Are you tired of standing in long queues at the bank just to get a cheque book? Well, I’ve got some good news for you!

Whether you’re a new customer or an existing one, getting a cheque book has never been easier. If you’re an SBI account holder and need a cheque book, you’re in the right place.

In this article, I’ll guide you through the simple and hassle-free process of applying for a cheque book in SBI.

How To Apply For a Cheque Book in State Bank of India?

You can apply for a cheque book in State Bank of India using both the modes – Offline and Online. We are providing you with exact steps on how to apply for a cheque book for your SBI account by visiting the bank or using the internet banking facility.

Here are the steps to apply for a cheque book offline at your nearest SBI branch:

Step 1: Determine your eligibility for a cheque book in SBI

When it comes to getting a cheque book from SBI (State Bank of India), the first step is to check your eligibility. This will ensure a smooth and hassle-free application process.

Here are the important points to consider:

Account Type: Before applying for a cheque book, make sure you hold an account with SBI. Whether you have a savings account or a current account, both are eligible for cheque book facilities.

Minimum Balance: Ensure that your account maintains the required minimum balance to be eligible for a cheque book. Remember, different types of accounts have different minimum balance requirements, so it’s important to check the specific criteria for your account type. Falling short of the minimum balance could delay your application or result in rejection.

Account Status: It’s essential to check the status of your account before applying for a cheque book. It should be active and not in a dormant or blocked state. If your account is dormant or blocked, you’ll need to reactivate it or resolve any issues before proceeding with the cheque book application.

KYC Requirements: Verify that your Know Your Customer (KYC) details are up to date. KYC is a mandatory process that helps banks understand their customers better and prevents fraudulent activities.

SBI may require you to submit identification documents such as Aadhaar card, PAN card, passport, or driving license. Ensure that you have these documents handy before applying for a cheque book.

Step 2: Collect the required documents

Once you have determined your eligibility for a cheque book in SBI, the next step is to collect the necessary documents.

This ensures that you have all the required information and paperwork ready before proceeding with your application.

Here are the documents you will need:

Identification proof: You will need to provide a valid and government-issued identification proof. This can be your Aadhaar card, PAN card, Passport, or any other acceptable form of identification.

Address proof: Along with the identification proof, you will also need to submit a valid address proof. This can include documents such as your Aadhaar card, utility bills (electricity, water, gas), bank statements, or a rent agreement.

Photographs: SBI may require you to submit a few passport-sized photographs along with your application. Make sure to carry a few recent ones, as these will be used for verification purposes.

It is important to ensure that all the documents you submit are valid, up to date, and meet the bank’s requirements. If any of your documents are expired or invalid, your application may be rejected.

Remember, providing accurate and complete documentation will help expedite the process and ensure a smooth application experience.

Once you have collected all the required documents, you are ready to proceed to the next step in applying for a cheque book in SBI.

Step 3: Visit your nearest SBI branch

Once you have gathered all the necessary documents for applying for a cheque book in SBI, it’s time to visit your nearest SBI branch. This step is an essential part of the process, as it ensures that your application is submitted correctly and promptly.

When you visit the SBI branch, you’ll need to follow these steps:

Carry all the required documents: Before heading to the bank, double-check that you have all the required documents with you. This includes your identification proof, address proof, and recent passport-sized photographs.

Identify the appropriate counter: Once you enter the bank, look for the counter specifically designated for cheque book applications. If you’re unsure, don’t hesitate to ask one of the bank employees for assistance.

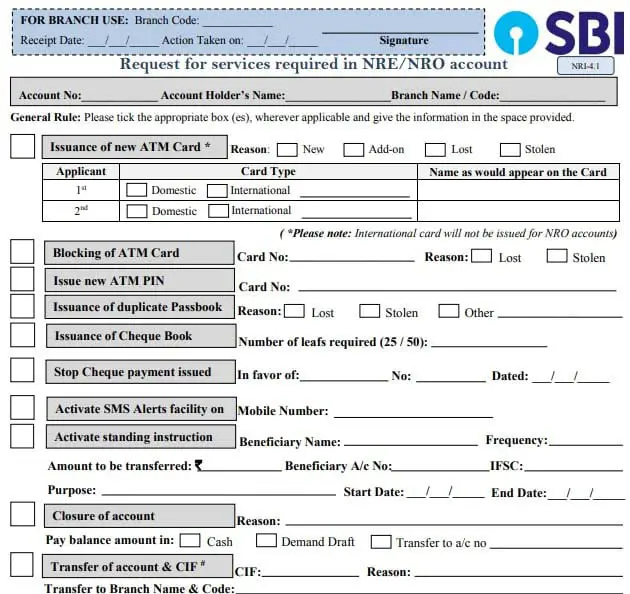

Fill out the necessary forms: At the counter, you’ll be provided with application forms to fill out. Make sure to fill in all the required details accurately and completely. Any errors or missing information may delay the processing of your application.

Submit your application and documents: After filling out the forms, submit your application along with the required documents to the bank representative at the counter. Ensure that you provide all the necessary documents photocopies as per the bank’s requirements.

Wait for verification and confirmation: Once you have submitted your application, the bank representative will verify your documents. This process may take some time, so be patient. Once your application and documents have been verified, you’ll receive a confirmation that your application is being processed.

Remember, it is crucial to provide accurate and complete documentation to expedite the application process. By visiting the SBI branch personally, you can ensure that your application is handled efficiently and any queries or concerns you may have can be addressed promptly.

Filling out the application form

Identification Information: Start by providing your personal details, such as your full name, date of birth, and gender. Make sure to double-check the accuracy of your information before submitting the form.

Account Number: Include your SBI account number, as this will help the bank identify your account and link it to the cheque book.

Cheque Book Type: Indicate the type of cheque book you want to apply for. SBI offers different types of cheque books, such as personalized, non-personalized, or a specific design if available. Choose the option that suits your needs.

Number of Leaves: Specify the number of cheque leaves you would like in your cheque book. This will depend on the frequency of your cheque usage and your requirements.

Delivery Options: Select your preferred delivery method for the cheque book. You can choose to collect it from the SBI branch where you submitted the application or have it delivered to your registered address through postal services.

Signature: Sign the application form in the designated area to verify that all the information provided is accurate and complete.

Step 4: Submit the application form and documents

Once you have filled out the application form with all the required details, it’s time to submit it along with the necessary documents.

Here’s what you need to do:

Review your application: Before submitting the form, take a few moments to double-check all the information you have provided. Make sure all the fields are filled accurately and completely. Accuracy is key when it comes to processing your application smoothly.

Attach the required documents: Along with the application form, you will need to enclose certain documents as per the bank’s requirements. These documents typically include:

- Identification proof: This can be your Aadhaar card, PAN card, passport, or any other government-issued ID.

- Address proof: Documents such as a recent utility bill, bank statement, or rental agreement can serve as valid address proofs.

- Recent passport-sized photographs: Ensure that the photographs are clear and meet the specifications set by the bank.

Visit the designated counter: Head to the designated counter at the SBI branch where you initially submitted your application. Find a bank representative who will assist you in completing the submission process. It’s important to approach the correct counter to avoid any confusion.

Hand over the application and documents: Once you’ve located the appropriate counter, hand over your completed application form along with the required documents to the bank representative. They will thoroughly review the form and documents to ensure everything is in order.

Collect the acknowledgment receipt: After verifying your application and documents, the bank representative will provide you with an acknowledgment receipt. This receipt serves as proof that you have successfully submitted your application for a cheque book.

Step 5: Wait for the processing of your application

After submitting your application form and the required documents, the next step is to wait for the processing of your application. The processing time may vary depending on various factors, such as the current workload of the bank and the accuracy of your application.

It’s important to note that the State Bank of India (SBI) strives to process applications as quickly as possible, but it also needs to ensure the accuracy and completeness of each application. This is to maintain the integrity and security of the process.

During this waiting period, avoid submitting multiple applications or contacting the bank frequently to check on the status of your application. This may cause unnecessary delays and confusion in the processing of your request. Instead, have patience and trust that the bank will review your application within a reasonable timeframe.

The SBI has implemented efficient systems to streamline the processing of cheque book applications. However, in some cases, there may be a need for further verification or clarification regarding the information provided in the application.

If additional information or documents are required, the bank will contact you directly. You may be asked to visit the branch again or provide the necessary documents electronically. Ensure that you promptly respond to any requests from the bank to avoid further delays in the processing of your application.

Once your application has been processed, you will be notified by the bank regarding the status of your request. If your application is approved, you will be informed about the date and manner in which you can collect your cheque book.

Remember, the processing time can vary for different individuals based on their specific circumstances. It’s essential to provide accurate and complete information in your application to expedite the process.

Step 6: Collect your cheque book

Once your application for a cheque book has been processed by the State Bank of India (SBI), it’s time to collect your cheque book and start enjoying the convenience it offers. Here’s what you need to know about collecting your cheque book:

Notification: After the processing of your application is complete, you will receive a notification from SBI regarding the status of your request. This notification will provide you with all the information you need to collect your cheque book. It could be an email, an SMS, or a phone call. Make sure to keep an eye on your communication channels to stay updated.

Instructions and Timings: The notification will include detailed instructions on how and when you can collect your cheque book. It will inform you about the designated branch or location where you can go to pick it up. Pay close attention to the timings mentioned, as each branch might have different operating hours for cheque book collection.

Identification: When going to collect your cheque book, remember to carry valid identification documents with you. This could be your Aadhaar card, PAN card, passport, or any other identification document accepted by SBI. Make sure to have the original as well as a photocopy of the ID for verification purposes.

Collecting your cheque book from SBI is the final step in the application process. Once you have it in your hands, you can start using it for various transactions and payments.

Now that you know how to collect your cheque book from SBI, you can confidently proceed with the application process and look forward to a hassle-free banking experience.

Also Read our Guide on How To Get a New SBI Passbook

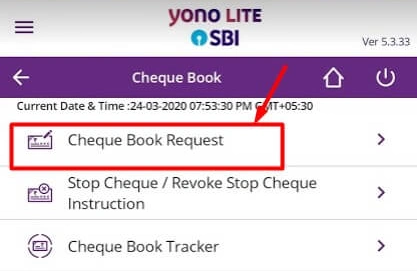

How To Apply for an SBI Cheque Book Online?

You have multiple options to request an SBI cheque book online:

SBI YONO App: This mobile banking application allows you to order a new chequebook. Navigate to the ‘Request‘ menu and follow the prompts to make your request.

SBI Online Internet Banking: Visit the bank’s internet banking site at https://onlinesbi.com. Under the ‘Request‘ menu, there should be an option to request a new chequebook.

Doorstep Banking: Although not commonly used and not available at all branches, this service is offered through the Atyati mobile app, available on Google Playstore. This app allows you to apply for a chequebook offline.

After making your request, a bank agent or representative will visit your location to collect and deliver the necessary paperwork.

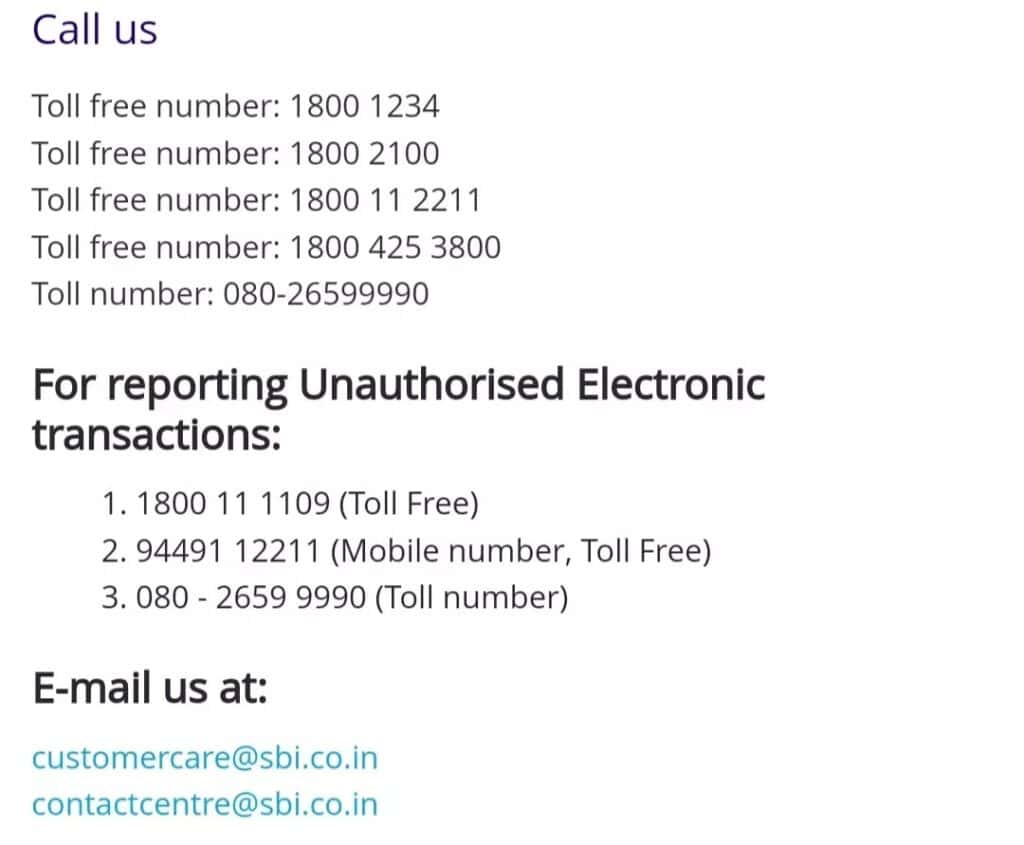

Email: You can also email your chequebook request. The bank’s email address can typically be found in your passbook. If you’re aware of your branch code, it’s easy to identify the specific email address for your branch.

The general format is [email protected], where XXXX represents your branch code.

For example, if your branch code is 065, it would be written as 00125 and the corresponding email ID would be [email protected].

Remember, regardless of the method you choose, ensure that all necessary information is provided accurately to avoid any delays or issues with your request

Conclusion

Applying for a cheque book in SBI is a straightforward process that requires a few simple steps. By following these steps, I can ensure a smooth and efficient application process. It is important to collect all the necessary documents and visit the nearest SBI branch to fill out the application form accurately and completely.

Once the application has been processed, SBI will notify me regarding the status of my request and provide instructions on how to collect the cheque book. When collecting the cheque book, you should remember to carry valid identification documents and handle the cheque book with care.

Frequently Asked Questions

What is the process of applying for a cheque book in SBI?

The process involves collecting the necessary documents, visiting the nearest SBI branch, filling out the application form, and submitting the form and documents.

How long does it take to process the application?

The processing time may vary depending on various factors. It’s important to ensure accuracy and completeness in the application to avoid unnecessary delays.

Should I submit multiple applications or contact the bank frequently to check on the status?

It is advised not to submit multiple applications or contact the bank frequently, as this may cause delays. The bank will contact you directly if they require any additional information or documents.

How will I know the status of my application and when to collect the cheque book?

Once the application has been processed, the bank will notify you regarding the status of your request and provide instructions on how and when to collect the cheque book.

What should I bring when collecting the cheque book?

When collecting the cheque book, it is important to carry valid identification documents.

How should I handle and store the cheque book?

You should handle the cheque book with care and keep it in a secure place. Familiarize yourself with the security measures associated with cheque books for added protection.