An expense ratio affects everything from exchange traded funds (ETFs) to mutual funds. It’s important to keep expense ratios as low as possible, as a high expense ratio can cost you hundreds of thousands of dollars over the long term.

An Index investing strategy can quickly get derailed if you do not keep costs low. With a high expense ratio, your portfolio is no longer getting the return of the overall market, it’s getting less!

We’ll dive further into what an expense ratio is and why it’s important to take into account when choosing index funds. But first, our disclaimer:

Just Start Investing is not a certified financial advisor. Please do your own research or consult a financial professional before making any financial decisions.

What is an Expense Ratio?

Simple stated, an expense ratio is the percentage of your investment that is used to pay an investment fund every year. It’s your cost.

The fund uses this payment to cover the operating costs that it undergoes.

Operating expenses covers a number of things, from the fund manager’s salary to basic legal fees the fund incurs.

The important thing to know is that this is the price the fund is charging you to use their services. Their services include matching an entire index with one easy investment. You might also hear this cost defined as a management fee or fund fee.

One important note to add – you will never be directly charged for an expense ratio. But make no mistake, you are paying for it. Rather than charging you, the fund simply takes the payment from the existing assets within the fund.

Let’s walk through an example to better explain what an expense ratio is and how it affects you.

A Good Expense Ratio Example

Charles Schwab’s S&P 500 Index Fund (SWPPX) has an extremely low expense ratio – currently 0.02%. Schwab is known for having lower fees compared to most index fund competitors.

Every year, Charles Schwab takes 0.02% of your investment and pays itself to cover the fund expenses.

If you have $10,000 in this fund, then your annual cost would be $2.

Not bad at all.

A Bad Expense Ratio Example

On the other hand, you have Charles Schwab’s actively managed core equity fund (SWANX). This mutual fund’s expense ratio is 0.74%.

So, if you have $10,000 in this fund, your annual cost would be $74.

Not terrible, but a lot worse than $2!

Keep in mind, expense ratios are not the only fees to look for when buying an index fund, but more on that later.

Why is an Expense Ratio Important?

As we’ve already indicated with the above examples, a higher than average expense ratio can mean a lot less money in your pocket. No one wants that. Well… except for fund managers.

With index investing, there is no need to pay a high expense ratio because you are investing in passively managed funds. You are simply trying to match an index (like the S&P 500), so you should find the fund that can do that for you for the least amount of cost.

And if you are still with an actively managed fund, check out the benefits of indexing and consider making the switch. Actively managed funds will almost always have higher expense ratios. Which means a higher cost for you to pay.

Also important to note, an expense ratio is a percentage (not a fixed rate). So as your income grows, so will this expense. The expense ratio will cost you a lot more when you are investing $100,000 than when you are investing $1,000.

Is Your Expense Ratio Costing You Too Much?

Let’s build on the above examples we already walked through with the Charles Schwab funds.

Let’s fast forward 10 years, and your investment has grown from $10,000 to $100,000 through hard work, saving, and investment growth – nice job!

Someone investing in a 0.02% expense ratio fund would be paying just $20 a year.

Someone investing in a 0.74% expense ratio fund would be paying $740 a year.

The disparity between the two funds is worse than just one year of fees, though. Especially when you consider how the fund getting charged less (and therefore has more assets) is affected by compounding growth.

Over 40 years, the cost can really add up.

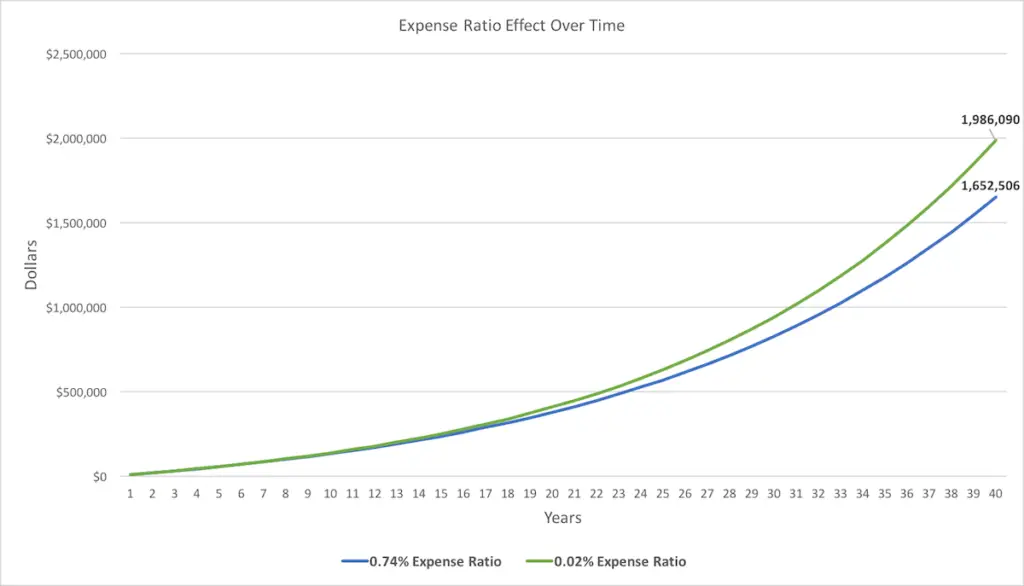

Example 1: 0.02% vs 0.74%

Here is an example of what would happen to your investment under the two different funds with the following assumptions:

- Starting with $10,000

- Investing an additional $10,000 every year

- Investing for 40 years

- Index funds grows +7% annually

As you can see, the low expense ratio fund grows to be over $300,000 more than the high expense ratio fund!

That’s a huge expense that can and should be avoided at all costs.

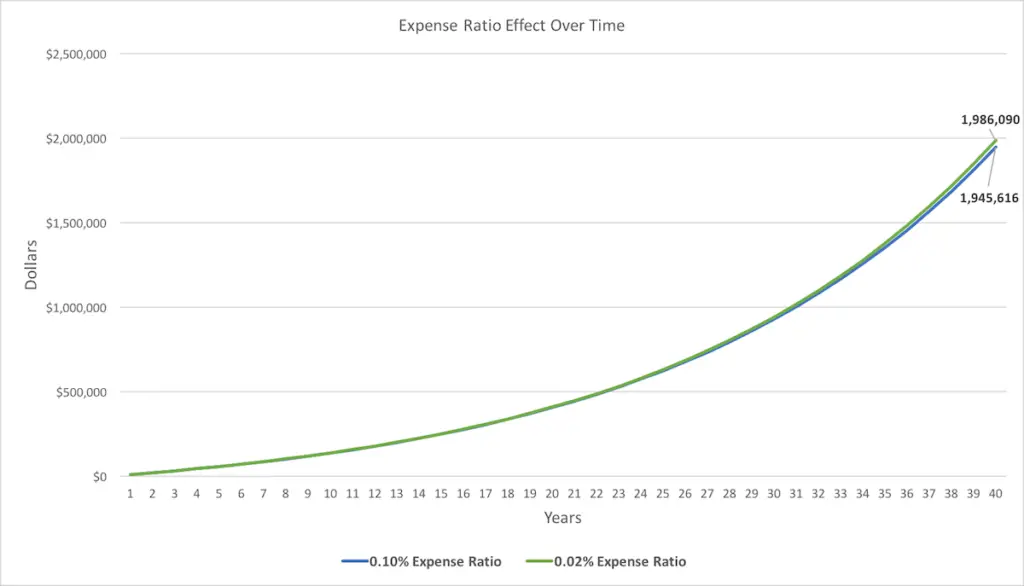

Example 2: 0.02% vs 0.10%

Let’s look at a less drastic example though. Say you’re looking at two good index funds (rather than an index fund vs an actively managed fund): one index fund charges 0.02% and another charges 0.10%.

That can’t be that big of a difference, can it?

Think again.

Yes, the lines on the chart are close together. But the higher expense ratio fund is still costing you $40,000 more. That’s a lot of cash.

Let’s take it one step further though…

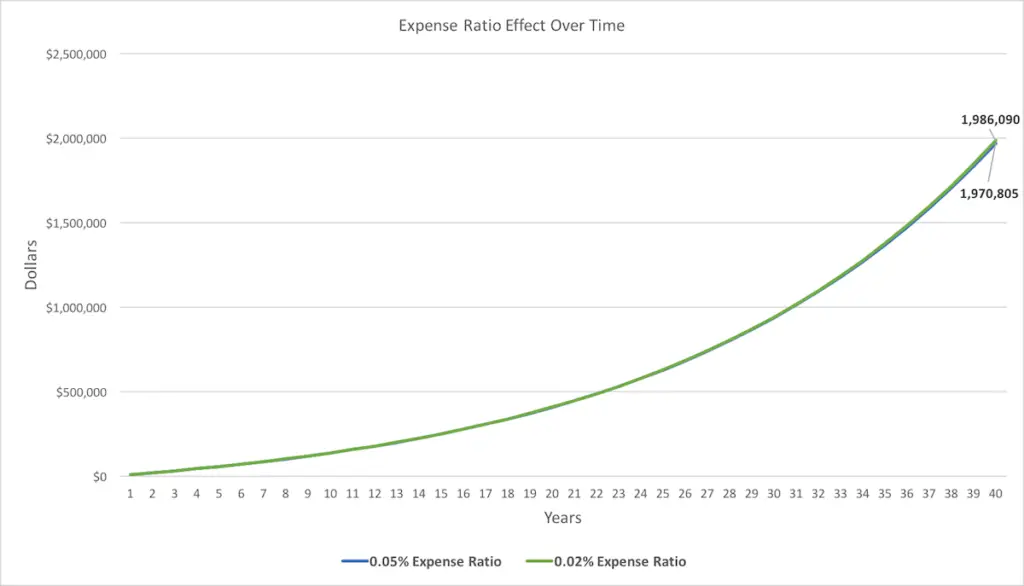

Example 1: 0.02% vs 0.05%

What if it’s only a 0.03% difference in expense ratios between the two funds I’m considering? A 0.02% expense ratio vs a 0.05% ratio… that certainly cannot matter, right?

Well…

Again, the higher expense ratio fund still costs significantly more of the long run – $15,000.

That’s the price of an economical car (I’m thinking a nice Honda Civic), or over 2,000 Chipotle burritos, but who’s counting.

The point is, expense ratios matter. You should pay close attention to them when picking funds to invest in.

Higher fees = a lower net return for you.

Why Expense Ratios are Different

Index fund expense ratios are low because there is little operational cost to matching an index. Compared to actively managing a fund which requires a lot more work.

That is why actively managed funds usually have a higher expense ratio.

Actively managed funds also promise above average returns (better than the index). This is not always delivered.

For me (and many others), getting market returns is perfectly adequate. It’s up to you to decide if you want the same or if you’d rather gamble for big wins (with the risk of underperforming as well).

And when it comes to index funds, they have different expense ratios for the same reason any group of similar products can have varying prices:

- A fund might supposedly cost slightly more to operate (like an equal weight index fund)

- The manager or institution might be making a little more profit compared to others

- A fund might be slightly different from another one (i.e., international vs domestic equity funds)

Just remember that all else equal, a 0.02% fund (or 0% fund for that matter) is always better than a higher-cost fund!

Other Costs to Look Out For

The expense ratio is a large and important cost for investors. Though, it is not the only cost to be aware of.

Other common fund fees to look for (to minimize and avoid) include:

Load Fees

Sales loads (whether a front end load or back end load) are sales commissions or sales charges from the fund family when you buy or sell the fund.

These should be $0.

No questions asked – only invest in no load funds.

Spreads

Spreads apply to ETFs because they trade like stocks. There will be an asking price (what you pay to get the ETF) and a bid price (what you receive when you sell the ETF).

Transaction Costs

Transaction costs are brokerage costs that you incur when you make a trade.

Certain online brokerage accounts (like Vanguard and Charles Schwab) charge $0 in brokerage commissions to trade their funds. Most other reputable online brokers should be charging no more than $5-$10 per trade (if not also $0).

12b-1 Fee

This is another fee (similar to an expense ratio) that funds like to charge to cover sales and advertising expenses.

Watch out for this, as it should be $0.

Bottom Line: Expense ratios (and all fees) are important to consider and should be minimized. Taking time to search for and find low cost funds is well worth it – you want your net expense to be as low as possible.

You can learn more about how to invest in index funds here if you’re interested. Also, you can check out Blooom who will analyze your 401(k) for you and point out funds who are charging management fees that are too high!

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.