Charles Schwab is the online broker for Just Start Investing. Schwab is a reputable, established online investment broker that is consistently improving its platform to benefit investors. Schwab features:

- Best in class fees / expenses:

- $0 per trade on all Charles Schwab funds, stocks, and ETFs (online)

- Expenses ratios as low as 0.02% on index funds / ETFs

- A wide variety of index funds and ETFs

- An easy to use online platform

Not to mention, getting started with Schwab is easy, and we’ll walk through exactly how to open an account and start investing below.

Disclaimer: Just Start Investing is not a certified financial advisor. This post lays out the steps to get started and the investing principles that we practice.

5 Steps to Start Investing with Charles Schwab:

- Select an Account Type

- Open an Account

- Fund the Account

- Research and Select Investments Vehicles

- Set an Ongoing Strategy and Maintenance Plan

Step 1: Select an Account Type

The first step to start investing with Charles Schwab is to select the type of account you want to open. There are a few basic account types that Schwab offers:

- Brokerage Accounts

- IRAs

- Estate and Charitable Planning Accounts

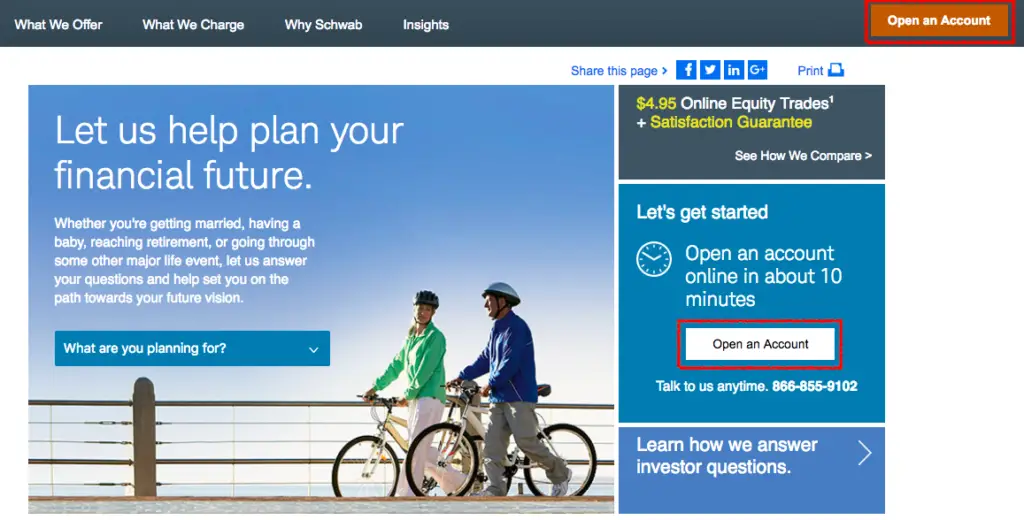

To select an account, start by clicking the “Open an Account” button found either on the upper right (orange box) or middle right (next to the clock icon) section of the web page.

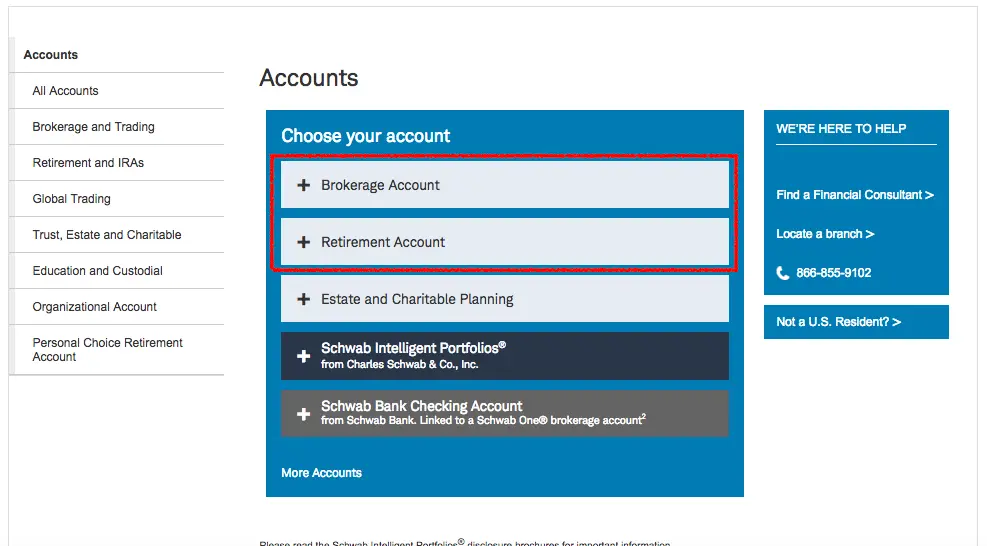

From there, you will get redirected to the following screen offering the 3 types of accounts that Schwab provides: Brokerage, Retirement, and Estate/Charitable planning.

There are two other options as well: “Intelligent Portfolios” and “Checking Account”. The intelligent portfolio is a robo-advisor that you can open if you are interested in a more automated experience (you can learn more about robo-advisors here). The checking account is what it sounds like, a checking account.

The most common type of account to open would be a brokerage account or retirement account.

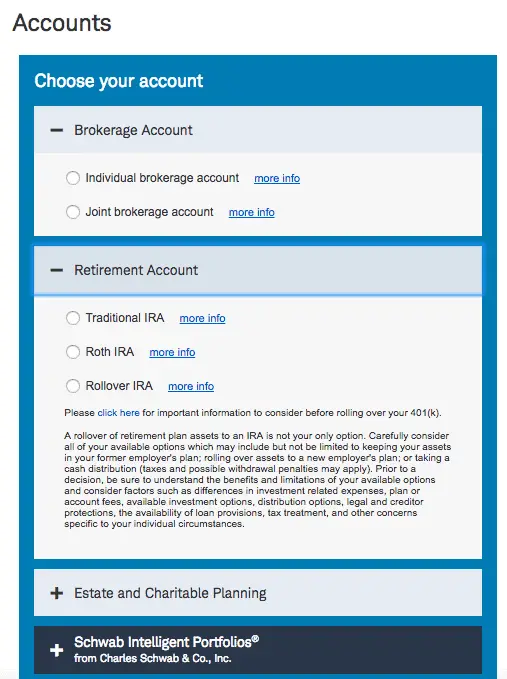

Once expanding the options, you can see that there are a couple types of accounts to choose from. If you need help deciding, this article on investment accounts goes into more detail, but some highlights are below.

Brokerage Accounts:

Brokerage Accounts give you the most flexibility with your money, but do not have any tax advantages.

- Individual Brokerage Account: A flexible account for one person.

- Joint Brokerage Account: A flexible account for multiple people.

Retirement Accounts:

Retirement accounts have certain restrictions around the amount you can deposit annually and when you can withdraw your capital gains, but come with certain tax advantages that make them extremely beneficial to most investors:

- Traditional IRA: A retirement account where you can deposit pre-tax dollars.

- Roth IRA: A retirement account where you can withdraw earnings tax-free.

- Rollover IRA: A retirement account that you can transition from an old employer to your own control/online broker.

Again, if you need more direction on which account to choose, all the details oninvestment accounts can be found here to help you decide.

Step 2: Open an Account

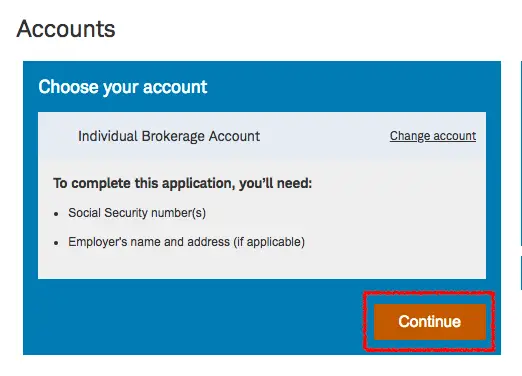

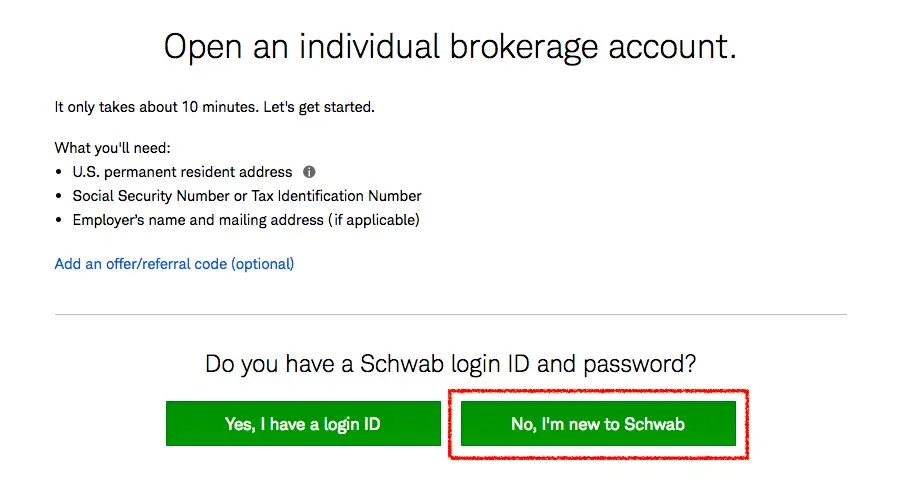

Opening the account is easy once you have selected which account type you want to open. to continue, simply click the orange continue button as seen below (in this example, we are opening an Individual Brokerage Account).

Then click the green button in bottom right that states, “No, I’m new to Schwab” (unless, of course, you are not new to Schwab).

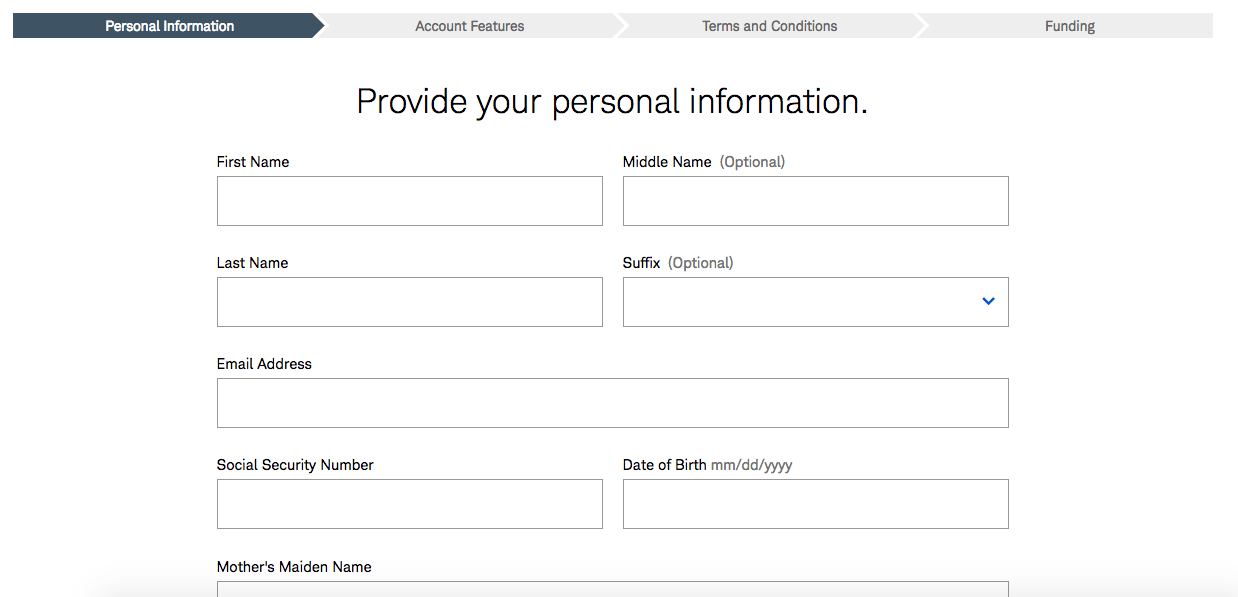

Lastly, you will need to fill out all of your personal information (including your social security number). This is necessary to open an account and start investing with Charles Schwab.

Once your personal info is complete, it’s time to officially open and fund the account.

Step 3: Fund the Account

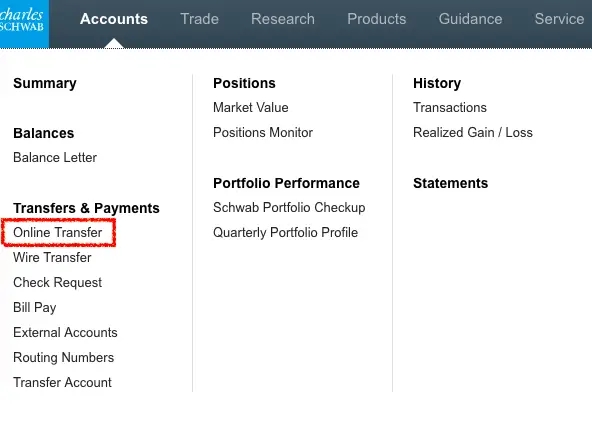

The easiest way to fund an account to start investing with Charles Schwab is to complete an online transfer. You can do this by hovering over the “Accounts” tab along the top bar, and then selecting “Online Transfer” under “Transfers and Payments”.

Different from a Wire Transfer, Online Transfers typically do not have bank fees associated with them.

Once in the Online Transfer section, you can set up a checking account that you wish to transfer funds from by entering the necessary details – usually an account number and routing number are required.

Then, you can transfer cash from your checking account directly to your Schwab account (which usually takes a couple days to process).

Of course, mailing in a check or stopping by a local branch to deposit funds are both options as well.

Step 4: Research and Select Investment Vehicles

Once your account is open and funded, it’s time to invest.

You can dive deeper into your investment options here, but below are some basic strategies that you can execute with Schwab accounts.

Option 1: Two-Fund Strategy

Overview: Also known as Rick Ferri’s Two Fund Portfolio, this lazy portfolio is adaptable for all investors. Ferri’s strategy is to blend the US Equities market with bonds to create a balanced portfolio (with a 60 / 40 split). You could recreate a similar 60 / 40 split using funds like the ones below:

- 60% SWPPX – S&P 500 Index Fund (or SCHX – U.S. Large Cap ETF)

- 40% SCHZ – U.S. Aggregate Bond ETF

And of course, if you are a more aggressive investor, you can always invest more aggressively in the equities portion of this split.

Option 2: Just Start Investing’s Portfolio

Overview: Below is how we at Just Start Investing balance our portfolio. We blend multiple investment vehicles (a variety of equities, bonds and real estate) to create what we believe is a balanced portfolio.

Thoughtful maintenance is required, and percentages can be adjusted depending on the life stage of the investor (i.e., increase fixed income %’s and lower equity %’s if later in investing lifecycle).

Note our disclaimer again, this is how we invest, and you should do your own research (or consult an advisor) before investing on your own:

- 60% SWPPX – S&P 500 Index Fund (or SCHX – U.S. Large Cap ETF)

- 20%: SCHM / SCHA – U.S. Mid Cap and Small Cap ETFs

- 10%: SCHF – International Equity ETF

- 5%: SCHZ – U.S. Aggregate Bond ETF

- 5%: SCHH – U.S. REIT ETF (Real Estate)

Do Your Research Before Diving In:

We recommend minimally doing enough research so that you have a sense for your ideal balance between equities and fixed income. Below is how Just Start Investing plans to balance those asset classes over time (assuming retirement at 65), but you must research to find the right balance for you:

- Age 19-30: 90-100% equities; 0-10% fixed income

- Age 31-40: 80-100% equities; 0-20% fixed income

- Age 41-50: 70-90% equities; 10-30% fixed income

- Age 51-60: 50-80% equities; 20-50% fixed income

- Age 61-70: 50-70% equities; 30-50% fixed income

- Age 70+: 50-60% equities; 40-50% fixed income

The more conservative of an investor you are, the more heavily you should be invested in fixed income.

Step 5: Set an Ongoing Strategy and Maintenance Plan

The work does not end when your Charles Schwab account is open and filled with long-term investments. There are two things you should do ongoing when investing with Charles Schwab (and with most online brokers that are not robo-advisors):

- Annually: Rebalance your portfolio and make sure your weight of equities vs fixed income is in line with your goals.

- Monthly: Deposit money. Set your ongoing savings plan and make sure you stick to it (as best you can).

Have questions on this article or about how to start investing with Charles Schwab? Reach out to get some help along the way!