A 401(k) is one of the best retirement accounts out there and is loaded with great benefits. Though, like a car that gets good gas mileage, there are things you can do to turn that “good” gas mileage into “great” gas mileage.

Today you’ll learn some of those tips and tricks. Otherwise said, you’ll learn how to best protect and grow your money in your 401(k).

By the way, this is part 3 to our series on 401(k)s. If you missed the first two lessons, you can check them out below. They go more in depth on specific 401(k) topics:

And if you’re looking to understand if your 401(k) is in a good spot today before digging in further, Blooom could be a great solution for you.

Blooom is a 401(k) robo-advisor that provides a free “check-up” on your 401(k). They let you know if you are:

- In the right investment funds, or not.

- Minimizing fees as best you can.

- And if you are making any other obvious mistakes.

It’s a great place to start so you know exactly what you need to improve in your 401(k) as you read through this guide!

Give Blooom’s free analysis a shot right now:

Alright, let’s jump in.

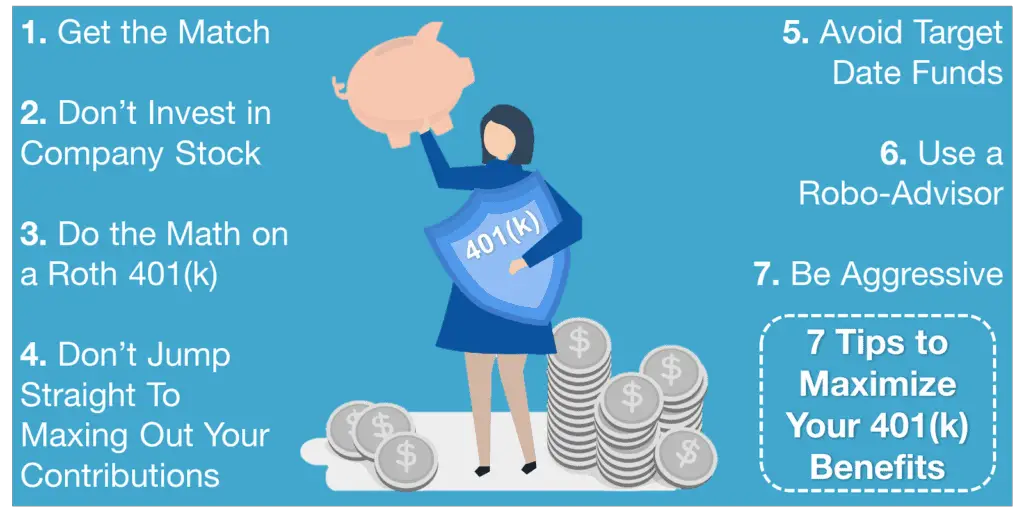

Here are the 7 tips to maximize your 401(k) benefits.

1. Get the Match

First things first – you have to get your company match.

This is the most obvious, and most important tip to maximize your 401(k) benefits. And that’s why I’m getting it out of the way first.

A 401(k) company match is when your employer also makes contributions to your 401(k) on your behalf.

For example, your company may match the first 50% of the first 6% you contribute (though, this can and does vary by company). It’s not as complicated as it sounds, here are a couple examples to help illustrate the 50% match up to 6%:

- Example 1: You contribute 2%, employer contributes 1%. Total = 3%.

- Example 2: You contribute 6%, employer contributes 3%. Total = 9%.

- Example 3: You contribute 10%, employer contributes 3%. Total = 13%.

You should always max out your employer contributions (at least getting to example 2), this is free money!

Not every employer offers a match. And those that do have varying rules. But if it’s available to you, then you should take advantage.

2. Don’t Invest in Company Stock

There are two main reasons you shouldn’t invest in company stock in your 401(k): bias and diversification.

Bias

Hopefully, you work for the company you work for because you like them. And because you want them to (and think they will) do well.

So, why not benefit from their eventual success because of your amazing contributions, right?

Well, the problem is, everyone at ever company likely has similar thoughts. And every company is not going to eventually to well and see its stock price go up.

Some go down. Thats a fact.

Without getting too pessimistic here, this is the part where I should say you’re not special and you likely won’t make a huge difference at your company. And that your company has just as good of a chance of seeing its stock price rise as everyone else (and same with the chances of seeing it fall).

But hey, I’m not going to stay that, because we’re keeping it positive today. Instead.. we’ll move onto the next topic and I’ll simply say, “don’t be biased towards your own company just because you work there.”

Diversification

Diversification has two parts to it.

First, is the obvious – investing in one stock does not properly diversify you. That is why I usually opt for index funds that allow me to invest in multiple stocks with just one purchase.

Second, is diversifying your job from your investments. If you’re company starts to struggle, you could be at risk of losing value in your investment portfolio and losing your job. It’s an extreme scenario, but it can happen. *cough* Enron *cough*.

There is an exception for investing in company stock, and it involves around stock options and discounted purchase plans. But you can learn more about that and get more details on why you shouldn’t invest in company stock in your 401(k) here.

3. Do the Math on a Roth 401(k)

The Roth 401(k) has been gaining in popularity because it combines the benefits of a 401(k) and a Roth IRA. At a high level:

- You contribute funds post-taxes [Similar to Roth IRA]

- You can withdraw earnings tax-free [Similar to Roth IRA]

- Contribution limits are $19,500 annually in 2021 [Similar to 401(k)]

- Required distributions start at age 70.5 [Similar to 401(k)]

When deciding if you should utilize a Roth 401(k), you need to ask yourself one question – will your tax rate be higher now or in the future.

Unfortunately, none of us know the answer for sure. If we did, it would make this decision very easy. Instead, you must make an educated guess. And the outcome will determine what is right for you:

- Higher tax rate now = Traditional 401(k).

- Higher tax rate later = Roth 401(k).

The one major watch out here goes back to our first point – getting the company match. Employers cannot contribute to post-tax accounts, like a Roth 401(k). They would need to place the match into a traditional 401(k).

This is more work for the employer, and some might not do it or have further stipulations around it, so just be sure to check with your employer and factor this piece in before jumping to a Roth 401(k).

Speaking of jumping…

4. Don’t Jump Straight to Maxing Out Your Contributions

Maxing out your 401(k) sounds like a great way to maximize your 401(k) benefits. And, it is.

But, it’s not always the right thing to do for your overall financial situation.

In fact, there are 5 things you need to consider before maxing out your 401(k):

- Pay Off Short Term Debt.

- Get Insurance.

- Set Up An Emergency Fund.

- Consider Other Tax-Advantaged Accounts.

- Ensure You Have Enough Saved for Near Term Goals.

You can learn more about each of those steps here.

What it boils down to is ensuring you have set yourself up for success in places outside of your 401(k) before putting more money into it. Because once money is in a 401(k), it’s hard to get it out – it’s not a flexible account.

5. Avoid Target Date Funds

If you get your free analysis from Blooom, one thing they will recommend (among other actionable advice) is to avoid target date funds.

There are two main reasons that target date fund are usually not a great ideas: high fees and being too conservative.

High Fees

Target date funds typically have higher fees that most index funds.

We all know what high fees can do to a portfolio over the long term – so avoiding them and building a portfolio of low cost index funds instead can save a ton of money.

Being Too Conservative

I’m jumping ahead a bit here, because the 7th tip to maximize your 401(k) benefits is to be aggressive. But, this is one of the flaws of target date funds to call out. They have a tendency to put too much weight on conservative investment vehicles too early in your career, which can hinder long term gains.

6. Use a Robo-Advisor

Speaking of Blooom, using a robo-advisor is a great way to maximize your 401(k) benefits. Specifically, Blooom offers two separate services, detailed below.

Free 401(k) Analysis

Blooom can link to your 401(k) to review your account and provide recommendations on how to optimize your 401(k).

- Price: Free.

- Expense Ratio: None. No hidden fees.

- Account Minimum: $0

- Services: 401(k) analysis, which provides:

- Diversification recommendation.

- Fee check up – ensuring you are in the lowest fee funds possible.

- Obvious watch outs, like being invested in company stock.

- Retirement tracking snapshot.

You can get you free analysis here.

Ongoing 401(k) Management

Blooom offers ongoing 401(k) management, so you can take a more hands off approach and let them take the wheel. Similar to what Betterment and other robo-advisors do.

- Price: Flat $10 / month.

- Expense Ratio: None. No hidden fees.

- Account Minimum: $0

- Services: 401(k) management, which provides:

- The free analysis detailed above.

- Automatically investing you in the right funds based on your risk profile and goals.

- Rebalancing your 401(k) as time passes, keeping you on track for retirement.

Give Blooom’s free analysis a shot right now:

You can get our full review of Blooom here.

7. Be Aggressive

Last, but certainly not least, is to be aggressive.

Your 401(k) is one of the most restrictive accounts investment accounts. You cannot access your money (without paying a hefty 10% fee) until retirement age (59.5).

In addition, we know over the long term that stock performance tends to outperform bond performance. At least that’s what history tells us.

So combining those pieces of knowledge, if your a 20-something (or even 30-something) year old adult looking to invest in your 401(k), and you know you cannot access your funds for 20-30 years, what would you do?

Likely, invest in the vehicle that will give you the best odds of the highest returns of the long term. Or at least, thats what I would do…

(Index funds… I’m talking about equity index funds here).

Summary: 7 Tips to Maximize Your 401(k) Benefits

To recap, here are the 7 tips to maximize your 401(k) benefits, and why they help you make the most of your 401(k):

- Get The Match: It’s free money!

- Don’t Invest in Company Stock: It’s too risky and does not provide proper diversification.

- Do the Math on a Roth 401(k): It could leave you with more money at the time of retirement.

- Don’t Jump Straight to Maxing Out Your 401(k): While this would certainly maximize your 401(k) benefits, it might hurt you in other areas of your saving and investing portfolio.

- Avoid Target Date Funds: They charge high fees and can hinder your 401(k) returns.

- Use a Robo-Advisor: They can provide a free analysis to ensure you are on track to maximize your benefits. And can even do it for you for a small fee.

- Be Aggressive: Over the long term, this will maximize your probability for the highest possible returns.

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.

I completely agree on avoiding the target date funds.

I think many people opt for these because they make sense of it. “hey i’m going to retire in 2050” i’ll put my money in “target date 2050 fund”.

You’re right with the fees. People select these options and don’t necessarily understand the fees involved. The companies, in my opinion, make the fees higher so they can take advantage of the situation.

-Chris

Money Savvy Mindset

Great points Chris, totally agree.

All very good points. I don’t have a company match, but Mr. Fat sure does. His match goes directly into company stocks, but all his contributions go into index funds. We’ve been waiting until the company stock goes up to sell them. They are offering good dividends though. I’ve looked at the target funds myself, and they are far too slow.

Does the match have to go into company stock? Or is there another option there? Love that index funds are being used for the rest! Good stuff!