To Stop calls from 502-267-7522 or GLA collections, verify the debt, negotiate a payment plan, report the number to the FTC or seek legal help.

Are you receiving calls from GLA Collections and wondering why?

In this article, we will explore who GLA Collections is, the reasons for debt collection calls, and how to verify the legitimacy of the company.

We will also discuss effective ways to stop calls from GLA Collections, such as requesting proof of debt, sending a cease and desist letter, and reporting the number to the FTC.

If you owe money to GLA Collections, we will provide tips on verifying the debt, negotiating a payment plan, and seeking credit counseling.

Stay tuned for useful information on dealing with debt collection calls.

Key Takeaways:

- Verify the legitimacy of GLA Collections before taking any action to stop calls.

- Request for proof of debt and send a cease and desist letter to stop calls from GLA Collections.

- If you owe money to GLA Collections, negotiate a payment plan and seek credit counseling to manage the debt.

.jpg)

Who is GLA Collections?

GLA Collections is a debt collection agency specializing in the recovery of outstanding debts on behalf of creditors.

With a focus on professionalism and efficiency, GLA Collections provides a range of services to assist creditors in retrieving their overdue payments. Their clientele includes a diverse mix of businesses, financial institutions, and individuals seeking assistance in recovering unpaid debts.

Whether it is credit card debt, medical bills, or personal loans, GLA Collections handles a variety of debt types.

Using both traditional and modern debt collection techniques, they tailor their approach to each case, striving to achieve successful outcomes while maintaining ethical practices.

Why Am I Receiving Calls from GLA Collections 502-267-7522?

Receiving calls from GLA Collections may indicate that you have an outstanding debt that has been assigned to them for collection.

Often, individuals find themselves in this situation due to various reasons. It could be because they have fallen behind on their bills, resulting in utility companies or service providers forwarding the unpaid amounts to collection agencies like GLA Collections.

Loans that have gone into default, such as mortgage payments or car loans, can also lead to debt being handed over for collection.

Another common scenario is high outstanding balances on credit cards that have not been repaid on time.

What Are the Possible Reasons for Debt Collection Calls?

Debt collection calls can be initiated for various reasons, including unpaid credit card bills, defaulted loans, or outstanding medical expenses, prompting collection agencies like GLA Collections to seek repayment.

Unpaid credit card bills are a common cause for debt collection calls, often stemming from overspending or financial hardship.

Defaulted loans, whether from personal, student, or business sources, can lead to intense collection efforts.

Outstanding medical expenses, accrued from unexpected illnesses or emergencies, can also escalate to debt collection if left unresolved.

These financial obligations can pile up quickly, especially when coupled with high-interest rates or missed payment deadlines.

As a result, individuals may find themselves facing persistent calls from collection agencies like GLA Collections as they pursue repayment for these outstanding debts.

Is GLA Collections a Legitimate Company?

.jpg)

GLA Collections is a legitimate debt collection agency operating within the boundaries of the Fair Debt Collection Practices Act.

The company’s commitment to abiding by industry regulations, such as the Fair Debt Collection Practices Act, ensures that their practices are ethical and lawful. GLA Collections’ adherence to these guidelines not only highlights their professionalism but also showcases their dedication to operating with integrity.

The company holds accreditations and affiliations that further validate its legitimacy in the debt collection sector.

These affiliations serve as a testament to GLA Collections’ reputation for ethical debt collection practices and solidify their position as a trustworthy agency in the industry.

How Can I Verify the Legitimacy of GLA Collections?

To verify the legitimacy of GLA Collections, you can request validation information regarding the debt they are attempting to collect from you.

Once you have requested validation information, carefully review the details provided in the validation notice to ensure it aligns with your records.

Pay close attention to the amount owed, the original creditor’s name, and any dates associated with the debt. If there are any discrepancies or uncertainties, consider reaching out to GLA Collections for clarification.

Ask for copies of any relevant collection documentation, such as the original debt agreement or statements. Review these documents thoroughly to confirm the accuracy of the information and the validity of the debt being pursued.

Verify the credentials of GLA Collections by checking their licensing and accreditation. Ensure they are licensed to operate in your state and inquire about any professional affiliations they may have. This step adds an extra layer of assurance regarding their legitimacy and professionalism.

How to Stop Calls from GLA Collections?

Stopping calls from GLA Collections can be achieved through various methods such as requesting proof of debt, sending a cease and desist letter, blocking the number, reporting to the FTC, or seeking legal assistance.

If you opt to request proof of debt, ensure that you do so within the stipulated timelines to exercise your rights effectively. Sending a cease and desist letter can communicate your desire for them to cease communication, backed by consumer protection laws.

Blocking the number on your phone is a quick fix to avoid constant interruptions. Reporting to the FTC not only helps address your case but can also contribute to larger regulatory actions against unfair debt collection practices. Seeking legal assistance can offer guidance on your rights and the steps to take for resolution.

Request for Proof of Debt

Requesting proof of debt from GLA Collections is a crucial step in validating the legitimacy of the debt they are attempting to collect from you.

By requesting validation of the debt, you ensure that the collection agency has the right to collect the amount from you. The validation notice should include details such as the original creditor’s name, the amount owed, and any relevant account information.

This process helps in verifying that the debt is indeed yours and not a mistake or fraud. It also ensures that the collection agency has the legal authority to pursue the debt.

Without proper validation, you could end up paying for a debt that may not be yours, or for an amount that is inaccurate.

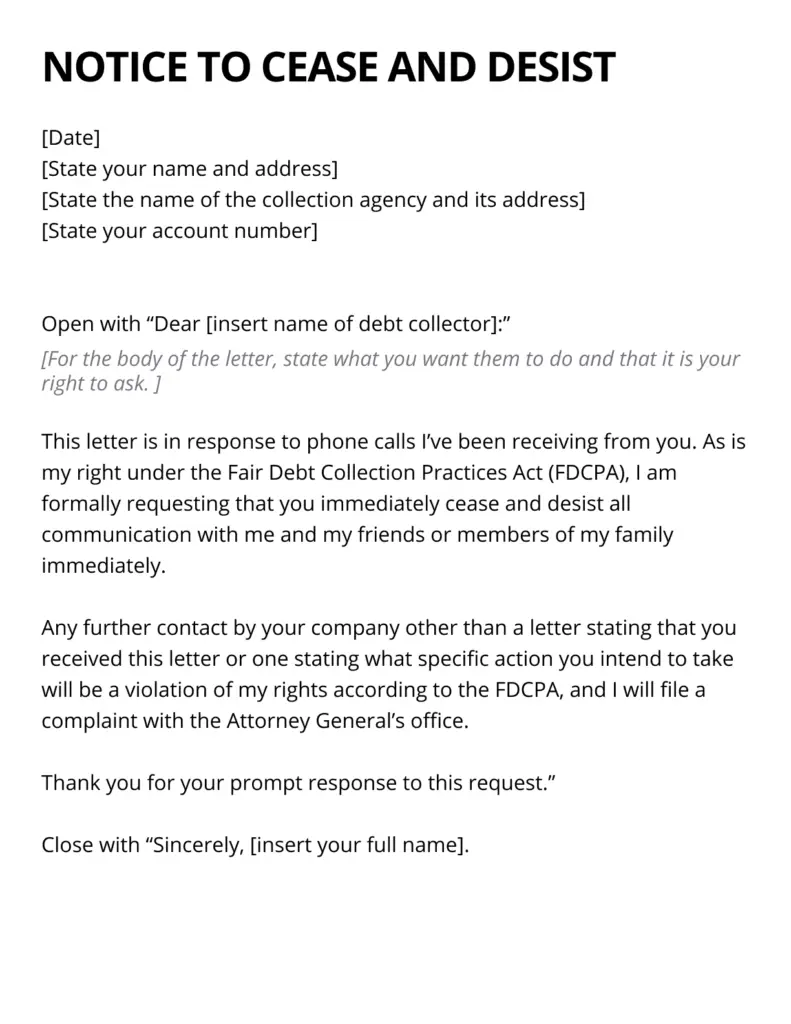

Send a Cease and Desist Letter

Sending a cease and desist letter to GLA Collections can legally require them to stop contacting you regarding the debt.

When preparing such a correspondence, it is crucial to clearly outline your demand for them to cease all communication, as continued contact could be a violation of the Fair Debt Collection Practices Act (FDCPA).

Include your personal information, the account details, and the specific language requesting the cessation of communication in a firm and professional tone.

It’s essential to send the letter via certified mail with a return receipt to ensure proof of delivery and establish a paper trail in case legal action becomes necessary.

Block the Number

Blocking the number used by GLA Collections is an effective way to prevent further calls from reaching you.

When dealing with persistent debt collectors, it’s crucial to take proactive steps to protect your peace of mind and privacy.

First and foremost, ensure that you have the correct number that GLA Collections is using to contact you. Once you have this information, you can proceed to block the number on your smartphone or landline.

On most smartphones, you can easily block a number by going to your call history or settings. You may want to consider utilizing call-blocking apps that offer more robust features for filtering unwanted calls.

Report the Number to the FTC

Reporting the number used by GLA Collections to the FTC can help address issues of harassment or abusive communication tactics.

When providing these details to the FTC, it is essential to include specific instances of unwanted calls, including the dates and times they occurred. This information plays a crucial role in establishing a pattern of behavior, thus strengthening your case against the violators of consumer rights.

Documenting the nature of the calls, whether they involve threats, persistent harassment, or misleading information, adds weight to your complaint.

Remember, the more thorough and accurate your documentation, the higher the chances of the FTC taking regulatory action against GLA Collections or any other entity engaged in such practices.

Seek Legal Help

Engaging a consumer attorney for assistance in dealing with GLA Collections can provide legal support and protection under the Fair Debt Collection Practices Act.

Consumer attorneys are well-versed in the intricacies of debt collection laws and can assess the situation objectively to determine the best course of action.

By seeking legal counsel, individuals can benefit from strategic negotiation skills that attorneys possess, which can lead to reduced debts or more favorable repayment terms.

Attorneys can help in identifying any potential violations of the Fair Debt Collection Practices Act by agencies like GLA Collections, and take appropriate legal action to protect the consumer’s rights. This proactive approach can alleviate stress and provide a sense of security during challenging debt collection situations.

What to Do If I Owe Money to GLA Collections?

.jpg)

If you owe money to GLA Collections, it is essential to take proactive steps to address the debt and explore repayment options.

Start by requesting debt verification from GLA Collections to ensure the accuracy of the amount owed. This step can help you understand the details of the debt and your rights as a consumer.

Once you have verified the debt, consider reaching out to GLA Collections to negotiate payment terms that are manageable for you.

Be honest about your financial situation and see if you can set up a payment plan or settle the debt for a reduced amount.

Seek guidance from a reputable credit counseling service to develop a personalized financial management plan. They can provide valuable advice on budgeting, debt repayment strategies, and improving your credit score.

Verify the Debt

Verifying the debt with GLA Collections ensures that you have accurate information regarding the owed amount and the legitimacy of the collection efforts.

By requesting validation details from GLA Collections, you can ascertain the validity of the debt in question. It is crucial to review the documentation provided, such as original creditor information, details of the debt, and any relevant payment history. Ensuring the accuracy of these records can help you avoid potential disputes or wrongful payments.

Taking the time to verify the debt before proceeding with any payments adds a layer of protection for your financial well-being and helps maintain transparency in the collection process.

Negotiate a Payment Plan

Negotiating a customized payment plan with GLA Collections can help you address the debt in a structured and manageable way.

When you initiate negotiations with GLA Collections, it is essential to outline your financial situation honestly and transparently. By fostering open communication from the start, you set the foundation for a smoother negotiation process.

Establishing realistic repayment schedules tailored to your income and expenses can alleviate stress and set clear expectations for both parties.

This proactive approach not only demonstrates your commitment to resolving the debt but also increases the likelihood of reaching a mutually beneficial agreement.

Remember, clear and respectful communication is key in navigating payment arrangements with debt collectors.

Make Payments on Time

Making timely payments to GLA Collections is essential for resolving the debt and preventing further negative impacts on your credit score.

When you meet your payment obligations to GLA Collections in a timely manner, you not only fulfill your financial responsibilities but also demonstrate a commitment towards improving your credit standing.

By honoring your payments on time, you show creditors and credit bureaus that you are reliable and trustworthy, which can positively impact your credit report and score.

Failing to make timely payments, on the other hand, can lead to increased debt, late fees, and even potential legal actions from collection agencies. It can tarnish your credit history, making it difficult to secure loans or obtain favorable interest rates in the future.

Keep Records of Payments

Maintaining detailed records of payments made to GLA Collections helps ensure transparency and accountability throughout the debt repayment process.

Proper documentation is crucial when managing interactions with debt collection agencies like GLA Collections.

By keeping organized records of all financial transactions, communications, and agreements, individuals can prevent any potential disputes or misunderstandings in the future. This includes saving copies of payment receipts, emails, letters, and any written agreements.

Having well-maintained records not only benefits the debtor but also provides a layer of protection in case of any discrepancies or challenges with GLA Collections. These documents serve as concrete evidence in case of any need for legal recourse or dispute resolution, ensuring that all parties are held accountable.

Seek Credit Counseling

Consulting with a credit counseling service can provide valuable insights and assistance in managing debts owed to GLA Collections.

These professionals are equipped with the knowledge and skills to assess your financial situation and create a tailored plan to tackle your debts effectively.

Through budgeting guidance, negotiation with creditors, and implementation of debt relief strategies, credit counselors can help you regain control over your finances.

By enrolling in a debt management program recommended by credit counselors, you may benefit from reduced interest rates, waived fees, and a structured repayment schedule, all of which can expedite your journey towards debt freedom.

Frequently Asked Questions

How can I stop calls from GLA Collections?

You can stop calls from GLA Collections by requesting a cease and desist letter from the company, sending a written request to stop the calls, or blocking the number on your phone.

What should I do if I continue to receive calls from GLA Collections?

If you continue to receive calls from GLA Collections after requesting them to stop, you can file a complaint with the Federal Trade Commission or seek legal action against the company.

Who is calling me from 502-267-7522?

The number 502-267-7522 belongs to GLA Collections, a debt collection agency that specializes in collecting medical debts.

Is GLA Collections a legitimate company?

Yes, GLA Collections is a legitimate company that has been in business for over 30 years and is licensed and bonded to collect debts in multiple states.

Can I negotiate with GLA Collections to stop the calls?

Yes, you can negotiate with GLA Collections to stop the calls by setting up a payment plan or settling the debt. However, make sure to get any agreement in writing to avoid any misunderstandings.

Are there any other ways to stop calls from GLA Collections?

Yes, you can also enroll in a debt management program through a credit counseling agency to handle your debts, which may also put a stop to the calls from GLA Collections.