Forbes calculates the personal net worth of the richest businesspeople, celebrities, and athletes for us to clamor over, but few of us actually know how to calculate our own net worth.

That’s a problem for anyone trying to get a grip on their personal finances.

Net worth is arguably the most important financial metric for you to measure every month (or quarter). It’s your financial pulse – it gives a glimpse into how healthy your financial situation is at any given time (and over time).

We’ll dive into the basics of net worth in this article, but if you’re already a net worth expert and want to start tracking it on your own now, you can get a free net worth tracking tool here:

Defining Net Worth

What exactly is net worth? What does it mean?

Simply stated, it’s your assets minus your liabilities. In 4th-grade math equation form, it is:

Net Worth = Assets – Liabilities

An asset is anything valuable that you own. And yes, it must be valuable. Assets include things like funds in investment accounts, retirement savings, money in bank accounts, houses (home equity), cars, household furnishings, and even collections. It’s not old socks, scratched DVDs, or other damaged personal property (those, obviously, don’t have any value).

A liability is anything you owe. This includes all of your debt, including things like mortgages, credit card debt, and car loans.

So, calculating your net worth involves just taking the total value of anything you own, and subtracting out anything you owe from that number.

Why is Net Worth Important?

Net worth is important at a high level just like your GPA was (or is) important in college or high school.

Net worth is the measure of how well you’re doing, financially. Like a GPA, you don’t really need it any given day, and you could probably go months or years without needing to know what it is. But one day, you’ll care very much about what your number is.

For your GPA, it was likely when you were applying for jobs.

For your net worth, it will likely be when a big financial decision needs to be made. Like deciding if you can you pay for your kid’s college, or if you have enough money to finally retire.

If you track your net worth on a regular basis, you will always know where you stand. And, most importantly, be able to influence where you will stand in the future.

It’s much better to know where you stand now compared to waking up 5, 10 or 20 years down the line to be surprised about where you stand and not be able to do anything about it.

*stepping off soapbox*

Look, personal finance is important to me, and I just want everybody to be set up for financial success. So I’ll walk you through exactly how to track your overall financial progress below so you can make sure you’re on the right track.

Just remember, there is not a “good” net worth figure to shoot for, as it’s different for everyone. It depends on your situation and what your goals are. Some examples further below will help illustrate this point. But first…

How to Calculate Net Worth

Calculating your net worth is actually extremely easy. However, gathering all of the data in order to calculate your net worth may take a little bit of time.

In general, you calculate your net worth in 3 steps:

- Add up all of your assets

- Add up all of your liabilities

- Subtract your liabilities from your assets

We’ll walk through the steps in more detail below.

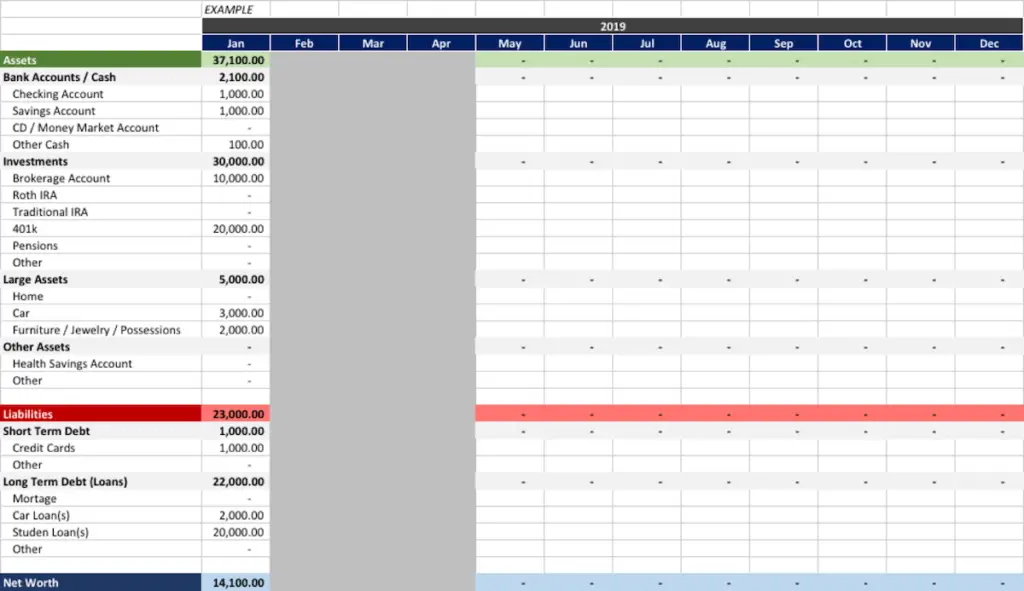

1. Add Up All of Your Assets

The first step in calculating your net worth is to take account of and add up all your assets. This includes items like:

Bank Accounts / Cash:

- Checking Account(s)

- Savings Account(s)

- CD / Money Market Account(s)

- Other Cash

Investment Accounts:

- Brokerage Account(s)

- Roth IRA

- Traditional IRA

- 401k

- Pension

- Other Investment Accounts

Within these accounts, you would hold assets such as stocks, mutual funds, index funds, ETFs, Bonds, etc.

Large Assets:

- Home(s) / Real Estate

- Car(s)

- Furniture / Jewelry / Possessions

Other Assets:

- Health Savings Account

- Other Assets

2. Add Up All of Your Liabilities

The second step in calculating your net worth is to take account of and add up all your liabilities. This includes items like:

Short Term Debt:

- Credit Card Balances

- Other Short Term Debt

Long Term Debt (Loans):

- Mortgage(s)

- Car and Auto Loan(s)

- Student Loan(s)

- Other Long Term Debt

3. Subtract Your Liabilities From Your Assets

Once all of your assets and liabilities have been tallied and added together you can take the final step in calculating your net worth.

This step is easy, just subtract your total liabilities from your total assets and you’ll arrive at your net worth.

As a reminder: Net Worth = Assets – Liabilities

Two Quick and Easy Net Worth Examples

Let’s look at two quick examples to help bring this whole net worth thing to life.

In the first example we’ll calculate the net worth of a recent grad who understandably has a negative net worth (yes, that is possible).

Then, we’ll examine the net worth of a 35-year old budding entrepreneur with business interests who has responsibly built wealth over a 14-year career so far.

The Recent Grad

1. Add Up All of Your Assets

- Checking Account: $2,000

- Savings Account: $5,000

- Roth IRA: $5,000

- Car: $2,000

- Furniture: $1,000

Total Assets = $15,000

2. Add Up All of Your Liabilities

- Credit Card Debt: $1,000

- Car Loan: $2,000

- Studen Loan: $50,000

Total Liabilities = $53,000

3. Subtract Your Liabilities From Your Assets

Net Worth = $15,000 – $53,000 = –$38,000

The Budding Businessperson

1. Add Up All of Your Assets

- Checking Account: $5,000

- Savings Account: $15,000

- Brokerage Account: $50,000

- Roth IRA: $50,000

- 401k: $50,000

- Car: $5,000

- Furniture/Possessions: $3,000

- Health Savings Account: $2,000

Total Assets = $178,000

2. Add Up All of Your Liabilities

- Credit Card Debt: $3,000

- Car Loan: $3,000

- Personal Loan: $1,000

Total Liabilities = $7,000

3. Subtract Your Liabilities From Your Assets

Net Worth = $178,000 – $7,000 = $171,000

Free Net Worth Tool

With the examples out of the way, now its time for you to calculate your net worth to see where you stand.

You can get an easy to use excel tool that can help you with calculating and tracking your net worth below.

Here is a preview of what the tool looks like:

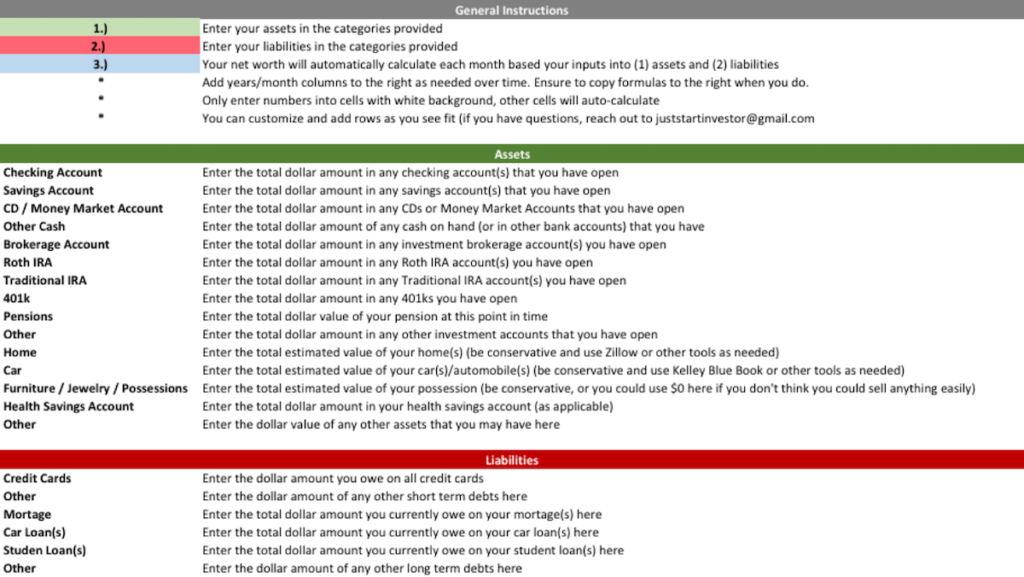

And here is a preview of the directions:

Why use an excel tool?

Great question.

The answer is: because it’s dynamic (it can easily be changed, updated and visited).

Other net worth calculators give you a one-time snapshot in time. You do all the work to enter the details, get your net worth, refresh the web page and then it’s gone forever.

Using a detailed excel spreadsheet allows you to continue to monitor your net worth growth (or decline) over time, especially as the current market value of your investment change.

Tracking your net worth is important to help you understand what you can afford when it comes to major life decisions. And, most importantly, when you can retire.

And last (but also probably least… least important that is) is a list of fun net worth facts. Test your friends, family, or whoever and see if they can guess the net worth of the following folks (thanks to Forbes for most of this data):

- Jeff Bezos and Family – $160 Billion (aka, the richest man in America)

- Warren Buffett – $88.3 Billion

- Elon Musk – $19.6 Billion

- Charles Schwab – $9.3 Billion

- Oprah Winfrey – $2.8 Billion

- Michael Jordan – $1.7 Billion

- Guy Fieri – Find out Guy Fieri’s Net Worth

- Peyton Manning – Find out Peyton Manning’s Net Worth

- Jimmy Fallon – Find out Jimmy Fallon’s Net Worth

- Jennifer Garner – Find out Jennifer Garner’s Net Worth

- John Krasinski – Find out John Krasinski’s Net Worth

- John Legend – Find out John Legend’s Net Worth

- The Median Net Worth in America – $97,300 (just south of $100k)

Yes, Bezos is 1,644,398 times richer than the median American household.

And, apparently, once you get to 12-figure net worth, you no longer need to include a decimal place. Kudos Bezos.

Where do you stack up? Find out and calculate your net worth with this tool:

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.

I find the hardest part of determining net worth is figuring out the value of assets that don’t have an easy, simple value attached to them in the way a bank account attached to them.

It’s easy to know your bank account is worth $200 if you have two hundred dollars in it, but how do you know the value of your house? Appraisals are largely guesswork. Educated guesswork, but guesswork nonetheless.

I tend not to include them, as I’m mostly interested in my change in net worth (is it going up or down) rather than it’s current value. If house value and car value, or such physical assets value, don’t change much, then not including them tells me pretty much the same information as including them.

Some great points. As far as assets that are hard to measure.. I agree sometimes leaving them off is the best move. For things like clothing, furniture, etc… I do not include those in my assets.

However, in my opinion, leaving off something like a house will drastically underestimate your assets. Rather than mess with fluctuations, I would just take your purchase price, and then every couple years do your best to estimate current value with sites like Zillow. No need to do it often though.