Real Time Gross Settlement or RTGS is a mode of fund transfer from one bank to another that happens in “real-time.”

If you are an SBI customer, you need to fill out an SBI RTGS form to send your money from one bank to another in real-time.

You can either download the form online or get it from the nearest SBI branch.

In this article, I will discuss how to get this SBI RTGS form online and fill the form correctly.

How To Download the SBI RTGS Form?

Downloading the SBI RTGS Form is a straightforward process and won’t take more than a few seconds.

To download the SBI RTGS Form, follow the below steps:

- Open the official SBI website on your smartphone, tablet, or laptop.

- In the search bar, search for PDF RTGS form.

- Download and take a printout of the form.

- Now, fill in the details and visit your nearest SBI branch to submit it.

Also, you can directly download the SBI RTGS form from here.

How To Fill out the SBI RTGS Form?

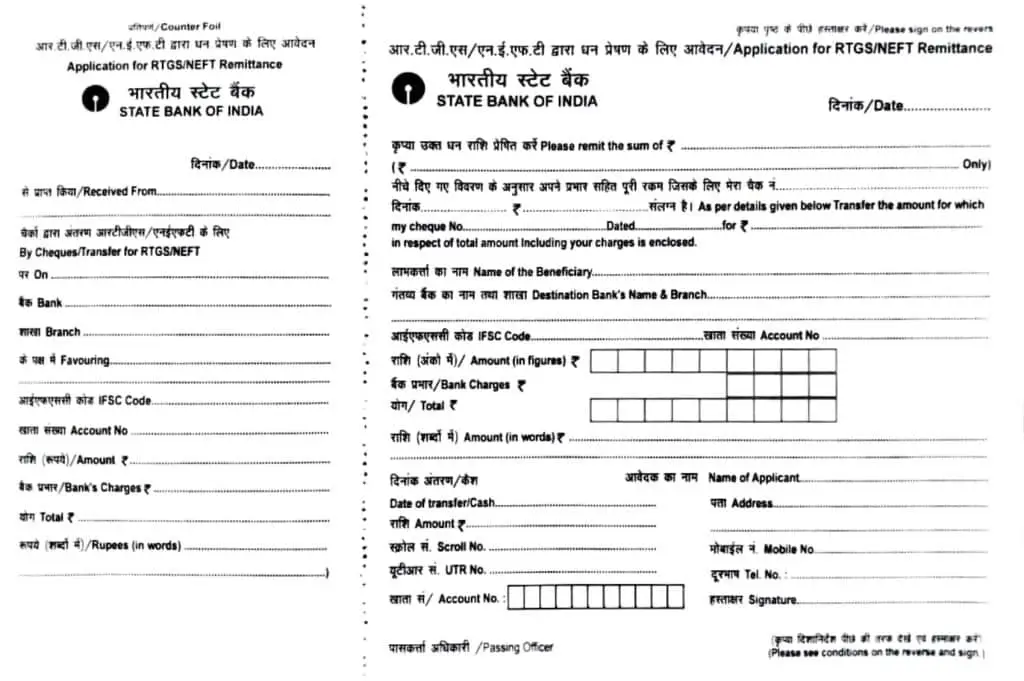

If you don’t want delays in your payments, you need to make sure that the details provided in the SBI RTGS form are correct to your knowledge. The SBI RTGS form asks for the following information,

- Beneficiary’s Name

- Beneficiary’s Account number

- IFSC code of the Bank where money is being sent

- Remitting Amount

- Account Number of the Remitting customer

- Beneficiary’s Bank

After entering all the above details, you will have to sign in the bottom right corner of the form (as described in the below image) and submit it to the SBI bank staff.

The authorized bank staff will do the transaction at their end, and the beneficiary’s account will get credited with that amount in real time.

Benefits of RTGS

The Real Time Gross Settlement (RTGS) system offers numerous benefits that enhance the efficiency and security of fund transfers:

Instant Fund Transfer

One of the primary advantages of RTGS is the immediate transfer of funds. This ensures quick availability of funds to the recipient, contributing to faster and more responsive financial transactions.

Enhanced Security Measures

RTGS transactions are settled individually and in real-time, minimizing the risk of fraud or interception. The secure nature of these transactions provides a robust shield against unauthorized activities.

Direct and Seamless Transfers

RTGS eliminates the need for intermediaries, facilitating direct and seamless transfers between banks. This streamlined process reduces delays and costs associated with intermediary banks, making transactions more efficient.

Suitability for High-Value Transactions

You can initiate high-value transactions using RTGS with typically no upper limit on the amount, which makes it an ideal choice for businesses or individuals involved in significant financial transactions.

Improved Cash Flow Control

Businesses benefit from RTGS by gaining better control over their cash flow. The immediate settlement of payments ensures that organizations can manage their finances more effectively and make timely decisions based on real-time fund availability.

Convenient Online and Offline Modes

RTGS transfers can be initiated through both online and offline modes. Online banking portals and mobile banking applications offer a convenient way for users to perform transactions from anywhere. Additionally, individuals can also visit their bank branches for in-person assistance and initiate RTGS transactions through a manual process.

Reduced or No Charges for Online Transactions

The Reserve Bank of India (RBI) has removed charges for RTGS transactions initiated online, promoting cost-effective and user-friendly digital transactions. However, offline transactions may incur charges, varying from bank to bank.

Are There Any Charges For RTGS?

There are no charges for doing RTGS as per the Reserve Bank of India (RBI) for RTGS performed via internet or mobile banking. But if you are initiating a transaction by visiting a bank branch, you may have to pay between 20 and 40 rupees with additional GST charges.

For RTGS Transactions From Rs. 2 Lakh to Rs. 5Lakh – SBI bank charges Rs. 20 + GST.

For RTGS Transaction Above Rs. 5 Lakh – SBI bank charges Rs. 40 + GST.

Conclusion

Filling out an SBI RTGS form is a skill for you if you are someone making a lot of payments from the State Bank of India. Using our step-by-step guide, you can easily send money to some seamlessly perform electronic fund transfers with ease.

If you have a net banking facility enabled, you can also download it from the Downloads section inside your State Bank of India (SBI) online user dashboard.

Frequently Asked Questions

What is the minimum amount I can send using an SBI RTGS form?

You can transfer a minimum of 2 lakh rupees using an RTGS form.

What is the maximum amount I can send using the SBI RTGS form?

You can send a maximum of any amount using a SBI RTGS form with only one condition the amount should be greater than 2 Lakh.

What are the RTGS timings?

You can use RTGS transfer mode 24×7 a year, but you cannot use this facility between 11:50 P.M and 00:30 A.M due to server maintenance.

Is RTGS transfer safe to use?

Yes, RTGS transfers are safe to use. Also, it’s a quick service where you don’t have to wait for an amount credited to your account.

Can I send money to a foreign bank using RTGS?

You can only use RTGS services to send money to foreign banks in India. You need to open a different account with the bank.

Does RTGS have transaction ID?

An RTGS transaction consists of Unique Transaction Reference with 22 characters code using which you can instantly identify the RTGS transaction in your statement. You will have to type in the password to Open SBI Statement.