issue might be on the bank’s end, and a simple retry after some time can often resolve these problems.

If that fails, reach out to customer service for further guidance.

Additional Tips To Solve “No Accounts Mapped for This Username” in State Bank Of India (SBI)

Clear Your Browser Cache and Cookies

Sometimes, stale data stored in your web browser’s cache can cause login issues. Clear out your browser’s cache and cookies, and then restart your browser to see if that resolves the issue.

Use an Updated Browser

Outdated browsers may not support the latest security protocols or may have bugs that could interfere with the login process.

Ensure you’re using a current version of a commonly updated browser to minimize these risks.

Conclusion

Getting the “No Accounts Mapped for This Username” error can be a great inconvenience, but with the systematic steps and tips provided in this guide, you should be well-equipped to tackle this issue head-on.

Always approach your financial information with caution, and if in doubt, rely on SBI’s resources and customer service for support. Remember, managing these issues is a part of the digital banking experience, and your patience and persistence will lead you to a solution.

Stay informed, stay calm, and may your online banking experience with SBI be as smooth as possible!

How to Get SBI CIF Number Without Passbook?

CIF or Customer Information File Number is a 11-digit unique identifier provided by banks such as SBI when a customer opens an account. Each customer is assigned a unique CIF Number, consisting of 11 digits, ensuring individual identification within the bank’s system.

CIF number serves as a digital file that has all the customer’s information including personal details, proof of address, account number, history of transactions, loan details, and any other relevant data.

If you’re trying to find your SBI CIF number without a passbook, this article is specifically tailored for you where you will know what the CIF number in SBI signifies and guide how to get your SBI CIF number through SMS, Online Banking, or via the Yono App.

There are 5 ways to get your SBI CIF Number without passbook including net banking, SBI Yono App, cheque book, visiting SBI branch and calling SBI customer support.

How To Get SBI CIF Number Using Net Banking?

You can use this method to find your CIF number if you have your Net Banking active on your account. Here are the steps you should follow to get your CIF number from net banking:

- Open sbionline.com on your browser.

- Sign in to your net banking account using your User Name and Password.

- Click on the “My Account and Profile” tab.

- Open the “Account Summary” section.

- Proceed to click on the “Nomination and PAN Details” option.

- Select the “View Nomination and PAN Details” from the available options.

- You will get your CIF number on the next page.

How To Get SBI CIF Number Using SBI Yono App?

If you are a SBI Yono app user, you can easily get your State Bank of India CIF Number without a passbook, right on your mobile device.

The very first step is to download and register on the SBI mobile banking application, SBI Yono App.

If you’re already a registered user, simply follow the below steps.

- Open SBI Yono Application.

- Click on the “Services” tab.

- Click on “Online Nomination“.

- Choose “transaction account” as the type of account and select your account number.

- Your CIF number will be displayed similarly to the image below.

How To Find CIF Number Using Your Cheque Book?

To find your CIF Number Using Cheque Book,

- Take out your bank cheque book.

- Open it to the first page.

You’ll find the Customer Information File (CIF) number displayed there. Please note, this method is only applicable if you have your cheque book on hand.

How To Find SBI CIF Number by Visiting Your SBI Bank Branch?

Getting your CIF number is also possible by visiting your local SBI branch. The process will involve some verification questions for security purposes.

Once you’ve successfully verified your identity, the bank will provide you with your Customer Information File (CIF) number.

It’s important to note that you should bring along your passbook and a form of identification during your visit to the bank.

How To Get Your SBI CIF Number by Calling SBI Customer Support?

If can’t visit an SBI branch or prefer not to stand in long queues, there’s another option for you. You can get your CIF number by contacting the SBI Customer Support team, also referred to as Customer Care, via their toll-free numbers.

They usually ask a few questions to confirm your identity, after which provide you with your CIF number. This method offers convenience and saves time. The toll-free numbers to reach out to SBI customer support are:

- 1800 425 3800

- 1800 11 2211

- 080-26599990

Frequently Asked Questions

How can I obtain my SBI CIF number without having my passbook with me?

To obtain your SBI CIF number without your passbook, you can visit the nearest SBI branch and request the CIF number from the customer service desk. You may need to provide identification and account details for verification. However, there are other ways too that we have already discussed in this article.

Is there a way to find out my SBI CIF number without using the passbook?

Yes, there are alternative methods to find out your SBI CIF number without the passbook that includes checking your CIF number on your SBI account statement, through online banking, or by contacting the customer support helpline.

What are the alternative methods for retrieving my SBI CIF number if I don’t have access to my passbook?

If you don’t have access to your passbook, you can retrieve your SBI CIF number by visiting the SBI branch in person, using online banking services, checking your account statement, or contacting the customer care helpline.

Can I get my SBI CIF number online without the need for a physical passbook?

Yes, you can get your SBI CIF number online without a physical passbook. Log in to your SBI online banking account, go to the account information section, and you should find your CIF number listed there.

Are there any digital platforms or online services that allow me to check my SBI CIF number without using the passbook?

Various digital platforms and online services provided by SBI, such as internet banking and mobile banking app, allow you to check your CIF number without the need for a physical passbook. Additionally, you can contact the SBI customer care helpline for assistance in retrieving your CIF number.

Does opening a new account in the same bank result in the creation of a new CIF for the additional account?

A bank typically generates a CIF (Customer Information File) only once for a customer. Subsequently, the same CIF number is used for all accounts held by that customer within the same bank.

Conclusion

Getting your SBI CIF number without a passbook is an easy process that you can do using net banking, the SBI Yono app, looking at your cheque book, visiting an SBI branch, or contacting customer support.

By following the steps outlined in this article, you can easily retrieve your SBI CIF number, ensuring that you have access to the necessary information without relying on a physical passbook.

Using SBI digital platforms, online services, and the support of SBI’s customer care helpline enhances the accessibility to get your CIF number, contributing to a more streamlined banking experience.

How To Reset SBI Debit Card PIN?

Are you having trouble accessing your SBI debit card due to a forgotten PIN? Don’t worry, I’ve got you covered!

Whether you’re a tech-savvy individual or someone who’s not so comfortable with banking procedures, I’ll break it down for you in a way that’s easy to understand and follow.

In this article, I’ll guide you through the simple steps to reset your SBI debit card PIN.

Why resetting your SBI debit card PIN is necessary?

Ensuring the security of our financial transactions is of utmost importance. One vital step in maintaining this security is resetting your SBI debit card PIN regularly. Doing so not only helps protect your funds but also provides peace of mind knowing that your money is safe from potential fraudsters.

Here are a few reasons why resetting your SBI debit card PIN is necessary:

Enhanced Security: By periodically changing your debit card PIN, you add an extra layer of protection to your financial transactions. This helps safeguard your funds against unauthorized access, reducing the risk of fraudulent activities.

Prevention of Unauthorized Usage: In case your debit card is lost or stolen, resetting the PIN immediately ensures that the person who finds or steals it cannot misuse your card.

Protection Against Skimming Attacks: Skimming is a prevalent method used by fraudsters to steal card information. By resetting your PIN regularly, you reduce the risk of falling victim to skimming attacks.

Compliance with Security Guidelines: Financial institutions, including SBI, recommend resetting your debit card PIN periodically as a security measure. By following their guidelines and resetting your PIN, you ensure that you are compliant with industry best practices, decreasing the risk of security breaches.

Now that we understand why resetting your SBI debit card PIN is necessary, let’s move on to the next section to learn the step-by-step process of resetting your PIN without any hassle.

Various methods to reset your SBI debit card PIN

Resetting your State Bank of India (SBI) debit card PIN is a simple and essential step to secure your financial transactions and protect your hard-earned money.

In this section, I’ll guide you through various methods to reset your SBI debit card PIN hassle-free.

Method 1: Resetting your PIN through the SBI Internet Banking website

Resetting your SBI debit card PIN through the SBI Internet Banking website is a convenient and secure way to ensure the safety of your financial transactions.

Here’s a step-by-step guide on how to reset your PIN using this method:

Login to your SBI Internet Banking account: Visit the official SBI Internet Banking website and enter your credentials to log into your account. If you don’t have an account, you can easily register for one.

Navigate to the “e-Services” section: Once you’re logged in, locate the “e-Services” section on the homepage.

Select “ATM Card Services”: In the “e-Services” section, click on “ATM Card Services” to access the options related to your debit card.

Choose “Generate ATM PIN“: From the available options, select “Generate ATM PIN” to initiate the PIN reset process.

Verify your details: You will be prompted to enter certain details to verify your identity, such as your account number, card number, and date of birth. Please ensure that you enter the information accurately to proceed.

Generate a new PIN: Once your details are verified, you can now choose a new PIN for your SBI debit card. Make sure to select a strong and unique PIN that is not easily guessable.

Confirm and submit: After entering the new PIN, re-enter it to confirm and ensure there are no typing errors. Once you are satisfied with the new PIN, click on the “Submit” button to complete the process.

Next, let’s explore another method to reset your SBI debit card PIN through the SBI Mobile Banking app.

Method 2: Resetting your PIN through the SBI Anywhere Personal App

Resetting your SBI debit card PIN through the SBI Anywhere Personal App is another convenient and secure method to ensure the safety of your financial transactions.

The app provides a user-friendly interface that allows you to reset your PIN on-the-go, saving you time and effort.

Here’s how you can do it:

Download and install the SBI Anywhere Personal App: If you haven’t already done so, visit your app store and search for “SBI Anywhere Personal.” Download and install the app on your mobile device.

Login to the app: Open the SBI Anywhere Personal App and enter your username and password to log in to your account.

Navigate to the “e-Services” section: Once you’re logged in, locate and select the “e-Services” option from the app’s menu. This will take you to a list of available services.

Select “ATM Card Services“: In the “e-Services” section, find and tap on the “ATM Card Services” option.

Choose “Generate ATM PIN“: From the list of ATM Card Services, select “Generate ATM PIN.” This will take you to the PIN generation screen.

Verify your details: On the PIN generation screen, you’ll be asked to verify your details. Make sure the displayed information is correct and matches your SBI debit card.

Generate a new PIN: Follow the prompts to generate a new PIN for your SBI debit card. Make sure to choose a PIN that is easy for you to remember but difficult for others to guess. Avoid using common patterns or numbers related to your personal information.

Confirm and submit: Once you’ve entered your new PIN, double-check it for accuracy and confirm. If everything looks good, submit your request.

By following these simple steps, you can easily reset your SBI debit card PIN through the SBI Anywhere Personal App.

Method 3: Resetting your PIN by visiting an SBI ATM

If you prefer a more traditional approach or don’t have access to internet banking or a mobile app, you can reset your SBI debit card PIN by visiting an SBI ATM. This method allows you to reset your PIN quickly and conveniently at your nearest ATM.

Here’s how you can do it:

Locate an SBI ATM: Find the nearest SBI ATM in your area. You can use the SBI website, SBI Anywhere Personal App, or other online resources to find the closest ATM.

Insert your Debit Card: Insert your SBI debit card into the card slot provided in the ATM machine.

Enter your PIN: When prompted, enter your current PIN to proceed with the transaction.

Select “PIN Services”: Once you have successfully entered your PIN, look for the “PIN Services” option on the ATM screen. This option is usually displayed prominently to guide users who want to change or reset their PIN.

Choose “Reset PIN“: From the available options, select “Reset PIN” to begin the process of changing your PIN.

Enter the New PIN: Now, you will be asked to enter the new PIN that you want to set. Remember to choose a PIN that is unique and not easily guessable.

Confirm and Submit: Re-enter the new PIN to confirm and submit the change. Make sure to carefully enter the new PIN twice to avoid any errors.

Get the Confirmation Slip: After successfully resetting your PIN, the ATM will provide you with a confirmation slip or receipt.

Method 4 – Reset SBI Card PIN through SMS

If you’re unable to change your SBI ATM Pin online, you can alternatively do so via SMS from your registered mobile number.

Here are the steps to reset your SBI Debit Card PIN via SMS:

- Open the messaging app on your phone.

- Create a new message to change your SBI ATM Pin.

- Draft a text message in the following format: “PIN<last four digits of your debit card><last four digits of your bank account number>” and send this to 567676.

- After sending the message, wait for the Green PIN.

- The State Bank of India will respond within a few minutes by sending an SMS containing a four-digit Green PIN. This PIN is valid for two days.

- With this Green PIN, visit your nearest SBI ATM and follow the previously outlined steps to change your forgotten SBI ATM pin.

Method 5 – Reset SBI Card PIN through Customer Care

You can also reset your SBI Debit card PIN by reaching out to SBI customer care. They will provide a Green PIN/OTP via SMS to your registered mobile number, which you can use to reset your Debit card pin.

Here’s how you can do this:

- Dial the SBI Toll-free customer care number – 1800 11 22 11/ 1800 425 3800 or 080-26599990 from the mobile number linked to your account.

- Choose your language by pressing the appropriate button as guided by the system.

- Follow the automated voice prompts and select the “ATM and Prepaid Card Services” option.

- Choose option 1 to generate a Green PIN.

- When prompted, enter your debit card number.

- You’ll then be asked to provide the account number associated with your debit card. Enter and confirm the details.

- After your information is verified, you’ll receive an SMS containing a Green PIN/OTP on your registered mobile number.

- This Green Pin is valid for 2 days. You can visit your nearest SBI ATM within this period and follow the steps mentioned above to complete the process.

Method 6 – Reset SBI Card PIN offline

You also have the option to go to your nearest SBI bank branch get your your Debit card PIN reset:

- Visit your local SBI branch.

- Inform the staff that you have forgotten your SBI Debit Card PIN and ask for the form.

- Fill the Debit Card PIN reset form.

- Fill out this form and submit it to the bank executive, ensuring you include a photocopy of a valid ID Card and your bank passbook.

- Once this is done, the bank will handle the rest. You can expect to receive your new debit card PIN either by SMS or post.

Precautions to take while resetting your SBI debit card PIN

When it comes to resetting your SBI debit card PIN, it’s important to take a few precautions to ensure the security of your account. By following these simple steps, you can protect yourself against unauthorized access and fraudulent activities.

Here are some precautions you should consider:

- Keep Your Personal Information Secure: It’s crucial to keep your personal information, such as your card number, CVV, and OTP (One-Time Password), confidential. Avoid sharing this information with anyone, whether it’s over the phone, through email, or on social media platforms.

- Use a Secure Network: When resetting your SBI debit card PIN, make sure you are connected to a secure and trusted network. Public Wi-Fi networks may not be secure and can put your information at risk. It’s best to use your own Wi-Fi network or a trusted network to perform the PIN reset.

- Double-Check the Website or App: Before entering any sensitive information, ensure that you are on the official SBI website or using the official SBI Anywhere Personal App. Scammers may create fake websites or apps that mimic the bank’s interface to steal your data. Always verify the authenticity before proceeding.

- Beware of Phishing Attempts: Be cautious of phishing attempts, where scammers try to trick you into revealing your personal information through deceptive emails, phone calls, or messages. Remember, SBI will never ask for your PIN or other confidential information. If you receive any suspicious communication, report it to the bank immediately.

- Change Your PIN Regularly: It’s a good practice to change your PIN regularly as an added layer of security. By regularly resetting your PIN, you reduce the risk of unauthorized access to your account. Set a reminder to change your PIN every few months to stay proactive about your account security.

Stay vigilant and prioritize the security of your financial transactions.

Conclusion

Resetting your SBI debit card PIN is a crucial step to ensure the security and protection of your account. By following the step-by-step instructions provided in this article, you can easily reset your PIN using any of the three methods discussed.

In addition to the instructions, it is important to remember the precautions to take while resetting your PIN. Keeping your personal information secure, using a secure network, double-checking the website or app, being aware of phishing attempts, and changing your PIN regularly are all essential steps to safeguard your account from potential threats.

By taking these precautions and regularly resetting your SBI debit card PIN, you can have peace of mind knowing that you have taken the necessary steps to protect your account from unauthorized usage. So, don’t delay any further and ensure the security of your SBI debit card by resetting your PIN today.

Frequently Asked Questions

Why is it important to reset my SBI debit card PIN regularly?

Resetting your SBI debit card PIN regularly is crucial for enhancing security and protecting your account against unauthorized usage. It helps to prevent potential threats and ensures that your financial information remains secure.

How can I reset my SBI debit card PIN?

You can reset your SBI debit card PIN using one of three methods: through the SBI Anywhere app, by visiting an SBI ATM, or by contacting SBI customer service. Each method has step-by-step instructions to guide you through the process.

What precautions should I take while resetting my PIN?

To ensure the safety of your account, it is important to take certain precautions while resetting your SBI debit card PIN. These precautions include keeping your personal information secure, using a secure network, double-checking the website or app you are using, being aware of phishing attempts, and changing your PIN regularly.

What are the benefits of resetting my SBI debit card PIN?

Resetting your SBI debit card PIN offers several benefits, such as enhanced security, protection against unauthorized usage, and peace of mind. By regularly resetting your PIN, you can stay one step ahead of potential threats and safeguard your account from fraudulent activities.

Is it easy to reset my SBI debit card PIN?

Yes, resetting your SBI debit card PIN is a simple process. The step-by-step instructions provided in the article make it easy to follow. Whether you choose to reset your PIN through the SBI Anywhere app, an SBI ATM, or by contacting customer service, the procedures are designed to be user-friendly and convenient.

Enable International Transactions on SBI Debit Card: A Step-by-Step Guide

When it comes to using my SBI debit card for international transactions, there are a few things I’ve learned along the way. International transactions can be convenient, but it’s important to understand how they work and be aware of any fees or charges that may apply.

By understanding the process of enabling international transactions on my SBI debit card, I have been able to make convenient and secure transactions while traveling abroad.

At the same time, you must be aware of the fees, keep track of your spending, and take necessary precautions.

How To Enable International Transactions on SBI Debit Card Internet Banking?

Enabling international transactions on your SBI debit card thorugh internet banking is a simple and straightforward process.

Follow the step-by-step guide below to activate this feature and start using your card for international payments

- Log in to your SBI Online Banking: Visit the SBI Online Banking portal and enter your username and password to access your account.

- Navigate to the Card Services: Once logged in, navigate to the “Card Services” section or menu. This is where you can manage various settings related to your debit card.

- Select your Debit Card: From the list of options, select the debit card linked to your account that you want to enable for international transactions.

- Choose “Enable International Usage”: Look for the option that says “Enable International Usage” or something similar. Click on it to proceed.

- Verify the Activation: Once you enable international transaction, you will have to verify the activation through a One-Time Password (OTP) sent to your registered mobile number. Enter the OTP to confirm the activation.

- Confirmation Message: Once the activation is successful, you will receive a confirmation message on the screen or via SMS.

Once you have completed these steps, your SBI debit card will be enabled for international transactions.

How To Activate SBI Debit card for International Transactions with SBI YONO App?

You can enable international transactions on your SBI debit card with SBI YONO App within minutes.

Here’s our simplified guide on how to do it:

- Download the SBI Yono App from the Play Store (for Android users) or the App Store (for iPhone users) on your mobile device.

- Open the App and log in using your internet banking User ID and password.

- Next, tap on the hamburger menu icon located at the top left corner of the YONO App interface, and select ‘Service Request‘.

- Go to the ‘ATM/Debit card‘ section and choose ‘Manage Card‘.

- Select your Debit card and account number, and activate the options for e-commerce transactions and international usage.

By following these steps, you can swiftly enable international transactions on your SBI debit card via the Yono App.

If you SBI ATM has been blocked, check our guide on how to unblock SBI Debit card.

How To Activate International Transactions on SBI Debit Card by SMS?

Activating international transactions on your SBI debit card can be done via SMS from your registered mobile number. Ensure your Sim card has a valid plan and is in working order, or you won’t be able to send the necessary SMS.

The format for sending the SMS is as follows:

For enabling international transactions, type “SWON INTL [last 4 digits of your card number]” and send it to 09223966666.

For example, if the last four digits of your card are 5465, the message would read “SWON INTL 5465“.

To enable e-commerce transactions, type “SWON ECOM [last 4 digits of your card number]” and send it to 09223966666.

Using the same example, the message would read “SWON ECOM 5465”.

Benefits of Enabling International Transactions on SBI Debit Card

Enabling international transactions on your SBI debit card can bring numerous advantages. Here are some of the benefits you can enjoy:

- Convenience: With international transactions enabled on your SBI debit card, you can make purchases and payments while traveling abroad without the hassle of carrying cash or exchanging currencies. It offers you the convenience of using your own familiar payment method wherever you go.

- Global Acceptance: SBI debit cards are widely accepted at millions of merchants and ATMs worldwide. Enabling international transactions ensures that you have access to your funds and can easily perform transactions wherever you are, giving you the peace of mind knowing that your card will be accepted almost everywhere.

- International Online Shopping: Enabling international transactions on your SBI debit card opens up a whole new world of online shopping possibilities. You can explore and shop from international websites, access exclusive deals, and purchase products from around the globe without restrictions.

- Emergency Situations: When traveling abroad, unexpected situations can arise, such as medical emergencies or unforeseen expenses. By enabling international transactions, you have a reliable and secure way to handle such situations and access funds instantly, providing you with peace of mind and a safety net when you need it the most.

- Enhanced Security: SBI implements robust security measures to protect your debit card transactions. By enabling international transactions, you can take advantage of these security features and safeguards, ensuring that your transactions are safe and protected from fraudulent activities.

- Rewards and Benefits: Some SBI debit cards offer rewards and benefits for international transactions. By enabling international transactions on your SBI debit card, you may be eligible for various perks such as cashback, discounts, travel rewards, and more, making your international purchases even more rewarding.

Enabling international transactions on your SBI debit card offers you a range of benefits, from convenience and global acceptance to enhanced security and rewards. Take advantage of these benefits and make the most out of your SBI debit card wherever your travels may take you.

Things to Consider Before Enabling International Transactions On Your Card

Enabling international transactions on your SBI debit card can open up a world of possibilities and convenience. However, before you proceed, it’s important to be aware of a few crucial factors.

Here are some things to consider before enabling international transactions:

Currency Conversion Fee: When you use your debit card for international transactions, a currency conversion fee may be applied. This fee is usually a percentage of the transaction amount, so it’s essential to understand the charges involved.

Foreign Transaction Fee: In addition to the currency conversion fee, there may be a foreign transaction fee levied by SBI or the merchant. This fee is typically a percentage of the transaction amount or a fixed fee per transaction.

Exchange Rates: Exchange rates can fluctuate, affecting the final amount you pay in your home currency. Keep an eye on the prevailing exchange rates and consider utilizing reliable currency conversion tools to ensure you get the best value for your money.

Daily Transaction Limits: SBI may have specific daily transaction limits for international transactions on debit cards. It’s important to be aware of these limits to avoid any inconvenience or surprises while making purchases abroad.

Card Compatibility: Not all merchants or ATMs abroad may accept SBI debit cards. Before enabling international transactions, research the acceptance of SBI debit cards in your intended destination. It’s always wise to carry an alternative means of payment, such as a credit card or local currency, as a backup.

By considering these factors, you can make an informed decision about enabling international transactions on your SBI debit card. Understanding the fees, exchange rates, transaction limits, and card compatibility will help you use your card wisely and avoid any unexpected charges or hurdles while abroad.

Conclusion

Enabling international transactions on your SBI debit card opens up a world of convenience and possibilities. By following the step-by-step guide provided in this article, you can easily enable this feature and enjoy the benefits it offers.

With international transactions enabled, you can make purchases online from global merchants, ensuring that you never miss out on any exclusive deals or products. In addition, having access to your funds while traveling abroad can be a lifesaver in emergency situations.

So go ahead, enable international transactions on your SBI debit card and enjoy the convenience, security, and rewards it brings.

Frequently Asked Questions

How do I enable international transactions on my SBI debit card?

To enable international transactions on your SBI debit card, follow these steps:

- Log in to your internet banking account.

- Go to the “Card Services” or “Card Management” section.

- Select your debit card and click on “Enable International Usage.”

- Confirm your selection and provide any additional details if required.

- Review and submit the request.

- Wait for confirmation from the bank.

What are the benefits of enabling international transactions on my SBI debit card?

Enabling international transactions on your SBI debit card offers several benefits, including convenience, global acceptance, online shopping, access funds in urgent situations, enhanced security and rewards and benefits.

What factors should I consider before enabling international transactions?

Your should consider currency conversion fees, foreign transaction fees, exchange rates and daily transaction limit before enabling international transactions on your SBI debit card.

Where can I get help if I have any issues enabling international transactions?

If you encounter any issues while enabling international transactions on your SBI debit card, reach out to SBI customer support. They will be able to assist you and provide the necessary guidance. Contact their helpline or visit the nearest branch for personalized support and resolution of any concerns.