Banking is a central part of personal finance.

There are a number of things to consider when selecting the right bank account for yourself, from the type of bank to the fees associated with it.

Banking Resources

Banking 101:

Find the Best Banks:

From the Blog

The Latest Banking Articles:

How to Open Your First Account

There are three simple steps when it comes to finds and opening the right bank account for you:

- Select what account(s) you need

- Prioritize a type of bank

- Rank and determine secondary offerings that are important to you

Getting started is easy, and you can get our full how-to guide on how to find the right bank for you here:

Banking 101

The two most common types of banking accounts are checking accounts and savings accounts, and they serve two different needs.

Checking Account

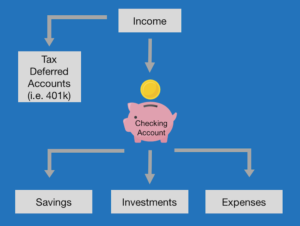

A checking account is an account that allows you quick and easy access to your money. This account is best used as the central hub of your finances. All of your income should flow through and out of this account (for the most part).

This flow chart below helps visualize how a checking account can be used:

A checking account is extremely flexible, which makes it a great first bank account to open.

Savings Account

A savings account is an account where you can store funds and access them 6 times per month. Savings accounts, especially the high yield variety, are best for emergency funds and longer term savings.

To be clear, all of your savings should not be in a savings account.

But a portion of them can be for emergencies or large purchases. For example, if you are going to buy a house, you likely want to build up money in a safer and less volatile account before you make a down payment.

Why Banking Matters

Banks and bank accounts should work for you and make your life more convenient.

A checking account should make managing your money seamless.

A savings account should be a safe way to store an emergency fund, without losing value to inflation.

Having the right bank and bank accounts will help make accomplishing your financial goals easier.