Health savings account rules are easy to follow. On top of that, they are one of the most underrated investment accounts available.

They’ve been around since 2003 and come with a lot of awesome benefits. The biggest perk is being able to contribute pre-tax dollars and have it grow tax-free. We’ll detail more of the benefits further below – there’s a lot of them.

A health savings account also comes with rules you need to follow in order to use them. Any tax-advantaged account, of course, has a string of rules attached to it.

Before diving too far into the various health savings account rules, we’ll start with a basic overview of health savings accounts. There are a lot of ways to optimize your health savings account, but the best thing you can do for now is to start using it.

A note on health savings accounts: they are only available with high deductible insurance plans (HDHP). So, if you don’t have a health savings account available to you, it’s likely because you are on a more expensive plan with better insurance (and a lower deductible).

What is a Health Savings Account?

Simply stated, a health savings account (HSA) is an account you can set up to pay for out-of-pocket medical expenses and health care costs.

Your health plan must be a high deductible health plan to be eligible to use a health savings account. You can open an HSA on your own if you qualify, or open one through your employer.

The biggest perk of an HSA is that you can contribute funds to it pre-tax (from your gross income). So, if you’re contributing through an employer it will get deducted from your paycheck before you pay any income tax. If you contribute on your own, you can write off your contributions when doing taxes.

The perk doesn’t stop there, though! You can also withdraw (and use your funds) tax-free.

That’s right, you don’t pay taxes on the way in or the way out. Its truly a tax-free account (unlike 401ks and IRAs, where you have to pay taxes one way or the other).

Plus, as we’ll get into, health savings accounts have many other versatile perks.

Health Savings Account Rules to Know

As the title of this article states, a health savings account has rules that need to be followed.

Rules, especially when created by the government, are usually complicated. We’re breaking it down in simple terms here to ensure you can take advantage of this awesome account.

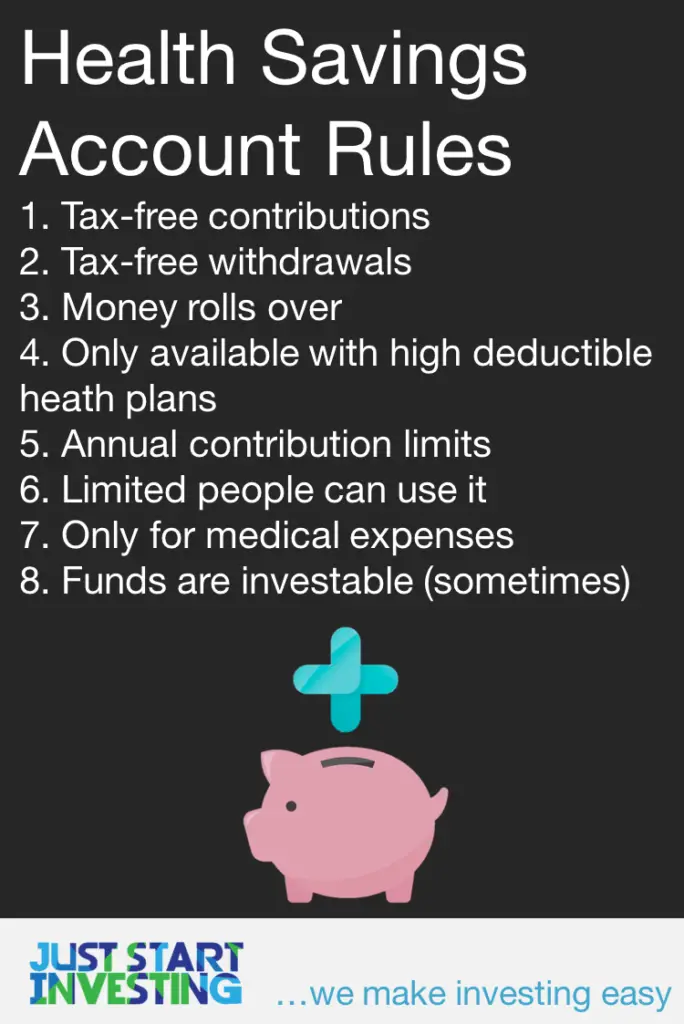

Here are the 8 rules to be aware of…

Rule 1: Tax-free contributions

This is a pretty easy rule to follow. It’s actually more of a perk and tax advantage than a rule.

With an HSA, as we’ve stated, you don’t have to pay taxes on the money you contribute to this account.

Rule 2: Tax-free withdrawals

Is this a list of rules or benefits?!

Another rule and perk of HSAs is that you can use your money without paying taxes (as long as it’s used to pay qualified medical expenses). The earnings and interest from this account are not taxed.

A true tax-free account from Uncle Sam.

Rule 3: Money rolls over

Another rule for HSAs (which is not true for a flexible spending account, or FSA) is that your money stays with you year after year. There is no pressure to use your HSA in your current plan year because your HSA funds roll over to the next year and will be available for you to use then.

Even if you change or leave companies, your HSA will stay with you.

This makes health savings accounts a great long term saving tool.

Rule 4: Only available with high deductible health care plans

In 2021, the IRS defines this as having a minimum annual deductible of $1,400 and maximum deductible (and out of pocket expense) of $7,000 if you’re in a self-only plan. So, your annual deductible must fall between that range.

If you’re on a family coverage plan, your minimum deductible must be $2,800 and your maximum $14,000.

If you’re outside of these ranges, unfortunately, you cannot use an HSA.

Rule 5: Annual contribution limits

In 2021, the annual contribution limit to an HSA is $3,600 for someone on a self-only plan.

The maximum contribution limit is $7,200 if you’re on a family plan.

This is the maximum amount of money you can add to this account each year. The one exception is if you are 55 or older there is a catch-up contribution rule and you are able to contribute an additional $1,000 annually.

Rule 6: Limited people can use it

A health savings account can be used for any of the qualified people below:

- You

- Your spouse

- Any dependents you claim on your tax return

That is some great flexibility! Even if your spouse is on a separate health insurance plan, you can still use your HSA funds on them.

Rule 7: Only for medical expenses

You must use your HSA only for medical and health care expenses. This is an obvious restriction of this account.

Qualified medical expenses that you can use your HSA for include:

- Common medical expenses, including health and dental

- Medicine with a prescription

- …full list found here

You cannot use your HSA for:

- Non-medical expenses

- Over the counter medicine without a prescription

If you use your HSA for a non-medical expense you will not only be taxed, but also charged a 20% penalty.

Though, once you reach age 65, you can use your HSA for non-medical expenses and will only be taxed (you will not face the additional 20% penalty).

Note: With most HSAs, you can either use a debit card that they provide or your own personal card to cover eligible expenses. If you use your own card, you need to apply to get reimbursed through the plan.

Rule 8: Funds are investable (sometimes)

This rule varies by HSA provider.

Some HSA providers let you invest funds (once you hit a certain threshold of funds) just like a 401k would. Others may earn interest. If you need the details on this, just contact your HSA provider to learn more.

Others simply provide interest, like a savings account.

If investing is an option for you, be sure to take advantage!

Health Savings Account Pros and Cons

We’re through the health savings account rules section… that wasn’t so bad. The rules are pretty straightforward and easy to follow once you know them.

Now, here are some of the biggest pros of a health savings account to hopefully convince you to take action.

And some cons farther below to balance things out.

HSA Pros

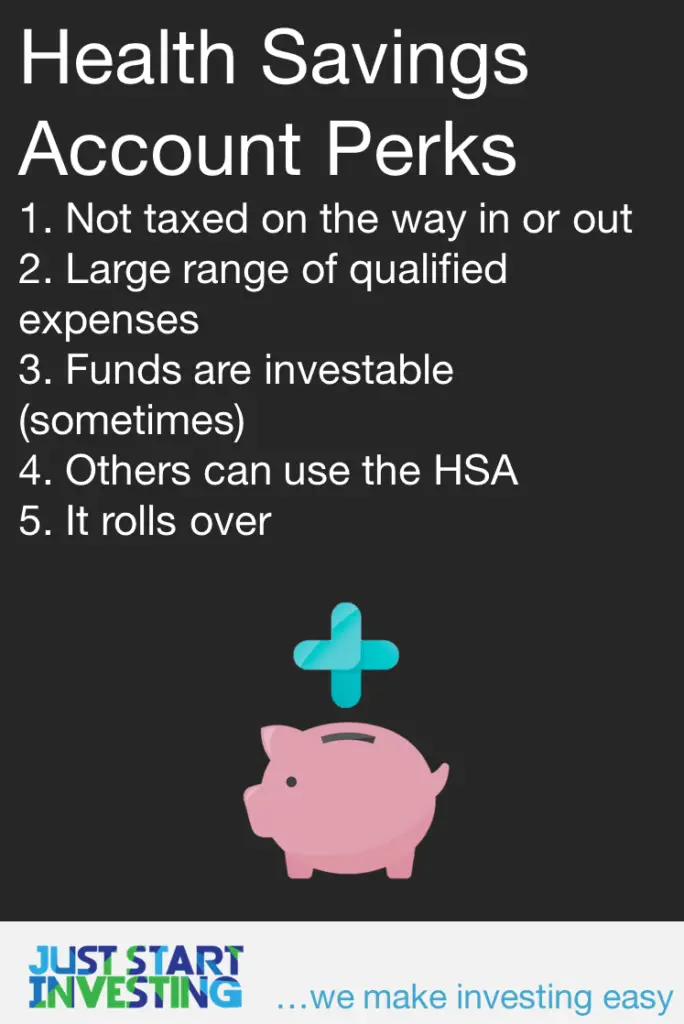

Pro #1: Not Taxed on the Way In or Out

Used properly, health savings accounts are not taxed at all. I cannot stress this enough, as you can tell by the number of times its been mentioned already in this post.

You don’t get taxed on the money you put into a health savings account – it’s either deducted from your paycheck or you can deduct it from your taxes at year-end.

There are also no taxes on any earnings or interest.

And lastly, you don’t get taxed when you take your money out to use it (assuming you use it on health expenses).

These three tax perks are commonly referred to as the triple tax advantage.

Pro #2: Large range of qualified expenses

While you can only use an HSA on medical expenses, the list of qualified expenses is actually quite large.

From dental expenses to chiropractic care, if the expense is remotely related to your health then you’re likely in the clear.

Note: over the counter medicine is not eligible (i.e., ibuprofen).

Pro #3: Funds are investable (sometimes)

Investing is an option for most health savings accounts.

For all of them, you will at the very least collect interest on your money. In most cases though, you can start investing once you reach a certain balance.

For example, some might set a threshold of $2,000. So once your account balance exceeds $2,000, you can invest in investment vehicles made available through the HSA.

If you need more details on this, just reach out to your HSA provider.

Pro #4: Others can use the HSA

Health savings account funds can be used for yourself, but also for your spouse and any dependents listed on your tax return.

That is a lot of flexibility for a tax-advantaged account!

Pro #5: It rolls over

Health savings account balances roll over year after year. Whatever you don’t spend one year will continue to be available to you.

Also, this account is portable (like a 401k). So if you leave or change employers, your HSA will not go away.

Again, this is a ton of flexibility for a tax-advantaged account!

HSA Cons

Con #1: Must use for medical expenses

The obvious downfall to this account is that it must be used for medical expenses.

If you are under 65, you will pay a 20% fee on top of any taxes for funds used on non-medical expenses.

After 65, you will just pay taxes. Which is actually starting to feel more like a pro.

Not only can you grow this huge safety net of funds tax-free to use for medical expenses, but if you’re past age 65 and lucky enough to have low medical bills, you can withdraw this money without any additional charges beyond taxes.

Similar to a 401k, you wouldn’t be taxed on HSA contributions made and would just have to pay taxes on funds you withdraw.

Con #2: Not available to everyone

Obviously, if you cannot use an HSA because you are on an ineligible health plan, that is a con.

One huge improvement to HSAs would be to make them more widely available.

Con #3: Fees

Like with any investment account, beware of fees and make sure you minimize them as best as possible. With the HSA provider, it might be difficult to take action on fees they charge for providing an HSA. But you can definitely minimize the fees on any investments you make.

Like always, when investing in mutual and index funds, make sure you are choosing low-cost options.

You now have a solid understanding of health savings account rules and benefits. Start taking advantage of this account if you can!

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.

Thanks for the good information. My wife is eligible for Medicare this month so my family plan is switching to a individual and I wondered how much I could contribute to the HSA with that change.

Of course! An HSA is arguably one of the best tax advantaged accounts out there that you can contribute to!

Correct me if I’m wrong but I don’t think you can contribute to HSA on a pre-tax basis once you switch to medicate

Correct, if on Medicaid, according to the IRA you cannot also contribute to an HSA.

I think you meant “once on MEDICARE”, correct? And yes once on Medicare you can no longer contribute to an HSA account.

Applies for both Medicaid and Medicare.

Double check with IRS.gov but I’m pretty sure you’re correct that you need to switch to the individual HSA contribution limits. You’ll probably be able to contribute the extra $1,000 for over 55 as well. I’ve used my HSA when I had $4500 in medical expenses one year but plan on holding onto the balance for later when I get hit with another large medical expense. The fees are a pain though, I did some shopping around and there is a wide gap of monthly fees being charged. It will be worth it to me to switch to a different custodian.

bookmarked!!, I like your site!

Thanks for the write-up – this is one of my favorite accounts. A few other tips – obviously make sure you do your research.

Triple Tax Saving – try to make sure personal (non-employer) contributions flow through payroll. Otherwise, we may miss out on the FICA tax shelter (Medicare and Social Security). That way, it works kind of like health insurance premiums through a cafeteria plan.

Family plan contribution limit: Once you are married and add a spouse you become eligible for the “family” contribution limit. So if your spouse doesn’t have access to an HSA through their employer, it may make sense to move them to yours even if it is a small hit on premiums. If you wait a few years to have kids have you are married, you can supercharge your account with the higher contribution limit with relatively low risk compared to having a full family. Do the math on this though.

This may go into the “gray” area but I have heard of people using these accounts for preventive over the counter things such as “sunscreen”. It is certainly up for interpretation and I personally don’t bother but if I did I would get a prescription for it from my provider just to be safe. I could make the argument either way per the IRS regs, and not sure how an auditor would handle it.

Max

What happens to the HSA funds when the holder starts Medicare .Can it still be used?

Double-check the latest from the IRS website, but my understanding is you can still use your funds. You just cannot continue to contribute.

Just a nice post. Really enlightening. I am very pleased that these topics are being discussed. I too, in my small way, am trying to provide people with content that allows financial independence