Everyone seems to love the gossip surrounding the net worth of celebrities, business people, and athletes. Though, there is a difference between regular net worth and the lesser-known liquid net worth, which is what we’ll get into today.

Jeff Bezos is worth about $116 billion right now in terms of net worth, but does that mean he could go out and purchase 116 billion dollars worth of mansions, yachts, jets, and whatever else rich people buy?

No.

While his net worth is $116 billion, his liquid net worth is a much smaller number.

Calculating liquid net worth is complicated for Jeff because of the huge amount of Amazon stock in his portfolio. This stock gives him a high net worth, but since it is challenging to sell such a large chunk of stock at one time, his liquid net worth suffers (poor Jeff…).

For the rest of us non-billionaires, it’s a little more straightforward, and a very important personal finance metric to understand.

What is Net Worth and Liquid Net Worth?

Net Worth Definition

Net worth is your total assets minus your total liabilities. It’s essential to understand this definition before you can understand it’s liquid counterpart.

Diving a little deeper on net worth:

- Assets are anything valuable that you own, like money, stocks, cars, and real estate

- Liabilities are anything you owe, like credit card bills, student loan debt, car loans, and mortgages

Subtracting the value of everything you owe from the value of everything you own will equal your total net worth.

You can get the Just Start Investing Net Worth Calculator by entering your email below. You’ll receive an Excel template that will help you easily and quickly calculate your net worth:

Liquid Net Worth Definition

Liquid net worth, simply stated, is the amount of net worth you could convert to cash today if needed.

In calculation form, it would be:

Liquid net worth = liquid assets – liabilities

The difference in calculating net worth and liquid net worth is understanding which of your financial assets are liquid assets.

How to Calculate Liquid Net Worth

The key to calculating your total liquid net worth is being able to identify liquid assets.

Liquid Assets

Liquid assets are cash and assets that could be converted to cash quickly. Some major liquid assets include:

- Cash

- Stocks

- Bonds

Essentially, anything that could be converted to cash quickly while maintaining its full value (net of taxes) is a liquid asset.

Here is a quick explanation of three major liquid assets:

Cash

Cash can take many forms. The first and most obvious is the cold hard cash in your wallet, purse, or pocket (hopefully not under your mattress).

In addition, cash can also be stored in a variety of places and accounts, including:

- Checking accounts

- Savings accounts

- High yield savings accounts

- Money market accounts

With any of the above bank accounts, you could walk in and withdraw your money the same day.

Equity in a Brokerage Account

Stocks, index funds, mutual funds, ETFs, and other forms of equity sitting within a brokerage account are also considered liquid assets.

You have to pay taxes on capital gains if you sell equity to convert it to cash, causing it to decline slightly from its market value. However, you can liquidate these assets very quickly whenever the stock market is open.

Bonds in a Brokerage Account

Similar to the equity example above, any bonds, bond funds, and other types of fixed income sitting in brokerage investment accounts are also liquid assets. You will have to pay capital gains taxes on your profits when you go to sell, but the transaction is quick.

Non-Liquid Assets

Non-liquid assets include anything that cannot be converted to cash quickly and/or for their full value.

For example, a 401(k) and other retirement accounts could be converted to cash pretty quickly, but they would lose some cash value due to the fees associated with withdrawing early.

On the other end, the value of a house is relatively well known, but it could take months to sell, making it not very liquid.

You have two options when valuing non-liquid assets. You can either apply a $0 value to them or calculate their “liquid value” by applying a discount percentage to them. Personally, I like the discount method.

A $200,000 home is not necessarily worth $0 in it’s “liquid form.” Applying a discount to non-liquid assets is one way you can estimate their true liquid value, and is usually more realistic than just assigning them a $0 value.

Within the list of major non-liquid assets below I’ll include an estimated discount value:

Real Estate

Most forms of real estate are non-liquid assets because of a few reasons:

- Selling real estate takes time, it is not an instant transaction

- You usually have to pay transaction costs in the form of a real estate agent fee and closing costs

- The value of real estate is typically well known, but there is always the chance you will be negotiated down from your expected selling price

Real Estate Discount Percentage: 25%

Cars

Cars are non-liquid assets because of their inability to hold value.

You can sell them pretty quickly, but you need to discount their value to get an accurate figure for their worth.

Car / Vehicle Discount Percentage: 15%

401(k) Assets

Assets within your 401(k) can be sold and liquidated just as quickly as stocks and bonds, however, you will have to pay a 10% early withdrawal penalty if you withdraw funds before retirement age.

This penalty is on top of any taxes you will also owe.

401(k) Discount Percentage: 25%

IRA and Other Retirement Account Assets

Similar to a 401(k), retirement savings within an IRA (Roth or Traditional IRA) can be converted to cash instantly if the market is open, but you will face a withdrawal penalty if you take out funds before retirement age.

The one exception is with a Roth IRA, in which you can withdraw your contributions at any time free of penalty. Your contributions in a Roth IRA are actually liquid assets and can be excluded from the discount percentage below.

IRA Discount Percentage: 25%

Liquid Net Worth Example

As mentioned, to calculate liquid net worth, you subtract your liabilities from your liquid assets.

The wrinkle that we ran through is that you have two options when it comes to your non-liquid assets, you can either:

- Exclude them from the calculation

- Include them with a discount percentage

Personally, I would include them with a discount percentage. You can come up with your own, or use the ones I provided above.

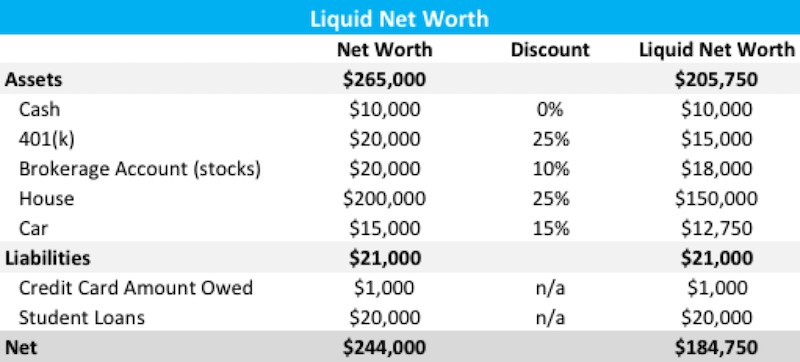

Below is an example of how to calculate your liquid net worth, including how it compares to a full net worth number:

Breaking down the Liquid Net Worth table:

- Cash: The $10,000 on hand in a savings account (or anywhere else) is worth the same as liquid net worth

- 401(k): A 25% discount was applied to the 401(k) value, bringing its total down to $15,000

- Brokerage Account: A brokerage account is a liquid asset, but you have to pay taxes (15% capital gains tax rate) on any gains, which is why I applied a 10% discount here

- House: There are a few reasons a house is not a liquid asset, and I applied a 25% discount rate accordingly

- Car: The car value came down to $12,750 after a 15% discount rate

- Liabilities: Liability values and debts (like student loans and credit card balances) do not change from a net worth calculation to a liquid net worth calculation

The total net worth in this example is almost a quarter of a million dollars, but liquid net worth discounts to only $184,750.

Why Does Liquid Net Worth Matter?

Liquid net worth is a true measure of how financially stable you are today. It is important to understand both versions of net worth if you are chasing financial freedom and if you want to be prepared for an emergency.

If you are chasing financial freedom, your liquid net worth is what you will rely on to cover expenses. Owning a house is great and a healthy 401(k) helps once you hit retirement age, but if you’re looking to retire at 40, you need to fund your lifestyle somehow.

In addition, your liquid net worth acts as an overall emergency fund. If you lost your job or were faced with overwhelming expenses, your liquid net worth is what would help cover you.

How to Increase Your Liquid Net Worth

If you’re on a mission to increase your liquid net worth, you have a few options. Below are four tactics that I think are the most effective:

1. Lower Expenses

Lowering your expenses is easier said than done, as with most of the tactics on this list. However, expenses tie directly to liabilities, and lowering your liabilities will, in turn, increase your net worth.

One place to start is to keep ongoing credit card debt low, but ideally at $0. The high interest rate on any unpaid debt and can cause liabilities to spiral.

Creating a budget is another strategy that can help. A budget will provide clarity on where you are spending, and help you identify opportunities to save.

2. Increase Your Investments

Investing more is also a great way to increase your assets over the long run.

On average, investments increase every year. This is not a guarantee, but in the long run, they will help grow your personal value faster than holding cash and cash equivalents, which actually loses true value thanks to inflation.

3. Increase Your Income

There are a few ways you can increase your income, but the two most common would be:

I prefer attempting to increase income over cutting costs. There is no limit to how much you can increase your income. With expenses, there is only so much you can cut before you end up spending $0.

4. Minimize Your Non-Liquid Assets

Last, this is a controversial tactic and not something I would recommend, but it is a way to increase liquid net worth today.

It also goes in direct contradiction to point #2, but here it is:

Technically, putting more money into cash and less money into your 401(k), real estate, IRAs, and other less liquid assets will make your liquid net worth increase right now. However, the tradeoff is that over the long run, your assets will grow at a slower rate and you risk being in a much worse spot down the line.

Final Thoughts on Liquid Net Worth

Your liquid net worth is your true measure of financial health.

It displays how prepared you are to handle an emergency, and informs how close you are to reaching financial freedom.

Having a handle on this figure can go a long way in ensuring financial security now and in the future.

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.

My ratio of liquid to illiquid net worth is high because I live in a modest house. And my cars are inexpensive older ones. I think its an interesting idea but my less liquid real estate investing friends probably make better returns than I do.

Yea that seems to be a natural tradeoff that goes in line with the old saying, “takes money to make money.” Oftentimes you have to tie up funds in investments in order to generate a return. Though, I often just go with index funds, which are still very liquid investments.