Are you struggling to deal with capital accounts and their demands? In this article, we will explore who capital accounts are and why people want to beat them. We will also discuss the consequences of not paying capital accounts and provide practical tips on how to beat them.

From sending a debt validation letter to negotiating a settlement offer, we will cover all the essential steps you need to take.

Stay tuned to learn more about the lawsuit process, possible outcomes, and the benefits of settling with capital accounts.

Key Takeaways:

- Be proactive and send a Debt Validation Letter to challenge the validity of the debt.

- Respond to the lawsuit filed by Capital Accounts to avoid potential consequences such as wage garnishment or property liens.

- Consider making a settlement offer to negotiate a manageable payment plan and potentially reduce the amount owed to Capital Accounts.

Who Are Capital Accounts?

Capital accounts refer to the section of a country’s balance of payments that records financial transactions including investments in foreign countries, changes in reserve assets, and other capital flows.

Understanding the role of capital accounts is crucial in assessing a country’s economic health. These accounts reflect the inflow and outflow of investment activities, which have a significant impact on the overall balance of payments.

The inclusion of various assets such as foreign direct investments, portfolio investments, and loans in capital accounts provides a comprehensive view of a country’s financial interactions with the rest of the world.

A strong capital account signifies investor confidence and economic stability, while a weak one may indicate vulnerabilities in the economy.

Why Do People Want to Beat Capital Accounts?

People aim to beat capital accounts by maximizing their investments, increasing net worth, and effectively managing their financial assets.

For many investors, the desire to outperform capital accounts stems from the aspiration to secure a stable financial future and achieve long-term financial freedom. By strategically allocating their funds, diversifying their portfolios, and staying informed about market trends, they hope to grow their net worth over time.

Implementing various investment strategies, such as active portfolio management, tax-efficient investing, and taking calculated risks, can significantly contribute to surpassing capital benchmarks.

Continuously evaluating and adjusting their investment tactics enables individuals to optimize their financial resources and better prepare for unforeseen economic fluctuations.

What Are the Consequences of Not Paying Capital Accounts?

Failure to address capital accounts may lead to diminished shareholder value, financial losses, and adverse impacts on business sustainability.

When capital accounts are neglected, shareholders can face the unfortunate consequence of seeing their investment lose value. This lack of attention not only undermines investor confidence but could also result in financial losses for the company.

These financial setbacks can have a ripple effect, impacting the overall health and longevity of the business.

In the long run, such neglect can jeopardize the stability of the company and its ability to attract future investments.

How To Beat Capital Accounts?

To outperform capital accounts, individuals and businesses must strategically manage their financial claims, navigate economic trends, and optimize their capital inflows and outflows.

One crucial aspect of surpassing capital accounts is understanding the dynamic nature of the economy and its impact on financial claims.

Keeping a close eye on market fluctuations, consumer behavior, and industry shifts can help in making informed decisions to enhance capital performance.

By effectively adapting to economic changes, individuals and businesses can stay ahead of the curve and adjust their financial strategies accordingly. This proactive approach allows for better risk management and the ability to capitalize on emerging opportunities.

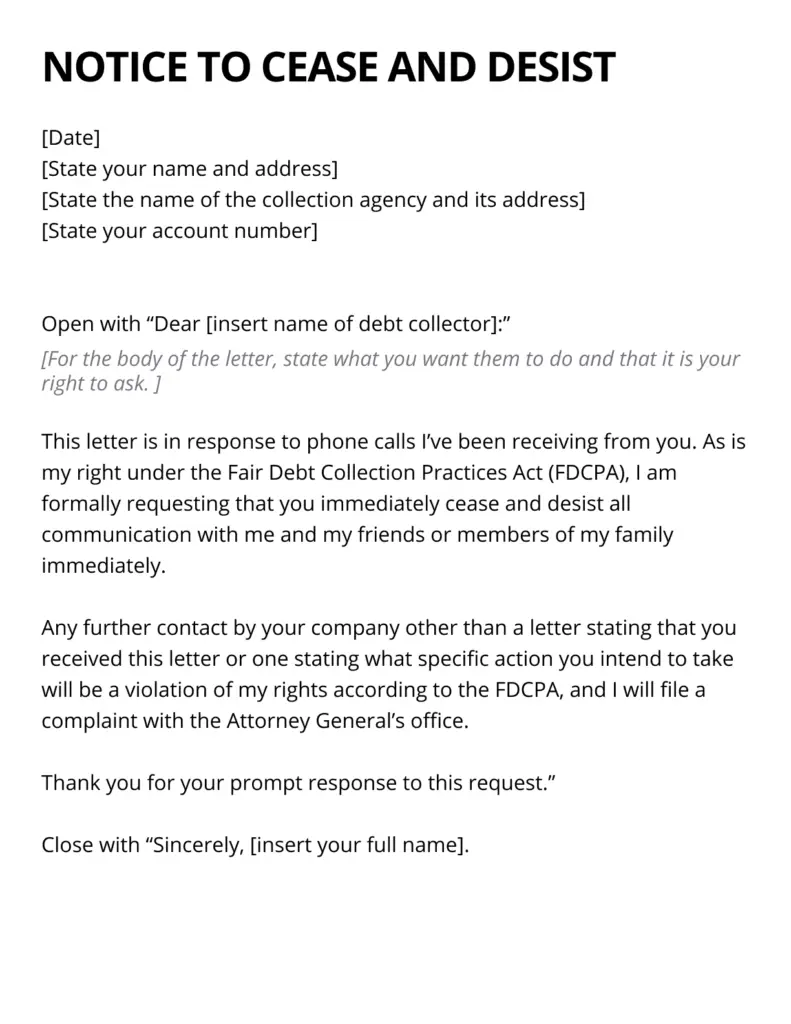

Send a Debt Validation Letter

One way to combat capital accounts is by sending a debt validation letter to ensure accurate reporting, address discrepancies, and validate financial obligations.

When drafting a debt validation letter, it is essential to include all pertinent information such as account details, dates of the disputed entries, and a request for proof of debt. This letter serves as a formal way to challenge any questionable items on the capital account and prompt the creditor to provide validation.

It is crucial to maintain a copy of the letter for your records along with proof of postage, ensuring a paper trail of your dispute.

By adhering to this process, individuals can advocate for their financial rights and maintain accurate accounting records.

Respond to the Lawsuit

When facing a lawsuit related to capital accounts, individuals should respond promptly, seek legal counsel if needed, and consider implications on international monetary fund transactions.

Timely responses to lawsuits connected to capital accounts can significantly impact the outcome and one’s financial stability.

Seeking legal advice is crucial to navigate the complexities of such legal matters and ensure one’s rights are protected.

Overlooking the implications on international monetary fund dealings can lead to severe consequences, potentially affecting not only the individual involved but also impacting broader financial systems and relationships between countries.

Make a Settlement Offer

To resolve issues with capital accounts amicably, individuals can propose a settlement offer, negotiate terms, and document agreements using relevant tax forms like Schedule K1.

When offering a settlement to address capital account disputes, it’s crucial to approach the negotiation strategically. Understanding the opposing party’s perspective and finding common ground can lead to a mutually beneficial agreement.

Active listening and clear communication play vital roles in fostering productive discussions. Documenting the terms of the settlement offer accurately is essential for future reference and legal purposes.

Utilizing tax forms like Schedule K1 helps ensure that the agreement complies with tax regulations and accurately reflects the distribution of profits and losses among partners.

What Is a Debt Validation Letter?

A debt validation letter is a formal request sent to creditors to validate the accuracy of financial claims, assess liabilities, and reconcile discrepancies in net worth calculations.

By sending a debt validation letter, individuals can ensure that the debts claimed by creditors are indeed accurate and valid.

This process helps in identifying any potential errors or fraudulent activities in financial records, protecting the individual’s financial interests. It also serves as a means to verify the legitimacy of the debt collector and their authority to collect the debt.

Ultimately, the goal of a debt validation letter is to give the power to individuals to make informed decisions regarding their financial obligations and safeguard their financial well-being.

What Information Should Be Included in a Debt Validation Letter?

A comprehensive debt validation letter should include details on assets, liabilities, equity holdings, and relevant financial instruments such as treasury stock to facilitate accurate assessment and resolution.

Assets in a debt validation letter refer to any valuable possessions or resources which can be used to offset the debt. These can range from real estate properties to investment portfolios or even intellectual property rights. Detailing these assets provides transparency and helps in determining the debtor’s financial strength.

Liabilities, on the other hand, encompass all existing debts and financial obligations that the debtor must settle.

Breaking down these liabilities in the validation letter enables the creditor to understand the extent of the financial burden on the debtor.

Equity details play a crucial role as they indicate the ownership stake within the business or assets. This information is essential for evaluating the debtor’s financial standing and potential for repayment.

What Is the Lawsuit Process for Capital Accounts?

The lawsuit process related to capital accounts involves legal proceedings, assessment of financial claims, potential impacts on foreign exchange reserves, and resolution through legal channels.

When embarking on a lawsuit regarding capital accounts, the initial step typically entails the filing of a formal legal complaint by the aggrieved party. This sets the stage for the legal process to unfold, involving court appearances, document submissions, and legal arguments from both sides.

Following this, extensive evaluation of the financial claims is conducted to determine the validity and quantum of damages sought. This meticulous assessment may involve forensic accounting, expert testimony, and examination of relevant financial records.

Consideration must be given to any potential impact on foreign exchange reserves, especially if the lawsuit involves international transactions or cross-border investments. Fluctuations in currency values could influence the final monetary awards or settlements in such cases.

Ultimately, the resolution of the lawsuit is achieved through various legal avenues, such as out-of-court settlements, mediation, arbitration, or trial verdicts. The legal system provides a framework for both parties to present their arguments, seek redress, and ultimately reach a resolution in line with legal principles and precedents.

What Are the Possible Outcomes of a Lawsuit with Capital Accounts?

Potential lawsuit outcomes tied to capital accounts include financial settlements, adjustments in visible trade balances, shifts in asset ownership, and implications on business performance.

When a lawsuit impacts capital accounts, the financial settlements reached could significantly alter the financial landscape of the involved parties. These settlements may lead to substantial changes in the visible trade metrics and financial reporting.

Adjustments in asset ownership resulting from the legal proceedings can have long-term implications on the overall financial health of the businesses in question.

Such legal battles can also influence business performance and market standing, potentially shaping the trajectory of future operations.

What Is a Settlement Offer?

A settlement offer is a proposed resolution to capital account disputes, aiming to negotiate terms, satisfy investors, address net creditor positions, and reach an agreement beneficial to all parties involved.

Settlement offers play a crucial role in the financial landscape by facilitating the smooth functioning of capital accounts and fostering trust among investors.

Investors rely on these offers to find common ground, resolve disagreements, and uphold the integrity of their financial investments.

By managing net creditor positions through structured negotiations, settlement offers pave the way for amicable solutions, ensuring that the interests of all parties are duly considered.

How to Negotiate a Settlement Offer with Capital Accounts?

Negotiating a settlement offer with capital accounts requires understanding stakeholder interests, evaluating foreign asset implications, proposing equitable terms, and fostering constructive dialogues for successful resolution.

When engaging in negotiations, it is essential to prioritize the needs and concerns of all parties involved to reach a mutually beneficial agreement. Assessing the impact of foreign assets on the proposed settlement can provide valuable insights into potential complexities and considerations that may arise.

Presenting well-thought-out and fair terms can enhance the likelihood of acceptance and facilitate smoother discussions.

By encouraging open communication and focusing on finding common ground, the negotiation process can be guided towards a positive outcome for all stakeholders.

What Are the Benefits of Settling with Capital Accounts?

Settling with capital accounts offers advantages such as resolving disputes efficiently, enhancing foreign direct investment prospects, stabilizing asset valuations, and fostering investor confidence.

When parties involved in business agree amicably on settlements related to capital accounts, it streamlines the resolution process, ensuring that conflicts are addressed swiftly and effectively. This not only saves time and resources but also contributes to a favorable business environment conducive to attracting foreign direct investments.

By reaching agreements on capital accounts, organizations can experience stabilized asset values over the long term, reducing uncertainties and risks. Such proactive measures also play a vital role in building and strengthening trust among investors, leading to enhanced market credibility and sustained growth.

You should also check our guide on how to beat FBCS.

Frequently Asked Questions

How can I beat capital accounts?

According to financial expert Kevin Keenan, sending a Debt Validation Letter, responding to the lawsuit, and making a settlement offer are the best options for beating capital accounts.

Why are these three options the best for beating capital accounts?

Sending a Debt Validation Letter helps to verify the legitimacy of the debt, responding to the lawsuit shows a willingness to address the issue, and making a settlement offer can result in a lower overall payment.

What is a Debt Validation Letter?

A Debt Validation Letter is a written request to the creditor or collection agency to provide proof that the debt is valid and belongs to the individual being contacted.

How should I respond to a lawsuit from a capital account?

It is best to respond to the lawsuit and not ignore it and this also shows a willingness to address the issue and can potentially lead to a more favorable outcome.

Is it possible to negotiate a settlement with a capital account?

Yes, it is possible to negotiate a settlement with a capital account, making a settlement offer can result in a lower overall payment.