For a long time, investing was viewed as complicated and intimidating. Thankfully, many recent innovations have made investing simpler and simpler over the years, whether it was the introduction of index funds, free stock trading, and most recently, micro investing platforms.

Micro investing apps and platforms make it easy for anyone to become an investor, no matter the amount of money. These platforms remove common barriers, including:

- Minimum investments and account balance requirements

- High stock prices

- Complicated and excessive fees

- Not knowing where to start

Below, we’ll answer the question, “what is micro investing?” in more detail and also walk through how you can start micro investing today.

What Is Micro Investing?

Micro investing is the act of saving and investing small sums of money. With most micro investing apps and platforms, you can get started with as little as $5!

This is made possible through buying fractional shares of stocks and ETFs.

For example, let’s say you want to invest in the stock of “Company A,” but the stock price is over $1,000. Fear not, through micro investing in fractional shares, you can invest in that company with just $5 by buying a part of a share.

It’s kind of like buying a slice of pizza instead of the whole pie.

Micro investing definition: Regularly investing small amounts of money (sometimes just a couple of dollars).

Some micro investing apps take it a step further and automate the saving and investing process for you.

For example, Acorns is one popular micro investing platform that utilizes a round-up feature. Every time you make a purchase, Acorns will round up the expense to the nearest dollar, and the difference will be saved and invested.

If you spend $29.40 at the grocery store, $0.60 is automatically deposited into your Acorns account. Then, if you go and spend $2.24 on a coffee, $0.76 will be automatically deposited into your account.

You get the idea.

Once your account reaches $5, Acorns automatically invests the balance based on one of its pre-set investment portfolios.

With an automatic investment plan like what Acorns offers, this type of micro investing is a “set it and forget” strategy for saving and investing small sums of money.

Pros and Cons of Micro Investing

While it sounds great on paper, micro investing does have some downsides that counteract the positives.

Below are the major pros and cons of this investing strategy to be aware of:

Micro Investing Pros

Nudges You to Get Started: Some people need a little help to start investing or invest in the stock market regularly, and the most significant benefit to micro investing is that it nudges you to get started and keep going. However, you won’t save a ton of money with this strategy, and it shouldn’t be your only investment plan.

Low Minimum Balances: Of course, a massive perk to micro investing is that there are no large (sometimes thousands of dollars) minimum balances, making it easier for new investors to start investing.

Realize Compound Returns Sooner: One common question people ask when considering micro investing is, “why not just wait until I have $100, or $1,000, or $3,000 to start investing?” The answer is that you are missing out on compound returns every day that you wait and keep that money in your piggy bank (or in a regular bank account).

It’s Automatic: With most micro investing platforms, you can “set it and forget it,” and the platform will automatically and regularly save small sums of money and invest it for you too.

The Investment Selections are Solid: Most micro investing platforms have reliable investment options. You won’t find overpriced mutual funds, typically just low cost and broad exchange-traded funds (ETFs).

Micro Investing Cons

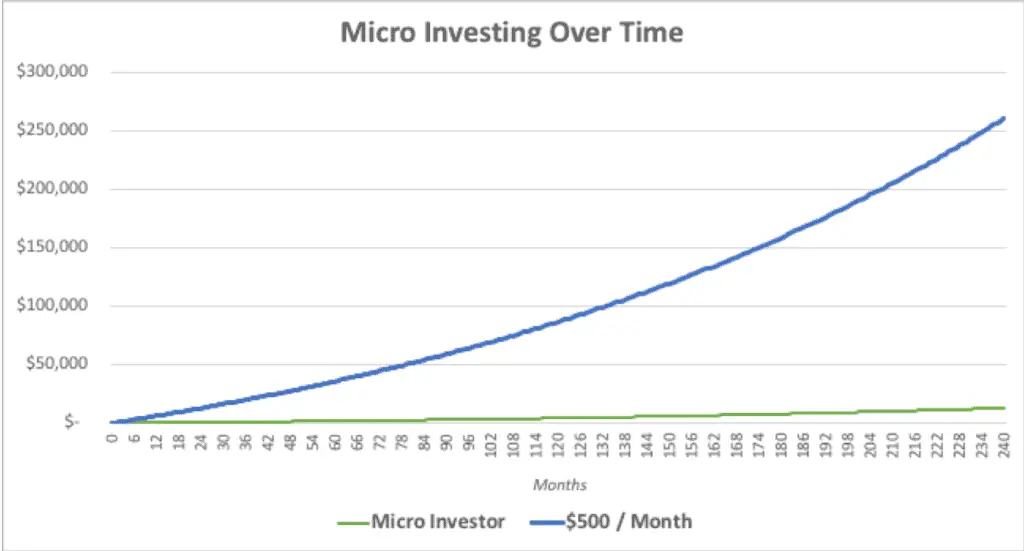

Small Results: The biggest con to micro investing is that your results will be… micro. You won’t make enough money to retire simply by rounding up your purchases or saving small sums of money. For reference, see the basic example below of someone who invests $500 a month on their own and someone who rounds up 50 purchases per month (with an average of $0.50 saved per purchase, which comes out to $25 per month).

With a +7% return on average, after 240 months (20 years), the micro investor ended up with over $247,000 less than the person investing just $500 per month!

Here are the final results:

- Micro Investor: $13,023 (green line in the graph above)

- $500 / Month: $260,463 (blue line in the graph above)

Micro investing cannot be your only investment and retirement plan; it won’t be enough.

Lack of Flexibility: The other con with micro investing, which is a con associated with most automatic or robo-investing, is that you lose some flexibility regarding your investment options. You won’t have all the options you typically get with a full-service brokerage account.

How to Get Started: Best Micro Investing Apps

From what I can gather, the two most popular true micro investing apps are Acorns and Stash.

I say “true” because some of the apps listed below start to expand beyond just micro investing, but they still let you invest small amounts of money. By that definition, they are micro investing platforms, just with some added bells and whistles.

1. Acorns

- Minimum Investment: $0

- Types of Investments: ETFs

As mentioned, Acorns is a popular micro investing app. It’s also one of the original ones.

We already walk through how the “Acorns Invest” service works above, where you connect a credit card or debit card and let Acorns invest your spare change in a predetermined investment portfolio based on your risk tolerance. Though that’s not all Acorns can do, it offers a variety of services, including:

- Acorns Later: Invest in retirement accounts like a Roth or Traditional Individual Retirement Account (IRA). You can also set up reoccurring contributions to grow your retirement savings.

- Acorns Spend: An Acorns debit card.

- Acorns Early: Investment account options for your children. This is also a great platform to help your kids learn about the value of investing.

- Acorns Earn: A type of cash back program that Acorns calls “found money.” Through Acorns Earn, you earn discounts when spending money with Acorns Found Money Partners, and that extra money automatically goes into your Invest account.

Acorns also offers a few different pricing tiers:

- Lite: $1 per month; provides access to the Acorns Invest product and the round-up feature.

- Personal: $3 per month; provides access to Acorns Invest, as well as Acorns Later and Acorns Spend.

- Family: $5 per month; provides access to Acorns Invest, Acorns Later, Acorns Spend, as well as Acorns Early.

Get Started with Acorns:

2. Stash

- Minimum Investment: $0

- Types of Investments: Stocks and ETFs

Stash is a finance app similar to Acorns. Though, instead of the round-up feature, you can add money to the Stash app either automatically or manually.

Getting started with Stash is easy and requires only four steps:

- Answer a few questions regarding your financial goals and risk tolerance

- Pick a plan starting at just $1 per month (more details further below)

- Add Money to Stash either automatically or manually

- Create goals and budget your money

- Invest in fractional shares of stocks or ETFs

Similar to Acorns, Stash also offers three different plans at varying price points:

- Stash Beginner: $1 per month; provides access to an investment account, bank account, and core Stash offerings

- Stash Growth: $3 per month; also provides access to individual retirement accounts (IRAs)

- Stash+: $9 per month; also provides access to investing with kids and expanded insurance

One unique feature of Stash is its stock-back card. Instead of offering cash back, you are rewarded with 0.125% stock on your everyday purchases and up to 5% at specific merchants with bonuses.

Get Started with Stash:

3. Robinhood

- Minimum Investment: $0

- Types of Investments: Stocks, ETFs, Options, Cryptos

Robinhood took the investing world by storm when it launched its platform offering commission-free trades on all stocks and ETFs. Gone are the days when you have to pay $5 to $10 per trade. Even Charles Schwab is following suit with no trading fees on stock and ETF buys!

While Robinhood does not offer auto investing features like Stash and Acorns, you can purchase fractional shares for as low as $1 through Robinhood.

You can also treat Robinhood like a full-service brokerage account and buy full shares of stocks and ETFs, among other investment vehicles.

Get Started with Robinhood:

4. M1 Finance

- Minimum Investment: $100

- Types of Investments: Stocks and ETFs

M1 Finance is another app with low minimum investment requirements. You just need a $100 account balance and can continually invest with deposits as small as $10. I would still call that “micro.”

Again, similar to the option above, M1 Finance offers the ability to invest in fractional shares. That’s how they get their investment minimums so low.

The unique aspect of M1 Finance is that you invest in predetermined “pies” made up of ETFs and stocks. You can learn more about M1 Finance is our robo-advisor comparison here.

Get Started with M1 Finance:

5. Betterment

- Minimum Investment: $0

- Types of Investments: ETFs

Betterment is a leading robo-advisor with a $0 minimum account balance that offers automatic investing, rebalancing, and tax-loss harvesting.

As we mentioned earlier, we’re stretching the definition of micro investing here. Still, Betterment does allow you to get started with a small amount of money ($10 minimum deposit ongoing, similar to M1 Finance), so I think it fits the definition.

Plus, Betterment makes it very easy to start investing, which is the primary goal of micro investing platforms in the first place. You simply answer a set of questions regarding your goals and risk tolerance (sound familiar?), select a plan and primary goal, and sit back and let Betterment do the rest for you.

It’s also worth noting that Betterment has a whole suite of personal finance offerings now, including a high yield savings account, checking account, debit card, and retirement accounts (like a Roth IRA). You can check out our full review of Betterment here if you are interested in learning more.

Get Started with Betterment:

Summary: Micro Investing Beginner’s Guide

Using a micro-investing app or micro-investing platform is an excellent way for someone to start investing, but it cannot replace a full-blown investment and retirement plan.

If you are looking to start your investing journey and want a way to consistently invest without manually doing it yourself every week or every month, micro investing and robo-advisor platforms could work well for you.

However, after a few years (or even after a few months), you should consider supplementing your micro investing with a more robust investment plan.

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.

Nice article, thanks for sharing.

I agree – the biggest risk of micro-investing is the risk of thinking you’ve actually done something. Micro-investing leads to micro-wealth, and personally, I think it is a distraction.

Also, I know ETFs are available, but most people use micro-investing to get into individual stocks. I cannot imagine a group for whom individual stocks are more inappropriate than investors with a portfolio of a few dollars or a couple hundred bucks.

Agreed. On its own, it’s simply not enough. But as a gateway to getting started or to supplement other investing, I think it can be useful.