Decentralized finance, often referred to as DeFi, is a relatively new money management system.

Its most impressive feature is that it works without a central overseer — all thanks to blockchain technology.

Because of that, DeFi offers a more democratic approach where everyone stands on equal footing. It wipes out the necessity for middlemen like banks, brokers, and insurance firms.

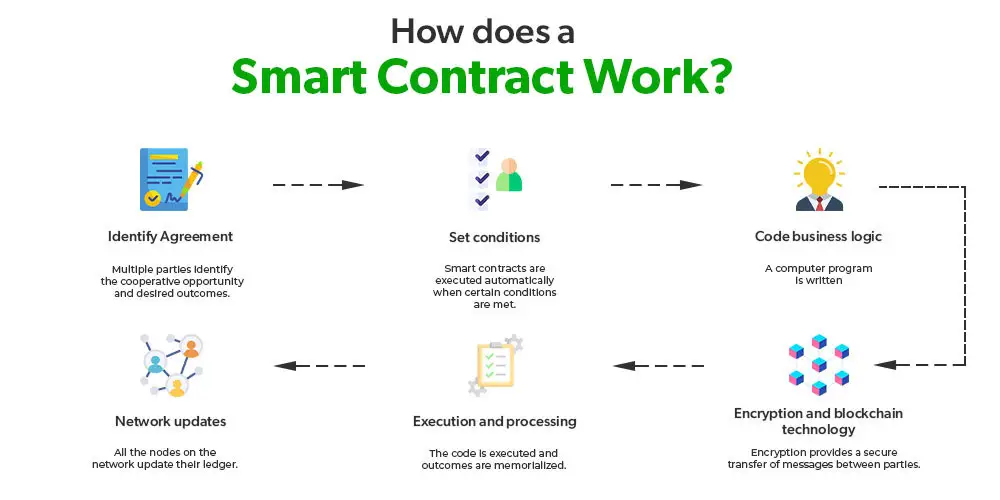

Instead, DeFi relies on smart contracts. These automated programs trigger transactions once specific conditions are met.

Smart contracts are public, meaning anyone can see them. They are also set in stone, so they can’t be modified once they’re in place.

Plus, because they’re automated, they eliminate the possibility of mistakes or deceit.

The Power of Blockchain Technology

Blockchain technology is the driving force behind DeFi.

There’s been a lot of talk about blockchain recently, with many tech enthusiasts jumping on the bandwagon. However, while impressive in some aspects, blockchain isn’t the be-all and end-all tech bros would like you to believe.

This distributed ledger technology is just that — a secure online ledger that is accessible to the public.

The benefits of blockchain technology boil down to three aspects:

- Decentralization: By removing the requirement for middlemen, blockchain technology creates a network where deals happen directly between people.

- Transparency: Every single transaction on the blockchain is visible to all.

- Security: The use of cutting-edge cryptography in blockchain guarantees that all transactions are almost impossible to alter or manipulate.

But there are also downsides to it.

- Energy Consumption: The blockchain’s network requires high electricity use, particularly with Proof of Work systems.

- Immutability: Once it’s on the blockchain, it’s irreversible. It can be an issue if the information needs updating or if there was an error that we would like to correct.

- Scalability Issues: Every block in a blockchain has a designated capacity to store data. This limited space can result in slower transaction validation.

Basics of Blockchain Smart Contracts

A smart contract is a self-executing agreement where the terms of the contract are directly written into code.

Such an agreement is immutable and distributed on the blockchain network.

Every blockchain smart contract transaction is visible to all network participants. Once deployed, it can’t be altered, which — as we mentioned — is a double-edged sword.

These contracts are an excellent way to conduct secure financial transactions. Nevertheless, you can use them for other applications, such as voting systems or identity verification.

Key Benefits of Smart Contracts

Smart contracts offer several advantages, including enhanced security, cost savings, and efficiency in processing transactions.

Let’s go over these in more detail below.

Enhanced Security

As you know already, smart contracts are created and carried out on blockchain. Since this digital record is difficult to alter, the contract’s integrity remains untouched. It keeps it safe from possible scams or meddling.

Cost Savings

By eliminating the need for intermediaries like lawyers or banks, smart contracts save on hefty transactional fees. They also reduce the time and resources spent on document preparation and verification.

Efficiency

Smart contracts execute transactions automatically once the preset conditions are met. It can make transactions quicker and more efficient.

Blockchain Smart Contracts’ Role in DeFi

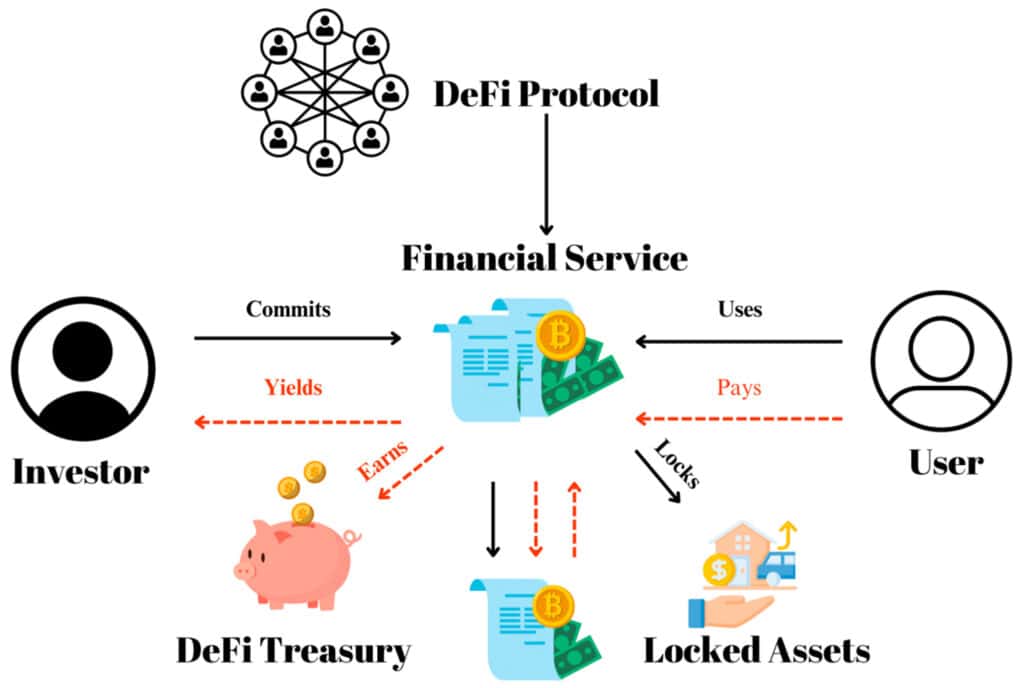

Self-executing contracts are the backbone of DeFi. Without them, it would be very difficult to offer reliable, transparent, and tamper-proof financial services.

Three primary ways smart contracts are transforming DeFi include:

- Decentralized Exchanges (DEXs): Smart contracts allow for peer-to-peer trades without intermediaries, reducing costs and increasing privacy.

- Lending and Borrowing Platforms: On these platforms, users can use smart contracts to lend and borrow funds, earning interest and leveraging their assets.

- Stablecoins: Smart contracts maintain the peg of stablecoins to other assets. It facilitates more stable value storage in the volatile crypto market.

Security Advantages of Decentralized Finance

Blockchain’s decentralized structure helps maintain the integrity of transactions.

Why? Because without a central authority, there is less vulnerability to hacking.

As a result, smart contracts significantly alleviate counterparty risk in blockchain transactions.

Besides, eliminating intermediaries and employing smart contracts automatically improves transparency and trust.

When transactions are carried out with no possibility for manipulation or deception, it increases security, giving participants greater peace of mind.

Automated and Efficient Transactions

Because smart contracts allow you to program a series of automated activities, you can focus on other, more important aspects of your life. It’s a straightforward way to improve operational efficiency.

It also makes decentralized finance more accessible to a regular Joe. You don’t need to be an expert to ensure your transactions are completed quickly every time.

Risks Involved With Smart Contracts

Much like blockchain, smart contracts also have their fair share of disadvantages.

One of the main risks involves coding errors.

Smart contracts are only as good as the code that drives them. If there’s a mistake in the code, it could lead to unintended consequences.

Furthermore, smart contracts are immutable. It’s the same story as blockchain, where this quality can be problematic if you discover a flaw after the contract is live.

There’s also the risk of hacks. Although blockchain is secure, smart contracts themselves can be vulnerable to attacks. For instance, the infamous DAO hack in 2016 resulted in the loss of millions of dollars’ worth of Ethereum.

What the Future Holds for Blockchain Contracts

Overall, the future seems promising for DeFi and blockchain.

Areas beyond banking, such as supply chains, real estate, and healthcare, may soon start adopting blockchain contracts. These contracts could simplify complex processes, verify records, and ensure compliance automatically.

However, there are also challenges ahead. Uncertainties around regulation, scaling issues, and complex technological challenges are the most obvious roadblocks.

Still, as blockchain technology improves and becomes more widely adopted, these issues might soon be resolved.

A Digitally Secure Future

Smart contracts are a relatively new concept, and there’s currently a shortage of seasoned developers who can skillfully put these contracts in place.

As this sector continues to grow and expert assistance becomes more commonly available, we can predict that programmers of all backgrounds will develop a better understanding of the legal aspects linked to smart contracts.

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.