It’s financial literacy month, so this post is focused on something all consumers should know: How are credit scores calculated?

Banks and lenders use credit scores to see how reliable consumers (people like you and me) are and to understand the likelihood that they will pay back a loan.

A good credit score = a reliable consumer.

A bad credit score = a risky consumer.

Most consumers have a general idea of what a credit score is, but we’ll dive into more of the nuances immediately below.

On the other hand, less consumers understand how credit scores are calculated. There are five simple components that make up a credit score, see further below to learn how they come together to form your credit score.

What are Credit Scores?

A credit score is simply a measurement that lenders use to understand if a consumer is reliable or risky, and what the chances of getting their loan repaid will be.

Of course, with anything financial, there are a lot of ways to make credit scores confusing.

For one, there are multiple credit scores floating around for every consumer, but the only one you should care about is the FICO credit score.

FICO credit scores are the most popular and most widely used. According to Discover, 90% of top lenders use FICO scores to make their decisions.

Second, there are multiple credit bureaus (like TransUnion, Equifax and Experian) who could be providing you your FICO credit score. It’s important to note that your FICO credit score may vary depending on who the credit bureau is reporting your score. Though, directionally, it should be very similar across all of them.

At the end of the day, all anyone needs to know is what their FICO credit score is across one of the major credit bureaus. Don’t make it more complicated than it needs to be.

What is a Good Credit Score?

Of course, the reason we ask, “how are credit scores calculated?” is because we want to understand how to make our score better. But what exactly is a good credit score?

Here is how Experian (one of those credit bureaus mentioned above) breaks it down:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Very Poor

Obviously, the higher the score the better. With the top score capping out at 850.

Looking around the web, you’ll find most others have similar (if not the exact same) guidance as above.

Generally, if you’re in the “Very Good” range or above, you’ll get the lowest interest rates available.

How Are Credit Scores Calculated: Five Components

To the good stuff: how are credit scores calculated?

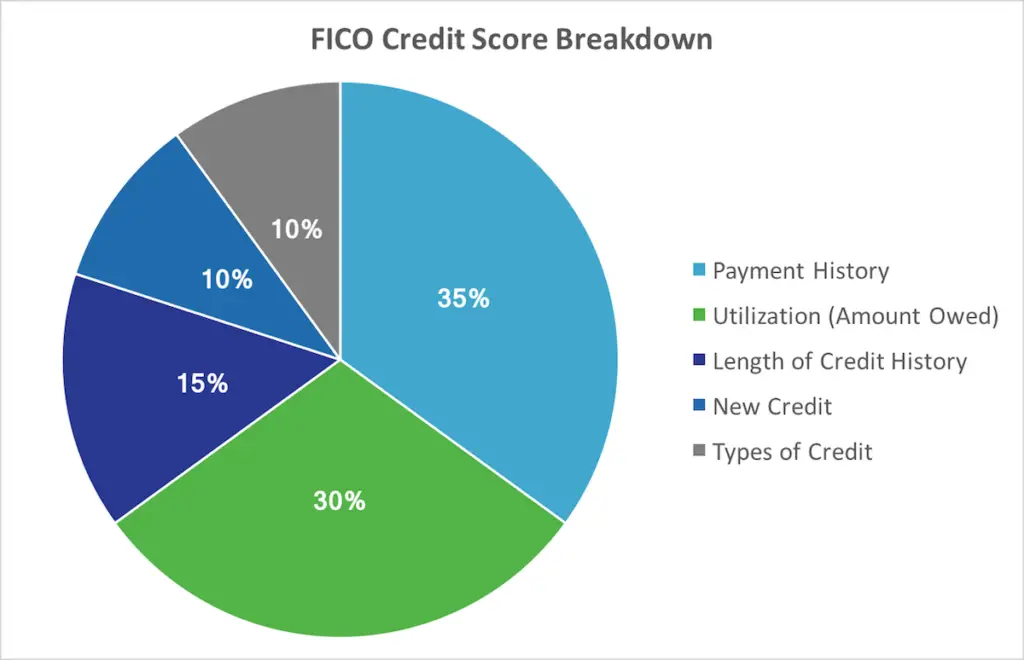

There are five components that make up your credit score. As you can imagine, there are a lot of complex algorithms working behind the scenes to calculate your credit score, but understanding these five major factors is all you need to know:

- Payment History [35%]

- Utilization [30%]

- Length of Credit History [15%]

- New Credit [10%]

- Types of Credit [10%]

As you can see, while all five components are important, they are not all created equal.

Payment history, being the most important, makes up 35% of your credit score.

While new credit and types of credit only make up 20% combined.

You can learn more about each factor below, including how to leverage it to help raise your credit score.

1. Payment History

Payment history makes up 35% of your score.

This is the most important component of your credit score. It consists of measuring how often you pay your debts back on time. And, of course, when you don’t.

It’s a important to note that not paying your debt or credit on time will have a larger negative impact than the positive impact of paying your debt on time. The expectation is that you pay on time, and when you don’t, you get dinged.

It’s kind of like a GPA in school. Consistently getting As and Bs is great and keeps your GPA around 3.5. But one F can sink your number really fast.

Like every other measure, this includes debts like credit cards, student loans and mortgages.

So pay your credit card bill on time every month!

Things that help: Paying your debt back on time and in full.

Things that hurt: Missed or late payments, and defaulting on loans.

2. Utilization (Amount Owed)

Utilization (amount owed) makes up 30% of your score.

Simply stated, utilization is both the measure of how much of your available credit you are using and the total amount of debt you have outstanding.

The piece that is easier to control is utilization. If your credit limit is $10,000, and you owe $5,000 on your cards throughout the month, then your utilization is 50%.

Most recommend to strive to be under 30%. Low utilization indicates that you are not overextending yourself and are acting responsibly with your credit.

So, try to ensure you spend under 30% of your credit, and if needed, request a larger credit line from your credit card provider (not to use it, but to help with your utilization percentage!).

Of course, credit cards are not the only form of debt. This measure also looks at the total amount you owe, including any home, car or other loans. The more reasonable this total amount owed is, the better your score will be.

Things that help: Utilizing less than 30% of your credit and only taking out loans you can afford to pay back on time.

Things that hurt: Utilizing more than 30% of your credit and taking out multiple, large loans (overextending yourself).

3. Length of Credit History

Length of credit history makes up 15% of your score.

This component measures if you are a new credit user or an experienced (and trustworthy) credit user.

Specifically it looks at things like the age of your oldest credit account, the age of your newest account, and the average age of all accounts.

This is a bit of a catch-22, as you need a decent credit history in order to get new credit. Though, there are a lot of beginner credit cards that you can usually get to help to start building credit (and ones to avoid too, like this one and this one).

One important thing to note is that when you cancel your oldest account, it does not immediately “fall off” your credit score. It falls off 7 years later. So you will still have that history working for you for 7 years.

Though, it is still advised to keep your oldest account open forever (assuming it is not an annual fee credit card that you no longer use).

This is best understood with an example: if you are 25 and have 5 years of credit history, but cancel your 1 and only credit card to get a new one, you will still have 5 years of credit history. But, 7 years from now, you will all of a sudden go from having 12 years of credit history to 7 (when your old card falls of your score) and that could negatively impact your score.

Things that help: Not closing your longest standing credit account and continuing to pay back credit on time over long periods of time.

Things that hurt: Closing your oldest accounts and not building a history of being a reliable borrower.

4. New Credit

New credit makes up 10% of your score.

This part of your score measures how many times you open a credit account in a given time period. Usually, this results in hard credit checks and can negatively impact your score.

Reason being, it is generally viewed that if you are opening a lot of accounts then you are shopping around and desperate for credit. The assumption is that you are either an irresponsible consumer or other lenders keep turning you down.

Therefore, your credit score is warning new, potential lenders of your sporadic behavior.

Personally, this is my least favorite component of the credit score. Every time you open a new credit card, you can expect a small dip in your score. So, be mindful and responsible with when and how often you open new accounts.

Things that help: Not opening new credit cards.

Things that hurt: Opening multiple new credit accounts in a short time span.

Note: this should not discourage you from opening new credit cards or travel hacking. Just be smart about it. For example, don’t open multiple credit cards right before you want to get a mortgage. Allow time for your score to bounce back from this one time hit.

5. Types of Credit

Types of credit makes up 10% of your score.

Otherwise stated, types of credit is your credit mix. Generally, it’s looking to see if you are responsible with a lot of different credit, like car loans and mortgages and credit cards.

Or, if you just have one type of credit.

Successfully paying off multiple forms of debt is viewed as a good thing.

Things that help: Having a healthy mix of different types of credit.

Things that hurt: Only have one type of debt or credit.

Note: It is NOT recommended to open credit cards or get loans to try to help this small part of your score. Let your credit mix build over time as you naturally have a need for various types of credit.

The Bottom Line

The bottom line is: understand your score and impact it where you can.

The best way to do this is to pay all your debts back on time and to use your credit cards responsibly. That’s it.

And if you want to check your score, most banks and credit card companies offer a free service to do so somewhere on their apps or website.

You can also view it for free here.

Ready to open a new credit card now that you understand how it will impact your credit score? Check out our credit card tool that will help find the perfect next card for you!

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.