Investing in fine art used to require an eye for talent, piles of cash, and access to stuffy galleries and auction houses – but those days are gone. Now even rookie investors can own shares of museum-caliber works, thanks to the rise of Masterworks and its tokenized, fractional investment model for blue-chip paintings.

NFTs, or non-fungible tokens, have likewise taken the digital art world by storm, and F-NFTs quickly followed suit, allowing people to own fractions of in-demand pieces. However, crypto’s volatility has challenged many NFT returns recently. While the market boomed in 2021, it saw a 90% drop in 2022, leaving many investors feeling whiplashed.

Meanwhile, Masterworks has quietly built an impressive track record securitizing physical masterpieces from Basquiat, Picasso, Warhol, and more. After 16 exits to date, the platform has offered investors an average of 45% in annualized returns so far.

So if you want to add blue-chip art to your portfolio without needing access to a heavily-guarded money vault, fractional shares from Masterworks could give you bragging rights the next time NFTs come up at happy hour. Read on to learn how fractional art platforms work their magic and why Masterworks’ returns have been leaving digital dust in the eyes of NFTs.

How Do Masterworks and F-NFTs Enable Fractional Ownership?

Alright, let’s break this down. How can someone invest in a Picasso painting without millions in the bank? The secret sauce is “fractionalization.”

With Masterworks, the startup’s art data specialists identify promising works by some of the most famous artists in the world. The procurement team purchases the full piece and then converts it into shares, securitized with the SEC.

As such, these shares represent fractional ownership in the underlying artwork. With a starting investment of $20, anyone can purchase a slice of the action. When Masterworks later sells the work, shareholders receive payouts based on the appreciation, minus some fees.

F-NFT platforms like Fractional.art use a similar approach. Take a Bored Ape valued at $300k. Complex smart contracts slice it into fungible ERC-20 tokens. People buy these tokens, each tracking ownership of 0.1% of the Ape.

So in both cases, tokenization makes owning fractions of expensive assets accessible for the average Joe. But there are some key differences when it comes to the assets themselves.

Why Physical Art Investing Has Advantages Over Digital

There’s no use in denying it – NFT art is still groundbreaking stuff. But those images of pixelated Crypto Punks may not stand the test of time like some of the works by contemporary masters.

First of all, physical artworks are one-of-a-kind creations you can see and touch. They provide a tangible experience that digital surrogates simply can’t replicate. There’s something profound about standing before a Van Gogh with its textured swirls of paint. Good luck finding that same awe on a smartphone screen.

There’s also scarcity. The supply of a Basquiat on canvas is limited by nature. But digital files can be reproduced infinitely. Sure, blockchain verifies ownership of individual NFTs. But if the broader market is flooded with barely distinguishable derivations of say, the Bored Ape memes, their value seems likely to suffer.

We shouldn’t underestimate the power of history either. Art collecting has prestige and institutional backing built up over centuries. The crypto space is still seen as fringe and speculative by many.

So while NFT art represents an exciting new chapter, old-world mediums like painting and sculpture have market presence and collector gravitas that can’t be replicated overnight. As an investment, physical art seems less likely to nosedive out of popularity even if NFT mania fizzles.

Additional Benefits of the Masterworks Model

Beyond the inherent strengths of physical art, the Masterworks approach also has some key advantages. For one, Masterworks has experienced art specialists selecting works with investment potential. They identify up-and-coming artists poised to break out, or established names whose markets are likely to grow.

Less than 3% of artworks on offer pass through this diligence process. This expertise gives investors confidence.

Masterworks also provides liquidity through secondary markets for its shares. So investors can sell anytime – no need to wait for a buyer for the full work. This model maintains liquidity at the share level similar to an exchange traded fund.

There’s also regulatory oversight that inspires trust. Masterworks submits offerings to the SEC for approval. Audited financials and other compliance provides transparency. This is a stark contrast from the “wild west” reputation of NFTs and crypto.

While the fractional ownership models have parallels, Masterworks’ track record and diligence around physical works gives it an edge over speculative digital art and assets. And that leads us to the ultimate question – how have the returns compared? Read on for some promising results.

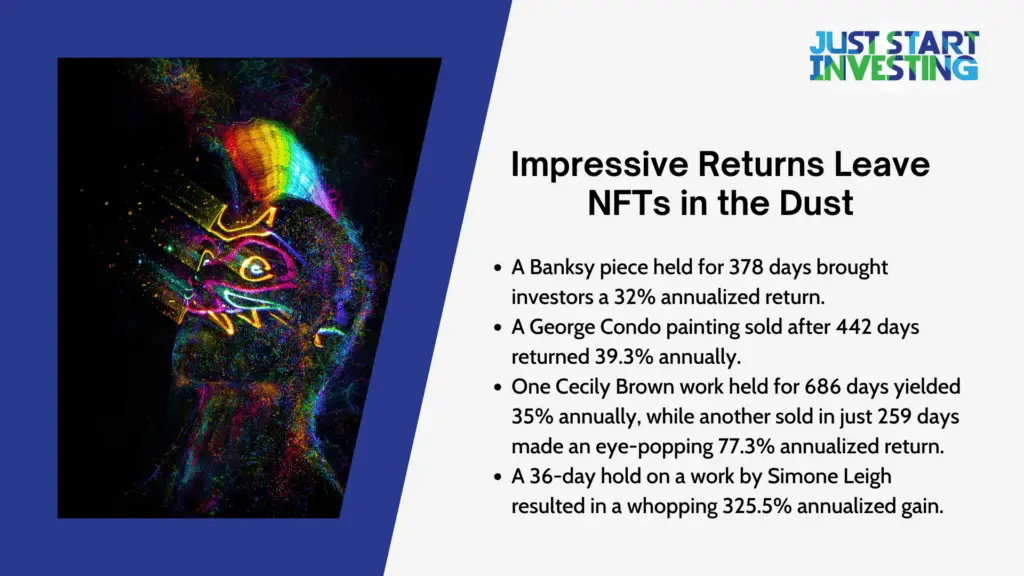

Impressive Returns Leave NFTs in the Dust

The proof is in the pudding, or in this case, the paintings. Masterworks’ track record of successful art exits demonstrates the earning potential of fractional shares.

Consider that eight of their last nine sales delivered over 13.9% average annualized returns to investors after fees. Other highlights include:

- A Banksy piece held for 378 days brought investors a 32% annualized return.

- A George Condo painting sold after 442 days returned 39.3% annually.

- One Cecily Brown work held for 686 days yielded 35% annually, while another sold in just 259 days made an eye-popping 77.3% annualized return.

- A 36-day hold on a work by Simone Leigh resulted in a whopping 325.5% annualized gain.

These are the kinds of steady double-digit returns that savvy investors dream of. NFTs may deliver sporadic home runs, but they strike out just as often. Their volatility makes crypto gains less consistent. Meanwhile, art’s inherent scarcity, Masterworks’ diligence, and the efficient secondary market makes fractional shares a potentially lucrative long-term play.

Final Word

For those seeking portfolio diversification and respite from crypto chaos, fractional blue-chip art offers lower-risk exposure to an asset class with proven earnings potential over time. The results speak for themselves.

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.