Whenever you perform a transaction at a State Bank of India (SBI) ATM, you get a transaction slip on which a response code is printed for every transaction.

Usually, a response code is a two digit number provided by a bank for the transaction done through bank’s CAS payment gateway. This code signifies why your transaction an ATM was successful or declined by your bank.

It is important for you to know the SBI ATM Response codes and their meaning , if you are a SBI customer.

Even if you aren’t, there would be someone in your family or friend who would definitely be a SBI bank customer, since it’s the largest public sector bank of India. You can help them out if you would be familiar with the SBI ATM response codes.

As an SBI customer, I was in that situation once and therefore I can have an idea about the number of SBI users who would be getting SBI ATM error codes, without an idea about what it means and how to resolve them.

Read this whole article to know these SBI ATM error codes, their meaning and where to contact in the situation you get an SBI error code.

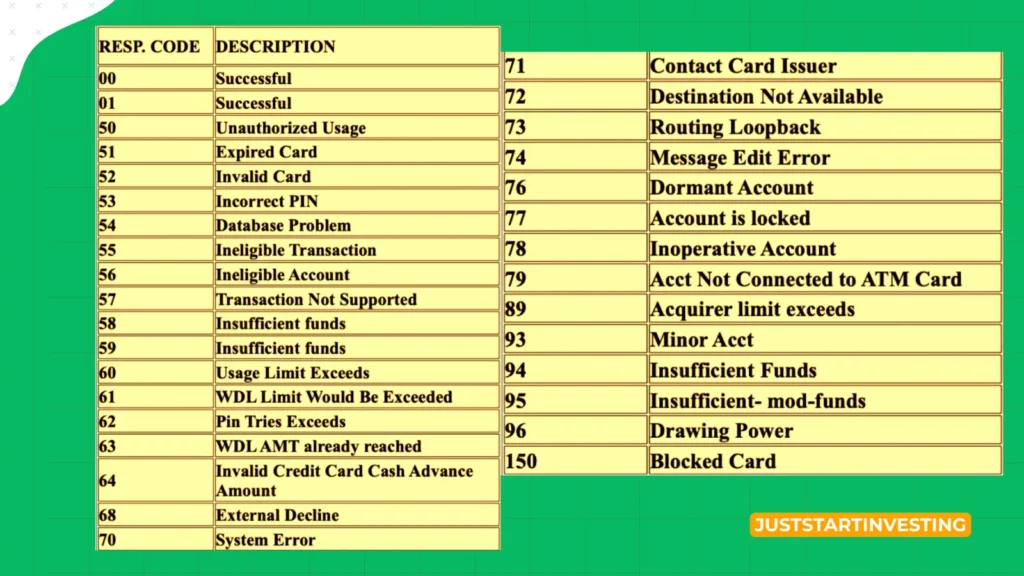

List of SBI ATM Response Codes And Their Meaning

| SBI ATM Error Code | SBI ATM Error Code Meaning |

| 0 | Transaction is successful. |

| 1 | Transaction is successful. |

| 4 | Card is captured. |

| 5 | Transaction is not honoured. |

| 6 | Data for PIN is not available. |

| 7 | Pick Up |

| 14 | Card number is Invalid. |

| 19 | Retry your transaction |

| 30 | Format problem. |

| 33 | The card is expired. |

| 36 | The card is restricted or blocked. |

| 39 | There’s no credit account. |

| 41 | Card Pick Up is lost. |

| 42 | Account is Invalid. |

| 50 | The user is not authorised. |

| 51 | The card is expired. |

| 52 | The card you are using is invalid. |

| 53 | The Card PIN is not correct. |

| 54 | Problem is with the database. |

| 55 | Ineligible transaction. |

| 56 | Account is not eligible. |

| 57 | Transaction is not supported. |

| 58 | Insufficient funds / Invalid Txn |

| 59 | Insufficient funds |

| 60 | Usage Limit Exceeds |

| 61 | WDL Limit Would Be Exceeded |

| 62 | Pin Tries Exceeds |

| 63 | WDL AMT already reached |

| 64 | Invalid Credit Card Cash Advance Amount |

| 65 | No Information for Statement |

| 68 | External Decline |

| 70 | System Error |

| 71 | Contact Card Issuer |

| 72 | Destination Not Available |

| 73 | Routing Loopback |

| 74 | Message Edit Error |

| 76 | Dormant Account |

| 77 | Account is locked |

| 78 | Inoperative Account |

| 79 | Acct Not Connected to ATM Card |

| 80 | System Not Available |

| 89 | Acquirer limit exceeds |

| 93 | Minor Acct |

| 94 | Insufficient Funds |

| 95 | Insufficient- mod-funds |

| 96 | Drawing Power |

| 99 | Timed Out |

| 100 | unable to Process Transaction |

| 105 | Card Not Supported |

| 106 | Pin Tries Exceed |

| 107 | Daily Usage Limit Reached |

| 112 | Pin Data Required – Contact Helpline |

| 114 | Invalid Account |

| 116 | Insufficient Funds |

| 117 | Incorrect Pin |

| 118 | No Card Record |

| 119 | The transaction is invalid. |

| 121 | Exceed Withdrawal Amount |

| 122 | Security Violation |

| 148 | Card Blocked |

| 149 | Card Blocked |

| 150 | Blocked Card |

| 151 | Expired Card |

| 168 | External decline |

| 201 | The PIN is not correct. |

| 204 | Please enter lesser amount. |

| 206 | CAF Not Found |

| 208 | The card is lost or stolen. |

| 903 | CAF Status 3 |

| 909 | System is not functioning. |

| 911 | Response is received too late. |

| 912 | There’s not HOST. |

| 993 | The system can’t verify the PIN. |

What Should I do When I Get an SBI ATM Error Code?

You have seen that most of the SBI ATM error codes are due to server and you can’t do anything when a server is not responding or if your transaction is declined due to SBI server issue.

However, if the response code means that your Debit card PIN is incorrect, insufficient funds, blocked debit card etc., you do some of the below listed things:

Call SBI Help Desk Assistance

To receive support from the SBI help desk, dial the State Bank of India’s toll-free numbers: 1800 112 211 or 1800 425 3800.

Communicate Your Bank About Missing or Compromised Card

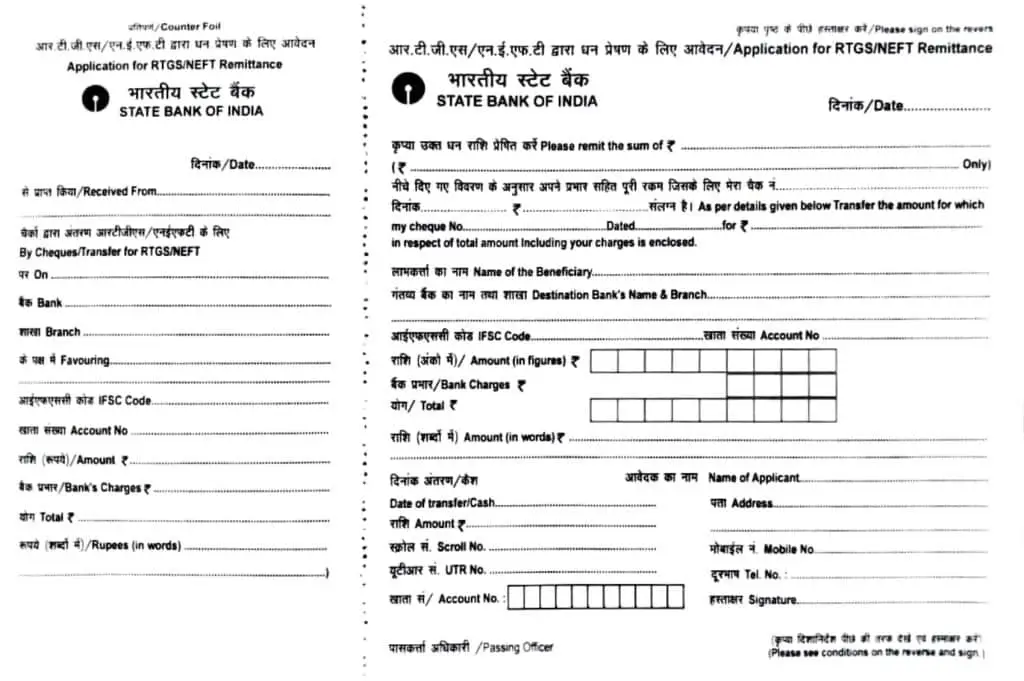

In case you are worried about missing or compromised card or cash, promptly get in touch with the nearest SBI bank for assistance.

Also, if you need to transfer your SBI account, check our details guide on how to transfer SBI Bank account from one branch to another?

Visit Nearest SBI Branch

If you need specific assistance from your local branch, don’t hesitate to reach out to them directly or contact the card centre.

Reset Your SBI Debit Card PIN

To reset the PIN for your SBI ATM, follow these online steps:

- Access your SBI account using your internet banking credentials.

- Go to the ‘E-Services’ section.

- Next, proceed to the ‘ATM Card Services’.

- From the available options, choose ‘Generate New ATM PIN’.

- Click on ‘Get Authorisation PIN’.

- You will get an OTP for verification at the mobile number linked with your account.

- Enter that PIN and your SBI ATM will get reset.

Frequently Asked Questions

What does Response Code 68 means?

The response code 68 means an external decline and appears if you have reached the maximum number of ATM withdrawals permitted in a month, typically capped at four times by SBI.

What does SBI Error Code 112 mean?

The SBI error code 112 means and invalid PIN. Encountering error code 112 indicates that the entered PIN for the SBI card is incorrect, causing the transaction to decline.

What does SBI ATM error code 88 mean?

The SBI ATM error code 88 means that the ATM is unable to read the card. The Error Code 88 suggests the ATM is unable to read your card due to possible issues with the card’s chip or magnetic strip. You should try cleaning the chip and retry, or use a different machine if the problem persists.

What does Error Code 150 mean?

The error code 150 means PIN Setup Failure and shows that there was an unsuccessful attempt to set the Debit card PIN, leading to the card being blocked, accompanied by a “your card is blocked” message.

What is ATM Error Code 057?

The ATM error code 57 means that the function you are trying is not permitted. It signifies that a transaction attempted with a credit card is not authorized by the bank.

What is ATM Error Code 068?

The ATM error code is generally encountered during a cash transaction when you don’t receive money, it indicates an ATM malfunction. Contact SBI customer support or visit your branch as soon as possible.

What is SBI Response Code 78?

The SBI ATM response Code 78 denotes a declined transaction possibly due to a dormant/inoperative account, lost/stolen card, or exceeding the transaction limit. If you get this error due to a damaged Debit Card EVM chip, it will require card replacement.

What does ATM Error Code 050 mean?

The SBI response code 050 implies potential compromise of the account linked to the card, necessitating immediate contact with the bank to secure your funds.

What is SBI ATM Response Code 077?

This code signifies a locked account, requiring reactivation through direct contact with the home SBI branch.

What is SBI Response Code 055?

The SBI response code 055 is displayed when a wrong PIN is entered for the SBI card. Correcting the PIN should resolve this issue upon reattempting the transaction.

What does SBI ATM Error Code 052 mean?

The SBI ATM response code 052 occurs when a credit card transaction is declined because the associated cheque account does not exist.

What is meant by an SBI ATM Error Code 71?

Code 071 usually appears when the ATM’s note cassette is empty or the currency inside is not dispensable.

What is ATM response Code 072?

This response code suggests that the bank server failed to interpret instructions from an ATM terminal, often due to using an outdated debit card.

What is Error Code 089?

When you get an error 089, it means the acquirer’s transaction limit has been surpassed. You can get this response code when withdrawing cash using a different bank’s card in an ATM with a per-transaction limit below ₹10,000. To resolve this, withdraw an amount less than ₹10,000.

What is SBI ATM Error Code 53?

The error code 53 means a closed savings account is linked to your credit card. It signifies a transaction attempted with a credit card linked to a previously closed savings account at SBI.