Index investing is a great strategy for beginners. It takes the complexity out of stock picking because you are buying the overall stock (or bond) market, not individual stocks. It guarantees your returns will be similar to the market you are looking to mirror (i.e., the S&P 500).

Many expert investors, like Warren Buffett, agree with and promote index investing. As Buffett told CNBC, “Consistently buy an S&P 500 low-cost index fund… I think it’s the thing that makes the most sense practically all of the time.”

Oh, and that was after Buffett won a $1 million bet against a hedge fund. He won that bet by beating the returns of the hedge fund over a ten year period by investing in, you guessed it, an index fund.

We’ll provide more details on why index investing works and how to get started, but first, what even is index investing?

What is Index Investing?

An index fund is the combination of an index and a mutual fund.

An index, simply stated, is a measure of something. In the financial world, an index is used to measure a group of stocks or bonds. Examples include the S&P 500 or the Dow Jones Industrial Average.

A mutual fund is an investment vehicle that pools multiple investor’s money together to purchase a larger, diversified group of assets.

For example, say you want to invest $1,000 in the US economy by purchasing a basket of stocks. You wouldn’t want to put all your eggs (money) in one basket (stock) only to have the basket (stock) go bankrupt.

So you pick a few stocks to diversify your investments.

With your $1,000, you could buy 5 stocks and invest $200 in each. Or 10 stocks by investing $100 in each. Or 100 stocks by investing $10 in each.

The problem is, buying 100 stocks is complicated and time consuming. Not to mention it can be costly, especially if your are investing small sums of money.

Transaction fees could eat away at any potential returns. Plus, you might not be able to afford all the stocks you want to buy – one share of Amazon is currently at about $1,600!

This is where mutual funds come in. Mutual funds collect money from a bunch of investors and then spread the collective funds over a group of stocks. So you can invest your $1,000 in one mutual fund (with many other investors also putting in money) and get the diversification of the entire fund.

Putting it Together

An index fund combines the two concepts. An index fund is a mutual fund, except instead of having a manager pick stocks to invest the collective funds in, the funds are invested in an index.

If Amazon makes up 3% of the S&P 500, 3% of the funds go into Amazon (with an S&P 500 index fund). A money manager does not get to put 10% in Amazon because he or she has a hunch. The index fund mirrors the index – no exceptions.

Difference Between an Index Fund and ETF

Index funds are similar to mutual funds – that is clear now. ETFs, or exchange traded funds, are extremely similar to index funds as well. They also mirror an index and have low fees, but sometimes include trading fees (although, not through online brokerage account like Charles Schwab).

The two other subtle differences between index funds and ETFs are:

- ETFs can be traded throughout the day, while index funds are only traded at the end of the day.

- Since ETFs trade throughout the day, like stocks, they also have a spread (a bid and asking price).

You can learn more about the differences between index funds and ETFs here. All in all, you can’t go wrong with either one as long as you play the long game.

Where Did Index Investing Originate?

John Bogle, founder of Vanguard, created the first index fund in the 1970s. Bogle had a vision of creating a fund that had low fees and simply mirrored overall index performance over the long term (instead of trying to beat it like many actively managed funds).

It was called “un-American” at the time.

Quite the warm welcome for an idea that would help American investors (of all sizes) grow their investments over the next 40+ years.

Bogle believed that high fees associated with actively managed mutual funds would eat away at any potential earnings greater than what the overall market was providing. Beyond that though, he believed that it was near impossible to pick winning stocks over the long term.

Sure, stock pickers can have a 1, 2 or even 5 year winning streaks. But a 40 year streak? That’s tough (maybe impossible) to do. Especially for an investor with limited funds (to pay a manager) and limited willingness to spend countless hours researching.

Investors today owe a lot to Bogle. He created the tool to help them invest for long term, sustainable returns with minimal costs.

Why is Index Investing So Great for Beginners?

Index investing is great for a large handful of reasons. We’ll walk through 4 of them and then provide a quick contrarian view.

Index Investing Pros

It’s Easy

Beginners can easily start index investing. There is no need to research and purchase a bunch of stocks, as a couple (or one) index funds can get the job done.

Beyond being easy to start, it’s also hard to mess anything up.

New investors are prone to panic and sell a stock when it declines. When you’re holding 10 stocks, and you see a few (or a lot) of them decline, it can be tempting to cut your losses.

On the flip side, you also may be tempted to sell your “winners” and cash out on the gains – going on a spending spree, or trip, or something else that’s not saving for retirement.

While that temptation is there with index funds, it is less so, because you avoid the ups and downs of individual stocks. The point of index investing is to get in the market and stay in for the long run. No short term trading and swapping of stocks that can hinder gains and add costs.

It’s easy to employ a “buy it and forget it” strategy with index investing.

Broad Diversification

Diversification is a fundamental risk management strategy for investing. It involves owning multiple investments to limit your risk of one investment taking a tumble.

For example, if you only own stock A and it declines 50%, your total portfolio will be down 50%.

However, if you own stocks A-Z, the theory is that stocks B-Z will help to offset/minimize the loss of stock A.

Of course, this works in reverse too. If stock A grows 50%, stocks B-Z would limit the total growth of your portfolio. It’s a way to manage risk which comes with tempering upside as well.

As a new investor, it can be hard to diversify your portfolio on your own. Especially if you are investing with limited money. Buying small amounts of a lot of stock is time consuming and expensive, as we’ve already went through.

Index investing solves this problem as it allows you to buy one investment vehicle (the index fund) and immediately become diversified. You become the owner of the single index fund which holds a diversified selection of assets.

They’re Extremely Affordable

As mentioned already, buying a lot of individual stocks can be expensive for a couple reasons:

- Commission costs: Some online brokerage accounts charge commission fees to execute a trade.

- Spreads: Every stock has a bid and asking price, with the difference between the two going to the middle man. This is another “fee” you have to pay every time you buy a stock.

There is only one commission fee (as applicable) when buying an index fund. There is usually no spread involved, either.

They also have extremely low expense ratios (0.00%-0.10%), which makes them affordable compared to actively managed mutual funds (which can have expense ratios as high as 1.00%). Instead of paying $10 annually for every $1,000 invested, in most cases you’re paying less than $1.

Lastly, index funds are usually tax efficient compared to mutual funds. Index funds have less turnover since they are not actively managed.

This means less trades throughout the year within the fund. So, there are less potential capital gains from these trades (and capital gains taxes) that are passed onto investors throughout the year.

It’s a Proven Strategy

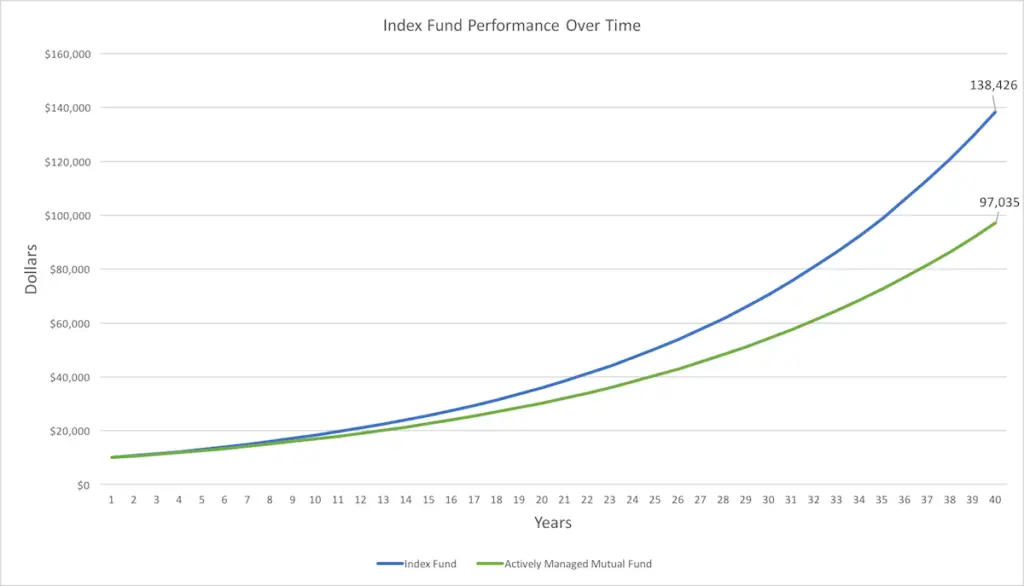

The S&P 500 (an oftly cited index) has historically returned +7% annually. $10,000 invested today would be worth $138,426 in 40 years at that rate (also assuming a 0.03% expense ratio). Not bad.

Compare that to an actively managed mutual fund which not only has to beat the +7% benchmark, but has to beat it enough to cover its annual fees (which can be as much as 1%, or higher).

And if the actively managed fund can’t beat the benchmark and grows at the same +7% rate (with the 1% fee), it only grows to $97,035 over a 40 year period. That’s over $40,000 less than the index fund!

Index Investing Cons

To be clear before diving in to this next section, the upsides of index investing typically outweigh these negatives.

Less Tax Loss Harvesting Opportunities

With an index fund, you lose most of your ability to tax loss harvest. Simply explained, tax loss harvesting is selling your “losing” investments before the end of the year so that you can write down your losses and get a tax break.

With an index fund, you can of course still tax loss harvest. If the fund is down one year (which it certainly will be at some point in the future), you can sell your fund and write down the losses.

But wait a minute… aren’t we investing for the long haul?

Yes, yes we are.

You should consult a financial advisor or do your own research before proceeding, but with tax loss harvesting, the point is to then buy a similar (but not identical) fund immediately after selling. So you never lose your exposure in the market (and don’t risk selling right before a huge market upswing).

This is what firms like Betterment do automatically for you.

The downside for index funds is that there are countless losers and countless winners every year within a given fund. If you own a diversified portfolio of 50 stocks you could sell the 20 losers in your portfolio and then buy 20 similar companies immediately after. You don’t need the entire market (or your holdings) to be down to tax loss harvest. You simply tax loss harvest the portion of the market (or your holdings) that are down.

When you own the full index with one fund, you cannot do this.

Flexibility: Market Weighted Funds vs Equal Weighted Funds

Most indexes, and therefore index funds, are market cap weighted. This means that larger companies (like Apple and Microsoft) make up a larger portion of the index than smaller companies.

Compare that to an equal weighted fund where every company in the index would make up an equal amount.

For example, lets look at creating an index of the top 5 companies in the US. The total market cap would be roughly $3.5 trillion. Microsoft’s market cap, being the largest currently, is about $780 billion. Here is how much Microsoft would make up of the index under the two types of weighting:

- Market Weighted: Microsoft = 22% ($780 Billion / $3.5 Trillion)

- Equal Weighted: Microsoft = 20% (1 / 5)

In the market weight example, the smallest of the 5 companies (Berkshire Hathaway) is only allotted 14% of the index. Where in the equal weight scenario, every company (including Berkshire) would make up 20%.

Alight, we get it, you can weight things different ways. What’s the point?

The point is, most indexes are weighted by market cap. This is fine. It has provided +7% returns annually so far. It just means you have limited options in how you weight your portfolio because you’re locked into however the index is weighted.

Some experts argue that equal weighted indexes perform better in a lot of cases. Here is a quick view of the past 15+ years:

The dark blue line is an equal weighted index fund (RSP) and the light blue is regular, market weighted index fund (SPY).

The equal weighted fund performed slightly better. Will that continue? No one knows.

The other tradeoff here is that equal weighted funds usually have a higher expense ratio. As mentioned, there are not a ton of options out there (like there are with market weighted funds).

In summary, with index funds, you lose your flexibility. You cannot change the weight of stocks within the portfolio based on hunches or research. Which may actually just be a good thing…

How to Start Index Investing

So we’ve answered the question “what is index investing?” It is a form of investing where you look to mirror overall market (index) returns, rather than picking individual stocks.

Index investing has historically performed well and is recommended by many experts. How can a new investor get started?

As you know, starting is easy. And you should start today to begin maximizing your money immediately:

Disclaimer: Just Start Investing is not a certified financial advisor, this post lays out the steps to get started and the investing principles that we practice.

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.