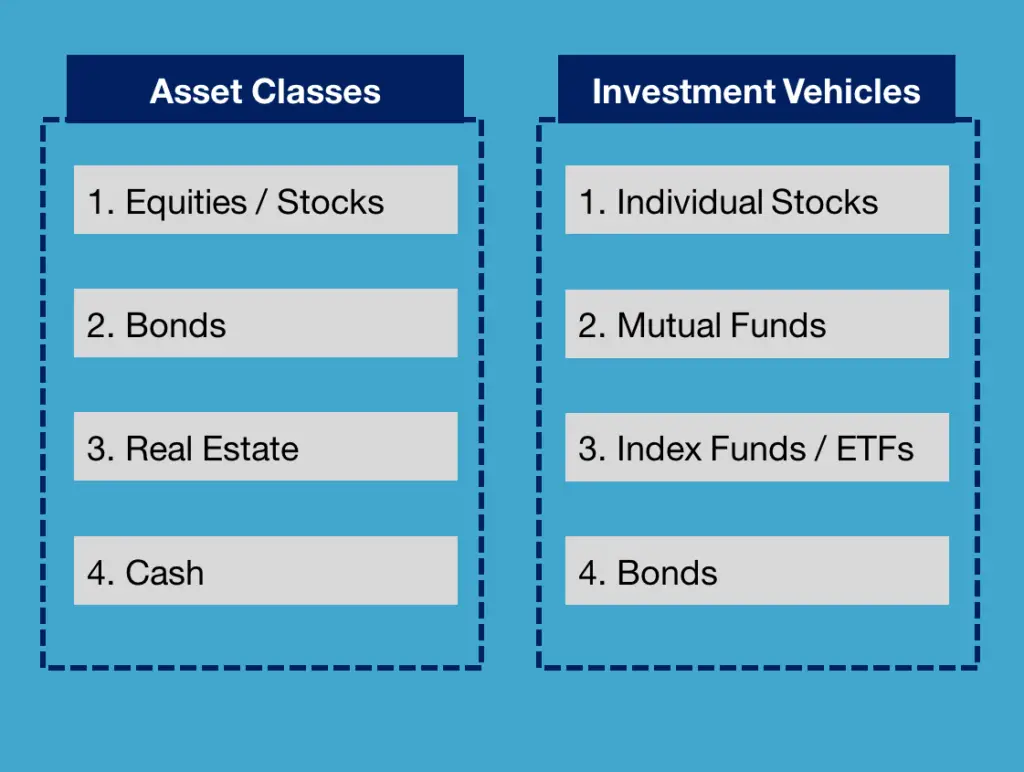

Various types of investment vehicles (like stocks, mutual funds, bonds, etc.) fall into a few basic asset classes. Asset classes are just the broad grouping or categorizations of your various investment options. The four major asset classes are equities / stocks, bonds, real estate and cash.

Four Major Asset Classes

- Equities / Stocks – pieces of individual companies

- Bonds – a loan that you issue to a company, government, etc.

- Real Estate – physical property

- Cash – money on hand or in a bank account

Fixed income is a term often used to define bonds and real estate (grouping them together). This is because they both produce a regular fixed income, or payment, in a fixed time period (monthly, quarterly, etc.).

If you invest in bonds, that fixed income you receive is the company or government repaying its debt with interest. If you invest in real estate, that fixed income you receive could be a renter or tenant pay monthly rent.

Typically, new investors invest heavily in equities and stock when they have a long time horizon before retirement (or needing to withdraw money). For example, 90% in equities / stocks and 10% in fixed income (bonds and real estate). Investors typically weight this ratio more heavily in fixed income as they get older and closer to retirement (which is less volatile and less likely to decline sharply right as you need to withdraw money).

Types of Investment Vehicles

Within these asset classes, there are types of investment vehicles to choose from. The main four that satisfy the needs of most investors are:

- Individual Stocks

- Mutual Funds

- ETFs and Index Funds

- Bonds

Individual Stocks

Individual stocks are pieces of individual companies, like Apple (AAPL) and Walmart (WMT). When you buy a stock, you reap the reward of any growth in earnings (which usually results in an increased stock price) and regular dividend payments to owners.

Mutual Funds

Mutual Funds are a group of assets (typically stocks, but can be bonds and other assets) that you can purchase by pooling money with other investors (i.e. VTSAX). Mutual Funds allow for easy diversification because when you buy the fund you are buying all of the stocks or bonds that fall within that fund. Though, they are usually actively managed by fund managers, which leads to higher costs.

ETFs & Index Funds

ETFs and Index Funds are groups of assets (typically stocks, but can be bonds and other assets) that you can purchase by pooling money with other investors (i.e. SCHX). ETFs and Index Funds allow for easy diversification because when you buy the fund you are buying all of the stocks or bonds that fall within that fund. These funds typically mirror various markets and established indices (like the S&P 500) without active management.

The major difference between index funds and ETFs is that index funds are traded like mutual funds – not throughout the day like stocks and bonds, but only at the end of the trading day. ETFs trade throughout the day, like stocks. They can be bought and sold any time (however actively trading ETFs is usually not recommended).

Bonds

Bonds are a form of debt. You can invest in bonds either individually or through ETFs and various funds. Bonds offer a lower return (in late 2018, about 2-3% annual) and are safer investments than stocks (you will get paid unless the underlying entity behind the bond defaults).

Comparing Types of Investment Vehicles

The Just Start Investing favorite of the 4 types of investment vehicles above is the ETF or Index Fund.

Through ETFs and Index Funds, you can easily build a diverse portfolio without having to purchase 10, 20 or 30 underlying assets to become diversified.

On top of that, ETFs and Index Funds have very low expenses (compared to Mutual Funds) and typically have $0 transaction costs if you invest in your online broker’s funds (compared to the typical $5-$7 transaction costs per trade).

More on the pros of ETFs and Index Funds vs other types of investment vehicles:

ETFs/Index Funds vs Individual Stocks:

- Easier diversification

- No transaction costs

ETFs/Index Funds vs Mutual Funds:

- Lower expense ratios

- Sustained long-term performance

ETFs/Index Funds vs Individual Bonds:

- Easier diversification

- No transaction costs

Ready to start investing today now that you know about asset classes and types of investment vehicles? Start now and invest in index funds on your own or through Betterment.