I’m a firm believer that investing should be easy – anyone who is interested should be able to start investing today. And in this Backer Review, you’ll see how this new Fintech company is doing its part to make starting a 529 plan easy.

Honestly, I think 529 plans are one of the most complicated areas of personal finance, which is unfortunate because it is a very beneficial account for anyone looking to save for a child’s future education.

They are complicated because each state offers its own version of a 529 plan – and sometimes more than one.

with a 401(k), IRA, or brokerage account, you know what you are getting into no matter where you live. They are a lot easier to understand and manage.

What Blooom has done for 401(k)s and Betterment for IRAs and brokerage accounts, Backer is doing for 529 plans. They are making it easy to save for college effectively.

What is a 529 College Savings Plan?

A 529 College Savings Plan is a tax-advantaged account designed to help you save for future college expenses on behalf of a beneficiary.

Typically, this account is used by parents, grandparents, Aunts, and Uncles to save for a child’s or young relative’s future college expenses.

529 Savings Plan Quick Facts:

- Contribution Limits: Varies by state, but typically there are no annual contribution limits, just a total contribution limit.

- Withdrawal Limits: Funds can be used broadly for education expenses across states, not just in the state where you opened a plan. They can also be used for K-12 and college expenses, including costs like room and board.

- Tax Advantage: Like a Roth IRA, a 529 savings plan taxes money on the way in and not on the way out. Meaning, you contribute funds post-taxes and get to withdraw money tax-free when you are ready to make education payments.

And in case you are wondering where this account got its name from, it originated from Section 529 of the Internal Revenue Code.

529 Plan Definition: A tax-advantaged plan that allows you to save and invest for a beneficiary’s future education expenses.

As I mentioned earlier, 529 savings plans are slightly more complicated than other tax-advantaged accounts because they are managed at the state level.

Don’t get me wrong, you can still open a plan on your own relatively easily. It just requires some research and general knowledge that most people don’t want to deal with – and that’s where Backer comes in.

Backer Overview

Backer was founded in 2015 by current CEO Jordan Lee as was originally called CollegeBacker. Since then, it has helped families save and invest over $34 million through its College Savings Plan.

Backer describes itself as “a modern college fund.”

I like the description – it’s fitting. I think Backer is modern for a few reasons:

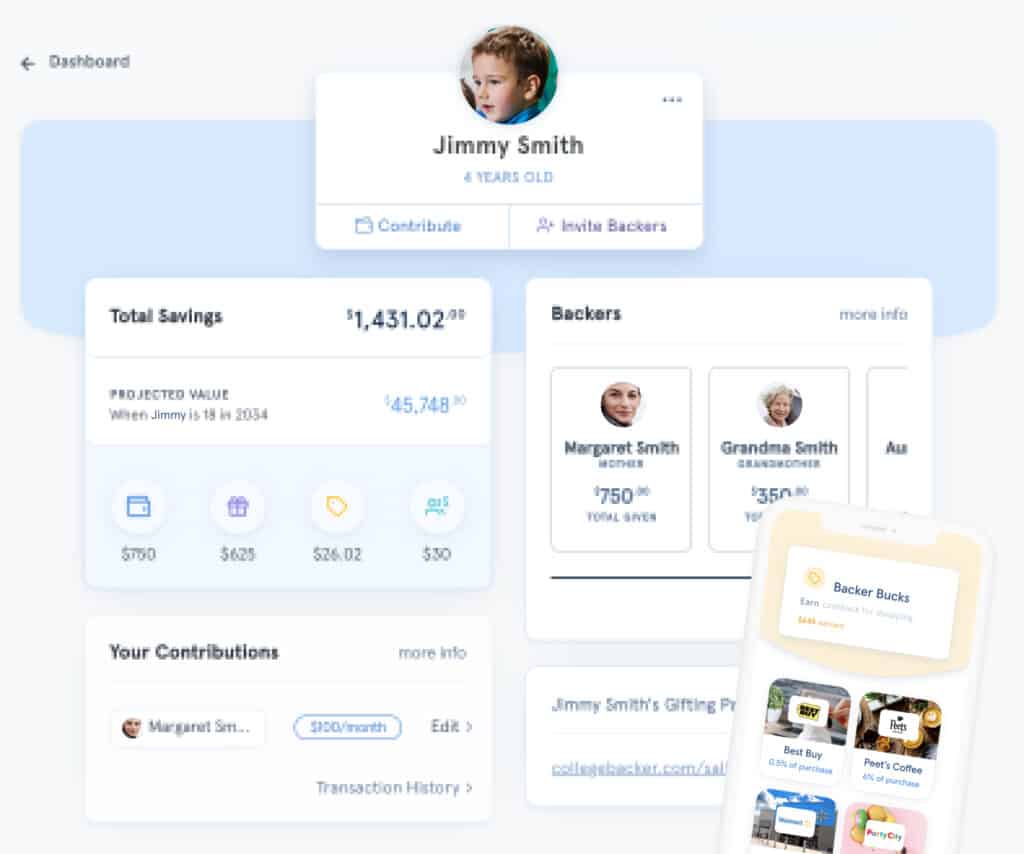

- Backer is easy to use, and its website and app have a solid user interface

- They keep costs low – only $1 per month

- The fund selection within Backer is top-notch

The bottom line is, Backer offers a lot of value for a low price.

Backer Mission: Backer was founded to make saving for college so easy that every American child will have a college fund, no matter their family’s means, where they come from, or what they look like.

Backer Key Features:

- Price: $1/month (plus small underlying fees)

- Speed: Can get started in just 5 minutes

- Accounts Supported: 529 plans

- Investments Offered: Low-cost funds

How to Start a 529 Plan with Backer

Getting started with Backer is easy.

At the end of the day, that is the most significant selling point for them – they make investing in 529 accounts painless!

Here are the three steps you can take to get started in just a few minutes.

Step 1: Start a College Fund in Minutes

The first step in starting a 529 plan with Backer is no different than other robo-advisors: answer a set of basic questions so that they can get to work on your behalf.

Typically, this includes things like your name, age, and contact info, and also your high level investing goals.

From there, per their website, Backer will “recommend a top-tier plan and help you select the right age-adjusting portfolio.”

They’ll set up the 529 plan for you and do all of the heavy lifting, so you can move on to step two.

Step 2: Automate Contributions

After you have your investment plan set up, it’s up to you to decide how much you want to contribute to your 529 plan each month.

Similar to creating a sinking fund, you’ll need to know both of the following to determine how much you should be saving:

- How much time you have to save

- How much money you’ll need in the end

For reference, if you’re investments generate a 5% annual return, $100 invested every month would turn into just under $40,000 over a 20 year time period.

Also, keep in mind, if you’re not ready to start investing in a 529 account, you could always utilize the Backer Safe program, which stores your money in an FDIC-insured account. Although, I wouldn’t necessarily recommend this route since the primary reason to use a 529 plan is to take advantage of tax-free investment growth!

Step 3: Watch Your Money Grow

Speaking of growth, the last step in the easiest – watch your money grow over time.

There are also a couple of ways you can accelerate your growth over time as well, including participating in their social gifting and Backer Bucks (cash back) programs.

Social gifting is one of the coolest aspects of Backer. You can set up a page for friends and families to donate to the account, so instead of getting birthday presents that get lost or forgotten in a few years, your child can receive the gift of future education!

With Backer Bucks, you can do your shopping in their online portal and earn cash back that gets directly deposited to your 529 account.

Backer Pros and Cons

Pros

Ease of Use: The biggest perk of Backer is they make investing in a 529 plan easy.

The Social Aspect: Offering the ability for relatives and friends to donate to a 529 account as a gift is a really unique idea and a great perk of using Backer

The Price: Backer currently charges $1/month, or whatever monthly donation you see fit if you think their services are worth more than $1/month. If you only have $100 in the account, this is a large fee (12%). However, as your account grows, this fee as a percentage goes progressively down. For example, if you have $5,000 in your account, this fee would be 0.24%.

Low Fees: Backer states the only other fees to expect is the 0.14 – 0.16% they charge per year on average to cover the underlying 529 plan expenses.

Security: Backer is an SEC-registered investment adviser and offers bank-level encryption and security practices.

App: Backer also recently launched a new app! Making it even easier to manage your 529 plan.

Cons

You Could Miss Out on State-Sponsored Tax Breaks: The biggest con to Backer is that you could miss out on a potential tax deduction depending on where you live. It’s worth confirming if your state offers a tax deduction for their 529 savings plan before making a final decision.

Fund Selection: You will be limited in your investment options with Backer, which is an issue with most robo-advisors and 401(k)s as well. However, it’s not really an issue as long as they offer quality, low-cost index funds or ETFs!

Is Backer Worth It?

Yes, if you are looking for an easy way to pay for your child’s education, Backer is 100% worth it.

Backer makes it very easy to learn how to open a 529 plan. Sometimes, that’s all you need to get started, someone (or a company) to help walk you through the process.

The main reason I think it would make sense to open an account on your own instead is if you live in a state where you can take advantage of tax deductions with your plan.

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.