There are four basic types of investment accounts:

- Individual Brokerage Account (or Joint Brokerage Account)

- IRA (Individual Retirement Account): Roth or Traditional

- 401k (and other Corporate Sponsored Accounts)

- 529 College Savings Account

This is not an exhaustive list, but it does cover the core types of investment accounts that will take care of 90%-100% of your investing needs.

1. Individual Brokerage Account

An individual brokerage account is the most basic and flexible type of investment account. In the simplest terms, a brokerage account allows you to buy and sell investment vehicles through a licensed broker (like Charles Schwab) with very little restrictions.

Opening an individual brokerage account has become very simple thanks to the rise of online brokers. The basic process is as follows:

- Open an online brokerage account (i.e. through Betterment or Charles Schwab)

- Deposit money into the account – there are a couple ways to do this, but the easiest is to link your checking account and electronically transfer money. You can usually mail a check as well if you prefer.

- Start Investing

Key Benefits:

- No contribution limits

- No restrictions on withdrawing funds

Drawbacks:

- Taxed on the way in

- Taxed on the way out

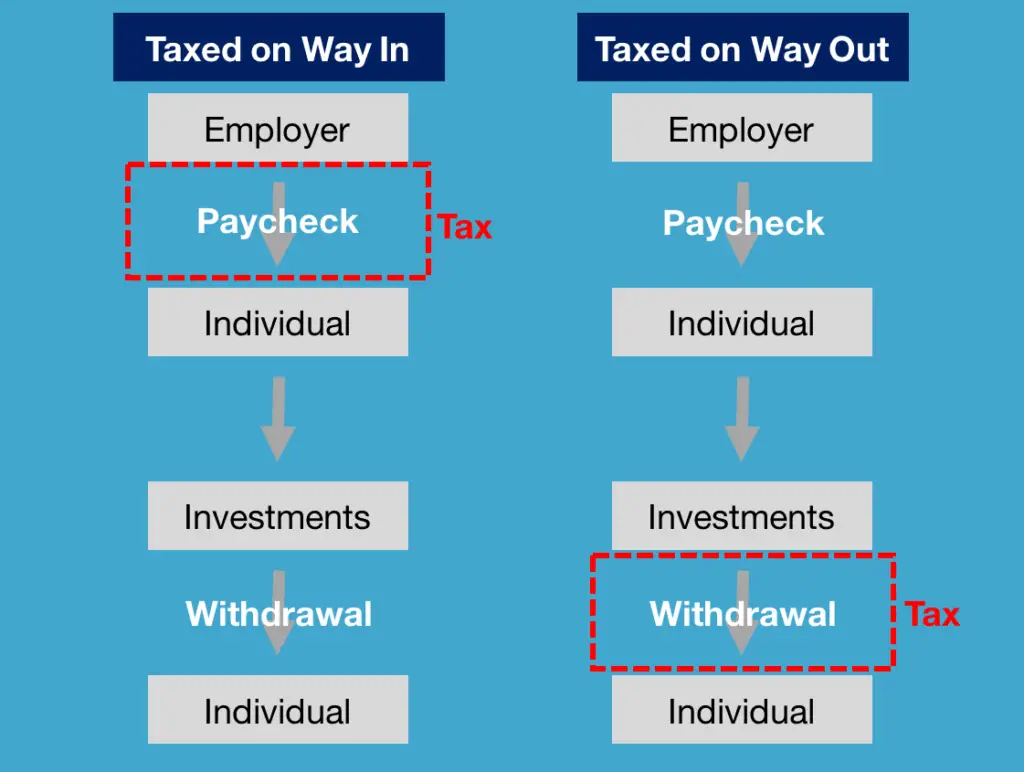

Note: I will use the above terminology in the rest of this post on types of investment accounts, the definitions are below:

- Taxed on the way in: Your money is taxed when you earn it (state and federal taxes on your income / checks from work).

- Taxed on the way out: Your money is taxed as you withdraw it from your investment accounts. Note, for most accounts (excluding Traditional IRAs and 401ks) this only applies to capital gains and not the money you initially contributed. Two quick examples to help illustrate:

- You buy Apple stock for $1,000, sell it for $2,000, and are taxed on the capital gains of $1,000.

- You contribute $1,000 to your 401k pre-tax (into various investments). It grows to $2,000 when you retire. Taxation occurs on the full $2,000 when you withdraw it.

Joint Brokerage Account

A brokerage account shared with another individual is a joint brokerage account. For example, your spouse.

2. IRA

An account designed to help you save for retirement is an IRA (Individual Retirement Account) – exactly what it sounds like. There are significant tax benefits to IRAs that help you keep more of your money, but also some rules on when you can withdraw your money (and penalties if you do not follow these rules).

Tax-advantaged accounts come with rules you need to follow. Here a couple key ones to keep in mind with IRAs:

- Max Contributions: In 2021, the maximum amount of money you can contribute to an IRA is $6,000 ($7,000 if you are 50+ using catch up contributions) annually. This applies to both Roth and Traditional IRAs (so, you cannot contribute $6,000 each to both a Roth and Traditional IRA).

- Withdrawal Rules: Money withdrawn before age 59.5 has a 10% additional tax (note: for Roth IRAs this only applies to capital gains, not your original contribution).

- Income Limits (Roth): Your ability to contribute to a Roth IRA reduces (and eventually goes down to $0) if your modified adjusted gross income (MAGI) is above certain levels. If you are single or filing separately from your spouse the limit is $125,000. If you are married filing jointly the limit is $198,000.

- Income Limits (Traditional): For a traditional IRA, the limits depend on if you qualify for a retirement plan through work. If you do not qualify for a corporate-sponsored plan, then there are no income limits.

You can read more about IRAs rules here.

There are several types of IRAs, but the two most common are the Roth IRA and Traditional IRA.

Roth IRA

Roth IRAs are accounts that you put post-tax income into, but you can withdraw any capital gains tax-free when you retire. In other words, you get taxed now (by using post-tax income) and get the benefit later (when you pull your money out at retirement tax-free).

Key Benefits:

- Not taxed on the way out

- No mandatory withdrawals

- Can withdraw your contributions anytime (although not usually recommended, it is a good safety net)

Drawbacks:

- Contribution limits

- Penalty if capital gains withdrawal before age 59.5

- Taxed on the way in

Traditional IRA

A Traditional IRA is an account that you contribute pre-tax income into*, but you get taxed on your contributions and capital gains when you withdraw. In other words, you benefit now (by using pre-tax income) and get taxed later (when you pull your money out at retirement).

Traditional IRAs operate very similarly to corporate sponsored 401ks in that they use pre-tax income.

*Technically you deduct your contributions when doing taxes.

Key Benefits:

- Not taxed on the way in

Drawbacks:

- Contribution limits (if you qualify for an employer-sponsored retirement plan)

- Penalty if withdrawal before age 59.5

- Mandatory withdrawals starting at age 72 (if you were born after June 30, 1949)

- Additional rules when also utilizing corporate-sponsored plan (I.e. 401k)

- Taxed on the way out

There are a lot of rules and drawbacks to keep in mind when dealing with these types of investment accounts, but do not let that scare you, IRAs are extremely useful tools in helping to save for retirement.

3. 401k

A 401k is a corporate-sponsored account provided by your employer. As mentioned above, a 401k is similar to a Traditional IRA – it offers a tax break on your income now and you are taxed on your money later. With 401ks, you designate a percent of your income (paycheck) that you want to contribute and it is automatically deducted and invested for you (based on your pre-selected investment vehicles).

Note: we’re focusing mainly on the traditional 401k. You can learn more about traditional 401ks vs Roth 401ks here.

The largest benefit of a 401k is employer match programs (as applicable). In short, some companies contributes a certain percentage of your income to your 401k in addition to your contributions (as long as you meet certain contribution thresholds). The most common example is companies matching 50% of the first 6% you contribute. Here are a couple of examples to help illustrate:

- Example 1: You contribute 3%, employer contributes 1.5%. Total = 4.5%.

- Example 2: You contribute 6%, employer contributes 3%. Total = 9%.

- Example 3: You contribute 9%, employer contributes 3%. Total = 12%.

There are a few rules to keep in mind with 401ks:

- Max Contributions: The max contribution for any individual is $19,500 annually, while the max contribution for the individual + employer is $58,000 annually.

- Withdrawal Rules: Money withdrawn before age 59.5 has a 10% additional tax.

- Mandatory Withdrawals: Similar to Traditional IRAs, you must start withdrawing from the plan starting at age 72 (if you were born after June 30, 1949)

Key Benefits:

- Not taxed on the way in

- Employer matching contributions

- Automatically deducted from paycheck

You can get 7 tips to maximize your 401(k) benefits here.

Drawbacks:

- Contribution limits

- Penalty if withdrawal before age 59.5

- Mandatory withdrawals starting age 70.5

- Taxed on the way out

- Limited investment vehicle options: typically, there are only a handful of mutual funds to choose from when investing in a 401k (versus the unlimited options when investing through a broker in an IRA or personal brokerage account)

Check out Blooom for a free 401(k) analysis to see if your account is set up as optimally as possible.

Other Corporate Sponsored Accounts

Other, less common types of investment accounts offered by employers include:

- Pension Plans: Becoming rarer for corporations to offer, but arguably one of the best retirement plans for individuals out there.

- 403b: Similar to a 401k, but typically utilized by public schools or non-profits.

- 457: Similar to a 401k, but typically utilized by local and state governments (police officers, firefighters, etc.).

- Solo 401k: A 401k plan for sole proprietors.

- SEP IRA: IRA Plans for small businesses.

- Simple IRA: A simpler retirement account typically used by small businesses.

4. 529 College Savings Account

Last on the list of types of investment accounts is the 529 Savings Account (specifically, the Education Savings Plan). This account is designed to help save for a beneficiary’s higher education (i.e., college) and includes generous tax benefits (benefits vary slightly by state).

Key Benefits:

- Not taxed on the way out

- Can use at most schools nationwide (not limited to certain states)

- Some states offer matching programs

Drawbacks:

- Limited to only use on education expenses for a beneficiary

- Taxed on the way in

Learn more about the 529 Savings Account.

Ready to start investing today now that you know about types of investment accounts? Start now and do it yourself.