Have you ever heard of CCS Offices? If not, you may want to pay attention.

We dive into what CCS Offices is and how they may contact you. We also explore why CCS Offices can be problematic, from harassment tactics to inaccurate credit reporting.

But don’t worry, we provide you with tips on how to remove CCS Offices from your credit report and report any misconduct to the CFPB.

Stay tuned to take charge of your credit and protect your financial well-being.

Key Takeaways:

- Be proactive and monitor your credit report regularly to catch any inaccurate information from CCS Offices

- Respond to CCS Offices’ contacts in writing and keep records of all communication

- Take charge of your credit by paying bills on time, reducing debt, and seeking professional help when needed

What is CCS Offices?

CCS Offices is a debt collection agency that may contact individuals regarding outstanding debts reported to credit bureaus. They are often associated with consumer complaints and have been subject to scrutiny by the Better Business Bureau.

When individuals receive communication from CCS Offices about unresolved debts, it can cause significant stress and anxiety, especially if they are unfamiliar with debt collection practices.

CCS Offices may use various methods to collect debts, such as phone calls, letters, and sometimes even legal action.

These interactions can sometimes lead to misunderstandings or disputes, which further contribute to the negative reputation of CCS Offices in consumer forums and review websites.

It’s important for individuals to understand their rights under consumer protection laws when dealing with debt collectors like CCS Offices to ensure fair treatment and avoid potential violations.

How Does CCS Offices Contact You?

CCS Offices contacts individuals through various means, including phone calls, letters, and emails, to communicate about outstanding debts and debt collection activities.

These different communication methods serve as channels through which CCS Offices can engage with individuals to discuss payment options, address inquiries, and provide updates on account statuses.

- Phone calls are often used for more immediate interactions, allowing for real-time conversations regarding outstanding debts.

- Letters offer a formal written correspondence that details the nature of the debts, payment schedules, and any legal implications.

- Emails, on the other hand, are utilized for quick updates, reminders, and digital copies of documents.

Phone Calls

CCS Offices may use phone calls as a primary method to contact individuals regarding debt collection, often seeking debt validation and payment arrangements.

These phone calls from CCS Offices serve the purpose of verifying the existence and accuracy of the debts owed, as well as offering solutions such as setting up payment plans.

The communication is aimed at ensuring that individuals are aware of their financial obligations and facilitating the resolution of outstanding debts.

It is important for individuals to be aware of their rights under the Fair Debt Collection Practices Act to protect themselves from potential harassment or misrepresentation during these conversations.

Letters

CCS Offices may send written letters to individuals as part of their debt collection efforts, providing information on debts, verification requests, and potential legal actions.

These letters typically outline the outstanding amounts owed, the timeline for response, and the steps individuals can take to validate the debt. In many cases, individuals receiving these letters have the right to request verification of the debt within a specific timeframe.

This process involves sending a formal written request to CCS Offices to provide evidence and documentation supporting the validity of the debt.

Written communication plays a crucial role in debt resolution as it serves as a paper trail documenting the interactions between the debtor and the collection agency.

By responding promptly and in writing to CCS Offices’ letters, individuals can protect their rights and ensure that the debt collection process proceeds fairly and transparently.

Emails

CCS Offices may utilize emails to communicate with individuals regarding debt collection matters, including validation requests, negotiation agreements, and payment arrangements.

Electronic communication plays a crucial role in the efficiency and effectiveness of debt resolution processes. Through emails, CCS Offices can promptly reach out to debtors, providing them with necessary information and documents.

This mode of communication allows for a paper trail, which is essential in tracking interactions and agreements made between both parties.

When responding to validation requests received via email, it is imperative to follow established procedures to verify the debt’s legitimacy.

Quick and accurate responses can help resolve any discrepancies and ensure transparent communication throughout the debt collection process.

Why is CCS Offices Problematic?

CCS Offices can be problematic due to reported instances of harassment, aggressive tactics in debt collection, and inaccuracies in credit report information associated with their activities.

While debt collection is a common practice, the approach taken by CCS Offices has raised concerns over compliance with consumer protection laws.

The issue of harassment complaints against CCS Offices highlights the need for regulatory oversight and transparency in their operations.

Inaccuracies in credit report information can have long-lasting effects on individuals’ financial health, making it crucial for consumers to monitor their credit reports regularly. Understanding the impact of these practices is essential to give the power to individuals to protect their rights and financial well-being.

Harassment and Aggressive Tactics

CCS Offices have faced criticism for engaging in harassment and employing aggressive tactics during debt collection, potentially violating the Fair Debt Collection Practices Act (FDCPA).

Instances of relentless phone calls, threatening language, or sharing personal debt information with third parties can all be forms of harassment by debt collection agencies.

Such behavior not only takes a toll on the consumer’s mental well-being but also constitutes a breach of the consumer’s rights.

The implications of these actions are serious, as the FDCPA strictly prohibits such practices to protect consumers from predatory debt collection methods.

Consumers have the right to dispute debts, request validation of owed amounts, and file complaints with regulatory bodies if they believe a debt collector has crossed legal boundaries.

Inaccurate Information on Credit Report

CCS Offices’ activities may result in inaccuracies being reported on individuals’ credit reports, potentially affecting their credit scores and financial status.

These inaccuracies can lead to serious consequences for affected individuals, such as:

- denied loan applications

- higher interest rates

- rejection of credit card applications

It is crucial for individuals to meticulously review their credit reports regularly to identify and dispute any errors found. This process involves notifying the credit bureaus of the inaccuracies and providing supporting documentation to substantiate the claim.

Failure to address these errors promptly can have long-lasting repercussions on one’s credit score and financial well-being.

How To Get CCS Offices Off Your Credit Report?

To remove CCS Offices from your credit report, you can start by requesting a debt validation letter to ensure the accuracy of the reported debt information.

Upon receiving the debt validation letter, carefully review the details to identify any discrepancies or errors. If you find inaccuracies, proceed with the process of disputing these errors directly with the credit bureaus.

Ensure to provide any supporting documentation or evidence to strengthen your case during the dispute. The credit bureaus are obligated to investigate and respond within a specific timeframe.

If the disputed information is found to be inaccurate or unverifiable, you can then request the removal of CCS Offices from your credit report. It’s crucial to monitor your credit report regularly to confirm that the corrections have been made.

Request a Credit Report Dispute

Initiating a credit report dispute with credit bureaus can help in rectifying any errors related to CCS Offices’ reporting on your credit history.

Once you’ve identified inaccuracies caused by CCS Offices, the first step is to gather supporting documentation that disputes the erroneous information.

You can then submit a formal dispute letter to the credit bureaus, such as Equifax, Experian, and TransUnion.

These bureaus have a legal obligation to investigate the claims within 30 days and provide a response back to you regarding the corrections made.

Successful dispute resolutions can lead to an improved credit score and financial standing, as the corrected information will reflect positively on your credit report.

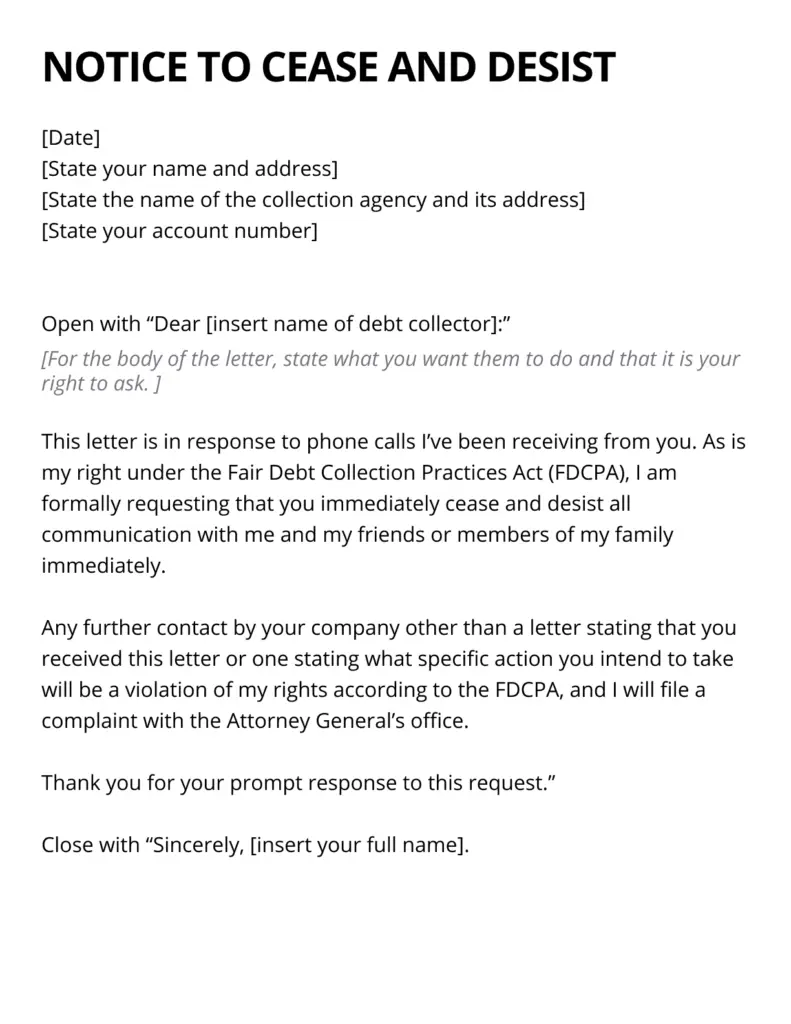

Send a Cease and Desist Letter

Issuing a cease and desist letter to CCS Offices can halt unwanted communication and collection activities, offering legal protection under the Fair Debt Collection Practices Act (FDCPA).

By sending a cease and desist letter, individuals have the right to demand that CCS Offices ceases all communication attempts regarding the outstanding debt.

This legal notice informs the debt collector that the consumer does not wish to be contacted further, except for certain specific situations such as acknowledging receipt of the letter or notifying of legal action.

Under the FDCPA, debt collectors are legally bound to honor this request, failing which they may face penalties and lawsuits for violating consumer rights.

Hire a Credit Repair Company

Engaging a credit repair company can assist in managing debt settlement negotiations with CCS Offices and improving your credit score through effective resolution strategies.

An experienced credit repair company understands the complexities of dealing with CCS Offices and can navigate the negotiation process efficiently to reach mutually beneficial agreements that help in reducing debt burdens.

By leveraging their expertise, individuals can have peace of mind knowing that their financial affairs are being professionally managed, allowing them to focus on other aspects of their lives.

Moreover, collaborating with a credit repair company can lead to significant improvements in credit scores by ensuring accurate reporting of settled debts and timely updates to credit bureaus, thereby enhancing overall creditworthiness and opening up new financial opportunities.

How to Report Misconduct by CCS Offices to CFPB?

To report misconduct by CCS Offices, individuals can file complaints with the Consumer Financial Protection Bureau (CFPB) to address any violations or abusive practices.

When submitting a complaint to the CFPB about CCS Offices, it is important to provide as much detail as possible, including dates, communication records, and any supporting documents. The CFPB plays a crucial role in overseeing debt collectors and enforcing consumer protection laws.

By filing a complaint, individuals not only seek justice for themselves but also contribute to the monitoring and regulation of the debt collection industry.

Once a complaint is lodged with the CFPB regarding CCS Offices’ misconduct, the bureau investigates the matter and may take actions such as initiating enforcement actions, imposing fines, or requiring corrective measures to rectify any violations found.

Filing complaints is an effective way for consumers to hold debt collectors accountable and protect their rights under existing consumer protection regulations.

How to Take Charge of Your Credit?

Taking charge of your credit involves actively managing your credit score, setting financial goals, engaging in debt settlement strategies, and monitoring your credit history for accuracy.

You can improve your credit score by making timely payments, reducing outstanding debt, and keeping credit card balances low.

By setting clear financial goals, individuals can work towards achieving major milestones such as buying a home, starting a business, or saving for retirement.

Navigating debt settlement processes requires effective communication with creditors, exploring payment options, and seeking professional guidance when needed.

Safeguarding your credit history involves regularly checking your credit report, reporting inaccuracies promptly, and being cautious with your personal information to prevent identity theft.

Monitor Your Credit Report Regularly

Regularly monitoring your credit report is essential to track credit score changes, detect errors, and identify potential instances of identity theft.

Keeping a close eye on your credit report allows you to stay informed about any fluctuations in your credit score over time, which can give you insights into your financial health and borrowing capabilities.

By promptly identifying and addressing any inaccuracies or discrepancies in your report, you can prevent them from negatively impacting your creditworthiness.

This vigilance is particularly crucial in guarding against fraudulent activity, as spotting unauthorized transactions early can help limit the damage and protect your identity from theft.

Pay Your Bills on Time

Maintaining timely bill payments is crucial for achieving financial goals, ensuring debt payment consistency, and positively impacting credit scores.

By consistently settling bills on time, individuals can effectively manage their finances and avoid unnecessary additional charges or penalties.

Timely bill payments play a vital role in establishing a strong financial foundation and cultivating responsible money management habits.

Adhering to payment deadlines showcases a commitment to financial responsibilities, which is crucial in building trust with lenders and creditors.

Reduce Your Debt

Reducing debt levels through effective debt settlement strategies can lead to improved financial habits and positively impact credit status and future financial opportunities.

By implementing debt settlement approaches, individuals can actively reduce their debt burden, which in turn alleviates the stress associated with financial obligations.

This newfound financial freedom allows individuals to focus on building healthier financial habits, like budgeting effectively and practicing mindful spending.

As debt levels decrease, individuals also experience a boost in their credit standing, opening up avenues for better loan terms, increased access to credit, and enhanced financial stability for the long term.

Build a Good Credit History

Establishing a positive credit history is essential for attaining financial goals, securing favorable credit status, and accessing various financial opportunities.

Having a strong credit history is like building a solid foundation for financial success. It showcases your ability to responsibly manage credit, making you a desirable candidate for loans, mortgages, and other financial products.

By maintaining a positive credit standing, you can negotiate lower interest rates, qualify for higher credit limits, and even land better job opportunities that require a clean financial record.

A good credit history opens doors to perks such as rewards credit cards, travel benefits, and ultimately paves the way towards your long-term financial aspirations.

Seek Professional Help (if Needed)

If navigating credit challenges becomes overwhelming, seeking assistance from professionals like attorneys or financial services providers can offer tailored solutions and expert guidance.

These professionals possess in-depth knowledge about debt resolution strategies and can negotiate with creditors on your behalf to reduce the overall amount owed.

Expert advice from seasoned professionals can help you understand your rights, explore options like debt consolidation or settlement, and create a feasible repayment plan.

With their support, you can navigate complexities such as credit score improvement, debt restructuring, and legal implications with more confidence and efficiency.

You should read our guide on how to beat Unifin if you getting debt collection calls from them.

Frequently Asked Questions

Why is CCS Offices causing problems for me?

CCS Offices is known for aggressive and sometimes illegal debt collection tactics. They may use harassment, threats, and other unlawful methods to try and collect on a debt.

Additionally, they may report incorrect information on your credit report, damaging your credit score and making it difficult for you to obtain loans or credit in the future.

Can CCS Offices contact me without my permission?

No, CCS Offices must first obtain your consent before contacting you. Under the Fair Debt Collection Practices Act, collection agencies like CCS Offices are required to send a written notice within 5 days of their first communication, stating the amount you owe and the creditor you owe it to. If you did not receive this notice, you have the right to request it from CCS Offices.

How can I remove CCS Offices from my credit report?

You can request a debt validation from CCS Offices, which requires them to provide proof that the debt is yours. If they are unable to provide this proof, you can dispute the debt with the credit bureaus and have it removed from your credit report.

You can also negotiate with CCS Offices to remove the debt in exchange for payment or pay for delete agreement.

How can I report misconduct by CCS Offices?

You can submit a complaint to the Consumer Financial Protection Bureau (CFPB) if you believe CCS Offices has violated your rights under the Fair Debt Collection Practices Act.

The CFPB will investigate your complaint and take action if necessary. You can also report CCS Offices to your state’s attorney general’s office or the Federal Trade Commission (FTC).

How can I take charge of my credit?

One way to take control of your credit is by monitoring your credit report regularly and disputing any errors or incorrect information.

You can also work on improving your credit score by paying bills on time, keeping credit card balances low, and avoiding new credit applications.

Creating a budget and sticking to it can also help you manage your finances and avoid getting into debt in the future.

Is there anything I can do to prevent CCS Offices from contacting me?

You can send a written request to CCS Offices asking them to stop contacting you. This is known as a cease and desist letter and once they receive it, they must comply with your request. However, this does not erase the debt and CCS Offices may still pursue legal action to collect it.

If you want to completely avoid contact from CCS Offices, you can also hire an attorney to communicate with them on your behalf.