I’ve been all over the map when it comes to an emergency fund and how much money should be stored in one.

I used to think that a nice, cushy emergency fund was important and necessary. I couldn’t take the risk of losing my job and not being able to pay the bills!

Then, I swung hard to the other side of the emergency fund spectrum and realized the risk of not investing my money. By keeping money stored in a bank account, I was foregoing potential returns!

Finally, I settled somewhere back in the middle. I now employ the mantra that one of my good friends told me, “do whatever helps you sleep at night.”

Not sure how much should be in your emergency fund that will help you sleep at night? Below we’ll dive into exactly what you should take into account when determining how much money to store in your emergency fund (and where to store it!).

But first things first…

What Exactly is an Emergency Fund?

An emergency fund is exactly what it sounds like – money you have set aside for emergencies.

Vanguard describes it well, “An emergency fund is a stash of money set aside to cover the financial surprises life throws your way.”

These financial surprises could include things like:

- An expected medical expense.

- House or car repairs from an accident.

- A loss of a job (and income).

- Etc.

Really, an emergency is any unplanned expense that you might not be able to cover with your regular income. And an emergency fund can help pay for those expenses.

Keep in mind, you should avoid using your emergency fund for “wants”, like a new bike or fun vacation. For those expenses, you should look to set up sinking funds.

What the “Experts” Say

Like with most things, personal finance experts do not agree on how much you should put in your emergency fund.

Some believe in no emergency fund because of the opportunity cost of not investing. Any money you have sitting in a bank account is missing out on the potential 7% annual return from the stock market.

The pros of no emergency fund are:

- Investment growth: If you invest $20,000 over 40 years (with only 5% returns) it would turn into about $134,000. If that money sat in a bank account with 0% interest, it would still be $20,000. You’re missing out on $114,000 in returns by foregoing that investment.

- Other ways to pay: Those against emergency funds are not saying emergencies won’t happen, they’re just saying you can find other ways to pay for them. Whether it’s through credit cards, regular income, or investments, they believe they can find a way to cover emergencies if they happen.

Others think that everyone should be prepared to pay for emergencies with cash, not by withdrawing investments.

The pros of having an emergency fund are:

- Easily pay for… emergencies: Having an emergency fund means you don’t have to think twice about how to pay for unexpected expenses.

- No short term investment losses: With an emergency fund, you also don’t have to worry about pulling money out of the stock market (or other investment) before you planned to (and potentially when the market is at a low point).

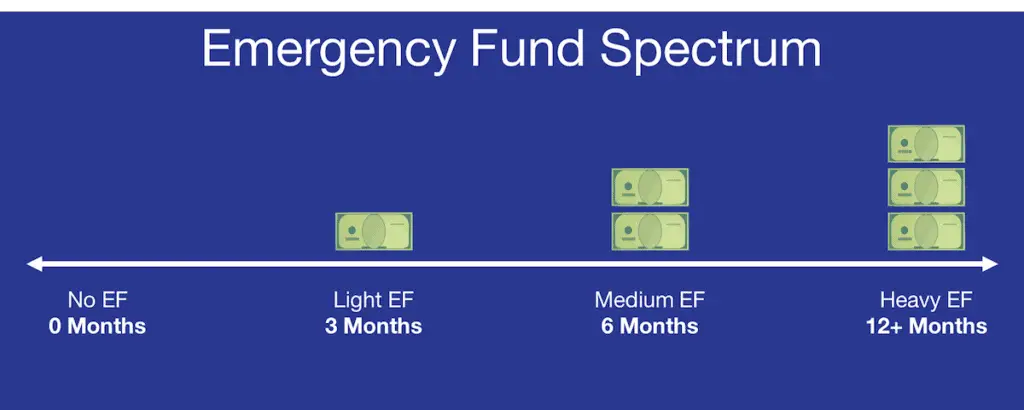

In general, everyone sits somewhere on the spectrum below. Recommending having an emergency fund with anywhere between 0 months of expenses and 12+ months of expenses in savings.

Here are some questions to ask yourself to figure out where you should sit on the spectrum:

- Do you have a lot of potential emergencies that could occur at any moment?

- Do you own a house or car?

- Is there a lack of job security in the industry you work?

- Do you have a history of medical issues?

- Are you naturally a risk-averse person?

- Do you already max out your 401(k)?

- Do you already max out an IRA?

- Are you living pay check to pay check, for the most part?

- Do you have a family to support?

The more questions you answered “yes” to, the farther right you should be on the spectrum. If you answered “no” more often, then you should likely sit on the left side of the spectrum.

Where Should You Put Your Emergency Fund

Alright, let’s say you landed somewhere right of “0 months” on the emergency fund spectrum. Where should you store that cash?

High Yield Savings Account

In my opinion, a high yield savings account is the best place. For a few reasons:

- Safety: Most high yield savings accounts are FDIC insured for up to $250,000. Like any standard bank account.

- Consistency: High yield savings accounts have more consistent returns compared to stocks and bonds. You don’t have to worry about the absolute value of your money going down (outside of inflation), only the interest rate changes.

- Interest Rate: Compared to standard bank accounts (yielding sometimes only 0.01%), high yield saving accounts offer amazing returns. Currently (in 2021), many are close to 0.5%.

- Accessibility: Savings accounts are easy to access. Typically, you can transfer money to your checking account in only a couple days.

If you’re not convinced, there are a number of other options you could consider.

Option 1: Money Market Account

Money market accounts are a bank account that usually require a higher minimum balance. Though, in exchange it offers better interest rates and check writing ability (something typically only available with checking accounts). However, with the growing popularity of high yield savings accounts, interest rates on money market accounts are not always better.

Option 2: Certificate of Deposit (CD)

A Certificate of Deposit (CD) is an account with a fixed time period over which it pays higher than average interest rates. However, you can’t access your funds during that time period without paying a penalty fee. Essentially, you are giving up your ability to access your funds for a certain time period in exchange for better interest rates.

Option 3: Bonds

Last but not least, you could always store your emergency funds in bonds or a bond index fund. While this is a more risky route to take, you will likely get higher returns on your fund. And it is still a safer approach than keeping everything in equities.

An Argument for Investing Your Emergency Fund

What if I told you that you could simultaneously be on the left and right side of the emergency fund spectrum at the same time…

…If you invest your emergency fund in index funds, you could consider that as either:

- Having no emergency fund.

- Or having an emergency fund of 3, 6 or 12+ months, but just in an index fund instead of another account.

Disclaimer: I do not do this. As I mentioned, I landed somewhere in the middle of spectrum and use a high yield savings account. But for some, this might be a good strategy.

To help illustrate why this could be a good strategy, check out this quick scenario that I first published on The Savvy Couple.

Scenario: Investing Your Emergency Fund

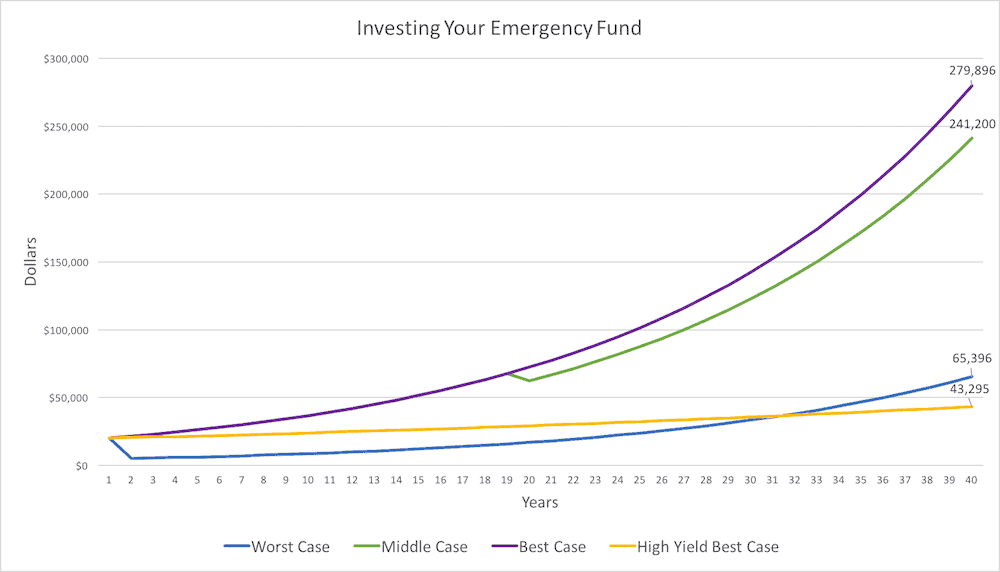

This is not an exhaustive scenario, but it helps paint the picture of what could happen if you invested your emergency fund. I am using the assumptions that stocks grow by 7% and a high yield savings account by 2%.

Here are four potential outcomes that could happen:

- Worst Case: Immediately after investing your $20,000 emergency fund the market dips and drops to half its value. Your $20,000 is now $10,000. At the same time, you need to withdraw $5,000 for an emergency.

- Middle Case: Halfway through life, you need to use $10,000 on an emergency.

- Best Case: You never touch your emergency fund.

- Best Case with a High Yield Savings Account: You never touch your emergency fund, but it was in a high yield savings account rather than stocks.

Here is how those outcomes would impact your money over 40 years:

As you can see, even the worst-case scenario when investing your emergency fund turns out better over 40 years than the best case scenario while using a high yield savings account.

Obviously, there are other scenarios where you could be worse off (like if you needed the full $10,000 right after the market dips – completely wiping out your funds). But these are relatively low probability scenarios, and it’s up to you to decide what level of risk you are comfortable taking on.

In Summary…

“Do whatever helps you sleep at night.”

Hopefully, this article helped you get closer to figuring out what type of emergency fund is needed to accomplish the above.

Keep the discussion going in the comments! Let me know what emergency fund strategy you are currently using!

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.

I’m with you – your emergency fund should be extremely liquid. Mine is split between a High Yield checking account and a money market account. I can access the high-yield checking account instantly and the money market in 48 hours. I think CDs are great if you are saving for a large purchase that you plan to buy near the time the CD matures, but don’t think they are liquid enough for emergency funds.

Agreed, Susie!