A checking account vs savings account both have unique benefits, and should not be thought of as the same thing – just another bank account.

I know, largely, they are similar – a FDIC insured location to store your hard-earned money. Though, you are making life harder if you do not use the accounts for their intended purpose.

We’ll dive into the differences and uses of a checking account vs savings account below, but first, some basic definitions are in order.

At a high level, a checking account is best for day-to-day transactions. While a savings account, not surprisingly, is better for longer-term saving.

What is a Checking and Savings Account?

A checking account is an account that allows you quick and easy access to your money. You have virtually unlimited access to a checking account and the minimum balance you must maintain in your account is typically low (if not zero). On the downside, interest rates are usually next to $0 (if not $0).

A savings account is better for storing funds for longer periods of time. Your access to a savings account is limited, as you can only withdraw funds 6 times per month. Again, with a savings account the minimum balance is usually fairly low (if not $0). On the flip side, savings accounts (if you choose the right one) do offer competitive interest rates.

Most banks and credit unions offer both checking and savings accounts (along with CDs, money market accounts, and other bank accounts).

The Main Differences Between a Checking Account vs Savings Account

With the high level definitions out of the way, we can dive into some of the main differences between a checking and savings accounts:

- Access: Savings accounts can only be accessed 6 times per month. Checking accounts have unlimited access, and more ways to withdraw your money as well (ATMs, checks, etc.).

- Interest Rates: Savings accounts typically have higher interest rates (especially if using a high yield savings account). Checking account interest rates have historically been next to 0% (again, if not 0%).

- Debit Cards: Checking accounts can be linked with debits cards. Savings account cannot.

Pros and Cons of a Checking Account vs Savings Account

The basic differences of a checking account vs savings account are limited and pretty clear. To help further understand the nuances between the two, lets see how the pros and cons stack up.

Note, not surprisingly, many of the pros and cons will be the same for both.

Checking Account

Pros

- Safety: The FDIC insures checking accounts for up to $250,000. If you have more than $250,000 in a checking account, you might want to consider rethinking your investing strategy.

- Access: Checking accounts provide quick and easy access to your money. Most checking accounts offer physical branches, ATMs, apps, and websites – allowing you to access your money any way you want.

- Low Fees: Usually, checking accounts have $0 in fees as long as you maintain a minimum balance in the account and do not make any unnecessary wire transfers or ATM withdrawals (from a different bank’s ATM).

Cons

- Low Interest Rates: Typically, interest rates are terrible – sometimes even 0.01%. Any money you have in a low interest rate account loses value over time due to inflation.

- Unexpected Fees: Common fees include minimum holdings penalties, fees for ordering checks, over drafting your account and much more. It pays (literally) to be aware of these fees as they are usually easily avoidable.

Savings Account

Pros

- Safety: Identical to checking accounts, The FDIC insures checking accounts for up to $250,000.

- Liquidity: While checking accounts offer ultimate ease of access, savings accounts are still a very liquid investment that you can access 6 times per month. Plus, you can usually link your checking and savings account to easily transfer money between the two.

- Interest Rates: As of January 2020, some savings accounts offer interest rates as high as 2%. This interest helps battle inflation, even though it is low compared to historical S&P 500 returns.

Cons

- Access: You can only withdraw funds 6 times per month. Though, 6 times is still a lot, and I don’t think this would be an issue for most people.

- Unexpected Fees: Penalties can quickly eat away at any interest upside. Like with checking accounts, make yourself aware of the rules associated with your savings account, as the fees are usually easily avoidable.

When You Should use a Checking Account vs Savings Account

Knowing the unique differences (and similarities) of a checking account vs savings account, we can now dive in and understand how to best utilize each account to make life easier.

Checking Account

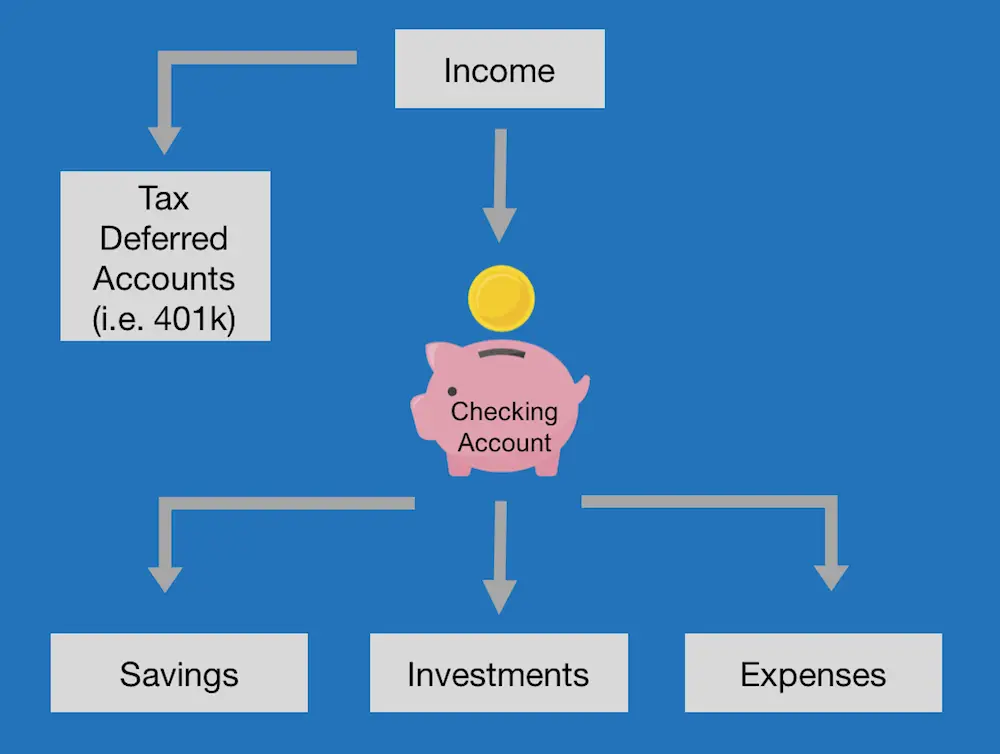

A checking account should be the central hub of your finances. All things should flow in and out of your checking account.

A checking account is where your deposit you income (setting up direct deposit is usually easiest, but checks work too), and then utilize that money to fund:

- Savings: Savings for an “emergency fund” or for near term expenses (like tuition, a downpayment, etc.).

- Investments: Investments in both personal brokerage accounts and tax advantaged accounts like Roth IRAs. This is your long term savings.

- Expenses: Everyday expenses like rent and groceries, as well as spending on entertainment and dining.

A checking account is the perfect tool to serve as this hub for all the reasons already mentioned, but mainly: its easy to use and access.

A checking account should make optimizing your finances seamless.

Savings Account

A savings account should be used for any for emergency funds and near in purchases, but we’ll get to that in just a second.

First, I want to make clear that any savings account you have open, if you have one, should be a high yield savings account. A high yield savings account is simply a savings account that offers above average interest (as of January 2020, around 1.5%-2%).

Usually, this means your looking for an online bank rather than a brick and mortar one.

The one potential downfall to using a high yield savings account is that it may not be linked to your checking account (the best high yield accounts do not always offer checking accounts). While this affects the ease of use of your checking account, it is minor a setback. You can still link your checking and savings account to make online transfers (even if they are different banks), it will just not be instant transfers between the two (usually takes a couple days).

Back to the benefits of high yield savings accounts.

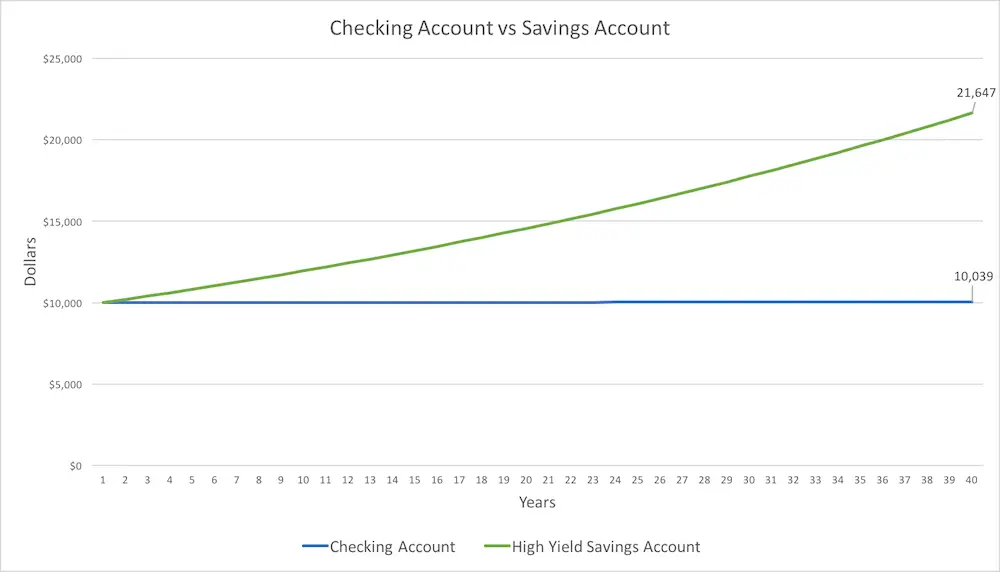

The main (and only) reason to use a high yield savings account is because of the opportunity cost of not doing so. As you’ll see below, your money will double in 40 years in a high yield savings account (at today’s 2% interest rate). Compare that to a checking account (at 0.01% interest), where you’ll grow less than 1% in the same time period.

Here are some of the best uses for your high yield savings account:

- Emergency Fund: Most people recommend storing 3-6 months of expenses saved in a liquid account to cover any emergencies that come up. A high yield savings account is a great place for this fund.

- Near in Purchases: If you have a large, near in purchase (like tuition or a down payment), a savings account would be useful. It is less volatile and will ensure you’re money holds its value as you get closer to making the purchase.

- Cushion: If you’re not always 100% sure of what your expenses will come in at in a given month (and don’t want to keep too much in a 0% interest checking account), then you could store some extra cushion in a savings account and transfer it to a checking account when needed.

In summary, a checking account should be the central hub of your finances. While a savings account should be used for any for emergency funds and near in purchases. This is the most efficient way to utilize each type of account.

Ready to optimize your banking? Here are some of our favorite resources to learn more:

- Get the details on how to effectively choose a bank

- Learn more about online banking

- Learn about prize-linked savings accounts

- Check out some of the best banks accounts out there

- Learn more about how many bank accounts you should have

- Find a no-fee checking account

- Learn more about all types of interest bearing accounts

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.

After reading your article, I’m compelling to share your points on this topic. You have done a very good job. I agree with much of this information.

Thanks – happy you’re willing to help spread this simple message.