If you have no idea how much to invest or save to reach your goals, don’t worry, you’re not alone.

Well, maybe worry a little, because if you don’t know how much you should be investing, chances are it’s not enough. The last thing you want is to wake up in 30 years and realize your another 30 years away from retiring!

Let’s have that wake up call be now, if necessary.

Whether you want to retire in 10, 20, 30 or 40 years, you need to know how much to save and invest to reach your goals.

Disclaimer: Just Start Investing is not a certified financial advisor. This post lays out strategies that we practice, but you should always do your own research.

How Much do I Need to Retire?

First, I want to dispel a couple myths when it comes to understanding what you need for retirement:

Myth #1: What your income is now is what you will want to live off in retirement…

Maybe, but not likely for two reasons.

For one, taxes. Right now, you probably pay more than 20% in taxes (federal and state). Some of you, much more. Long term capital gains tax is only 15%. If you make $100,000 a year right now, you might only be netting $70,000 after taxes. To net that same $70,000 in retirement, you only need an “income” of ~$82,000.

This assumes you are only investing in a brokerage account, here is how those assumptions change if you use other types of accounts:

- 401(k) or Traditional IRA: Taxed at the same ordinary tax rate as income

- Brokerage Account: Subject to long term capital gains tax, as noted above

- Roth 401(k) or Roth IRA: Withdrawals are not taxed at all!

Second, you are no longer in saving mode! If you were saving $20,000 a year when you were netting $70,000 of income, then you really only need $50,000 to maintain your lifestyle.

You should focus on cost of living, not income.

Myth #2: Saving for retirement is hard and complex…

It’s not, and getting started on your own is easy. There is plenty of free (and good) advice to help you navigate towards retirement. You just have to get started.

Myths = dispelled.

Back to figuring out what you need to retire… there are two routes you could take (among some others) to help determine what you need:

- The 4% Rule

- The 25 Rule

The 4% Rule

The 4% Rule is quite simple. It outlines what you can safely withdraw from your retirement account every year without ever running out of money. With this rule, that magic withdrawal number is 4%.

If you want to live off $50,000 a year, then divide that number by 0.04 and you’ll get your retirement target. In this case, $1.25 million.

Wait wait wait… but how does this work? Won’t I run out of money in just 25 years with the above example?

No, and simply stated, here’s why: we’re assuming the market will have a positive return. So if the market returns +4% after inflation, you’ll never run out of cash (in reality, most assume the market will return +7% after inflation, so the below example is conservative).

Your $1.25 million would grow to $1.30 million (+4%) and you subsequently would pull out your $50,000 ($0.05 million) to get the account back down to $1.25 million. Rinse and repeat.

Are there risks to this approach? Yes, as for one, it doesn’t take into account taxes (unless all of your money is in Roth accounts, you’ll need to factor taxes into the analysis).

Additionally, the market is volatile…

It will perform worse than +4% in a some years.

It will also perform much better than +4% in some years.

The goal, however, is that on average by withdrawing only 4%, you won’t run out of money. At end of the day, it’s a good rule of thumb and starting point.

You can learn more about the 4% rule here if you’re interested.

The 25 Rule

The 25 Rule, in essence, is the 4% Rule.

So much for having two routes to determine what you need to retire.

With the 25 rule, you multiply your desired annual retirement income by 25 to get to your retirement goal.

If you want to live off $50,000 then you need to save, you guessed it, $1.25 million ($50,000 x 25).

With the 25 Rule, the rule of thumb for a safe withdrawal rate is also 4%. It all comes full circle.

Takeaway: Figure out how much you need for retirement. Determine what you want to live off (to the best to your ability) and then multiply that number by 25. If you have any doubts about the 4% Rule, then dive into the math yourself and figure out the right withdrawal rate for you.

When Do You Want to Retire?

The next step in determining how much to invest to reach your goals is to decide when you want to retire.

Maybe you want to retire at 70.

Maybe you’re into the FIRE movement and want to retire ASAP.

Either way, you need to set your expectations. You cannot save 10% of your income and expect to retire at age 30 (unless you started making $1 million annually at 22 and are good with making $32,000 a year for the rest of your life instead of the cool million).

If you absolutely have no idea, start with 65.

From here, you can calculate how much to invest and save to reach your goals. And if the savings rate seems easy and you can save more, then save more and retire earlier (or don’t and spend more money now)! Seems like a win win situation to me.

Takeaway: Decide what age sounds like a good retirement age. If you can’t decide or if you’re unsure, stick with 65 and make adjustments from there.

How Much to Invest Based on Your Goals

Now you know both how much you need to retire and what age you want to retire at. The hard part is mostly over.

From here, the only question that remains is: What percentage of my income should I be investing in order to meet my goals?

Just Start Investing has a simple calculator (in Excel) that will help you answer that question. Here is how it works:

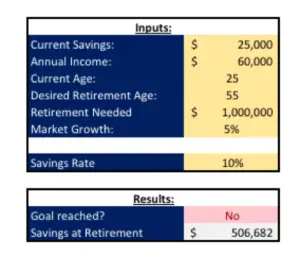

Provide inputs for the yellow cells:

- Basic Info: Current savings, annual income, age.

- Steps 1 and 2 from this Article: Desired retirement age and total dollars needed for retirement.

- Estimated Market Growth: +5% is a good default.

- Savings Rate: This is the new variable – how much you plan to save (and invest) each year. You will need to continue to change and adjust this number to get the results you want. This is also your savings rate based on gross income (before taxes), so keep that in mind.

View the results:

- Goal Reached?: This will provide a “yes” or “no” response based on all of your inputs telling you if your savings rate is enough to reach your goals. If this is a “no”, you will need to consider raising your saving/investing rate (or rethinking the age you want to retire).

- Savings at Retirement: Based on your current inputs, this is how much money you will have saved at retirement.

Data:

- You can also see some of the raw data and how your investments grow over time further below in the calculator. Unless you’re a numbers nerd, you can ignore this eye sore.

*Two Caveats: One, your income will likely rise as you grow in your career, this calculator is creating a worst-case scenario (which is not a bad thing). As your income rises, you can reassess your goals and either (1) save less or (2) save more and retire sooner. Two, the calculator does not take taxes into account, so you will need to factor that into your money needed in retirement.

Below is a screenshot of what the tool looks like with the following assumptions built in as an example:

- Basic info: $25,000 in savings, $60,000 annual income and 25 years old.

- Steps 1 and 2 from this Article: Desired retirement age of 55 and total dollars needed for retirement of $1 million. Based on this and the 4% Rule, your withdrawal rate would be $40,000 annually.

- Estimated Market Growth: +5%.

- Savings Rate: 10%.

As you can see, a 10% savings rate will not cut it in the example above. With this savings rate, you wouldn’t reach the $1 million goal. In fact, you would barely reach half of it.

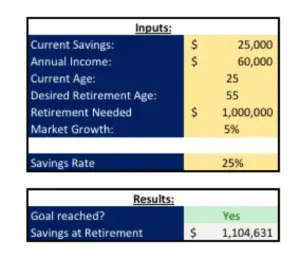

To reach the goals established in this example, a 25% savings rate would be needed.

This calculator is designed to shed light on your current financial situation.

If this 25 year old in the example above had dreams of retiring at 55, he or she would now know that saving 10% annually is not enough. And it’s better to know now than 10 years from now!

So go ahead and play around in the calculator. Enter your goals and see what savings rate you need to hit them.

Takeaway: Enter your current situation and goals into the calculator and see how much to invest and save to reach your goals.

Oh, and you can officially stop worrying now.

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.