Geoarbitrage is a fancy word with a simple meaning. In a nutshell, it involves moving in order to lower your cost of living.

The term was made popular by Tim Ferriss, the guy behind The Four Hour Work Week and the creator of the well-known podcast called The Tim Ferriss Show. He discussed geoarbitrage in his book The Four Hour Work Week as one of the many strategies to help you optimize your life.

Geoarbitrage can help you save money, grow your net worth, reach FIRE (financial independence retire early) faster, and potentially increase your overall happiness.

What is Geoarbitrage?

The word geoarbitrage can be broken down into two parts, “geo” and “arbitrage.”

Geo is referencing geography.

Arbitrage involves taking advantage of a price difference between two or more markets.

Simple enough.

Put them together and you get geoarbitrage, the process of taking advantage of the different prices for different markets or cities.

More specifically, it’s defined as moving to a lower cost of living area while maintaining the same or higher income.

Maintaining your income is as important as lowering costs. You likely wouldn’t be “taking advantage” of a lower cost of living area if your income was reduced by the same percentage as well. With geoarbitrage, the goal is to maintain your level of income (including retirement income) as best you can, while simultaneously lowering costs.

Geoarbitrage Factors to Consider

As alluded to above, when looking to execute a geoarbitrage strategy, there are two important personal finance metrics you need to keep in mind:

- Income

- Cost of living

Income is an important factor to consider before making a move. You should have a strong understanding of how you make money and ask yourself:

- Are you switching jobs?

- Do you work remotely?

- Will you be starting a new business?

- Can you live off passive income?

- Do you have multiple income streams?

- Will your earning power change at all?

For geoarbitrage to be truly successful, you should maintain or even increase your income while moving. At a minimum, you need to have an understanding of if it will change and plan accordingly. Especially if you are expecting your earnings to go down.

Cost of living can be broken down into many different pieces, including the following:

Taxes

No one likes taxes.

No likes to pay them, file them, or even talk about them.

And for good reason. For some people, taxes can be their largest expense!

They do provide some obvious benefits, such as roads, schools, and many other services we take for granted.

That doesn’t mean you shouldn’t try to minimize them, though, just like any other expense.

One easy way to way to lower your taxes, and your cost of living, is to move somewhere with no state income tax. As of Jan 2021, there are nine such states:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

- Tennessee

- New Hampshire

Just don’t blow all your tax savings gambling in Vegas…

While those are the states with no income taxes, they aren’t the only ones to consider. The remaining states live on a spectrum, and moving to a state with lower income taxes than where you live now will result in you saving money on taxes.

If you get a little lost in the tax optimization process, this income tax calculator by smartasset should keep you straight.

Housing

It’s no surprise that real estate, property taxes, and overall housing costs can vary wildly by state, city, and neighborhood.

If you want to live in the heart of San Francisco, a modest apartment could cost upwards of $1.4 million! According to Zillow, that is the median home price in this expensive city.

Compare that to Cleveland, where the median home price is only $66,000.

Of course, we’re talking average prices here. You could find a home in San Fran for under $1 million, and you could find one in Cleveland for over $1 million.

However, when comparing similar houses and apartments, there are certain locations that are more cost-friendly than others.

Transportation

Transportation is less of a question of cost and more of a question of access.

Will you be walking distance from everything you ever need? Walking is the least expensive option, but it’s also the least viable unless you’re in the heart of a big city.

So if walking is not an option, could you get away with biking everywhere?

If not biking, could you use public transportation?

Let’s say there is no public transportation, will you need a car?

Do you have a spouse or a family? Will you need two cars?

As you work your way down this list of questions, things naturally get more expensive. The largest jump in cost is between public transportation and cars, as cars come with many secondary expenses such as:

- Insurance

- Gas

- Repairs

- Parking

If you want to save on transportation, limiting the need for a car is your best bet.

Everyday Goods

Things like food, restaurants, entertainment, clothes, and other everyday goods and services vary in cost depending on where you are.

Granted, you will always have a choice when it comes to these items, for example:

- Grabbing a bite to eat at the gourmet or cheap burger place

- Buying the cage-free, organic eggs vs the store brand eggs

- Going out to the movies or staying home and streaming an old one

The difference is that on average, that cheap burger will have a different price depending on where you live.

School

Do you have school-aged children or are you planning on going back to school yourself?

If the answer is yes to either of the questions above, then school and education should play a role in where you choose to live.

Even if you are sending your kids to public schools, you will want to ensure the district you live in is up to your standards and expectations.

If college is on the horizon, certain states (like Indiana) offer much better in-state tuition at public universities compared to other states (like Illinois).

Lifestyle

Last, but certainly not least, you should take into account your lifestyle.

At the end of the day, not everything is about minimizing costs.

Should someone who loves surfing and the ocean move to Nevada for the tax savings? Probably not.

Should someone who loves the mountains and hiking move to Cleveland? I’d guess no (unless Cleveland has great hiking that I don’t know about…).

You should take into account your quality of daily life and where you want to be when making your decision. Along with all of the cost of living info above.

Now that you know what to look for, it’s time for the fun part! You need to estimate some costs.

For any non-math lovers our there, here are a couple of geoarbitrage calculators that make estimating costs super easy:

- Bankrate Cost of Living Comparison Calculator

- Nerdwallet Cost of Living Calculator

- Nomad List FIRE Calculator

Types of Geoarbitrage

There is no one-size-fits-all geoarbitrage strategy, it can be big or small.

Take two people living in Chicago as an example. Both of them are looking to reduce annual expenses and are currently living in the popular and expensive River North neighborhood.

Person A might choose to move to Andersonville, a neighborhood farther north and away from the skyscrapers found downtown. Naturally, this area is also cheaper, and they save $200 a month on rent while maintaining the same job and largely the same lifestyle. That’s geoarbitrage.

Person B might choose to move to Costa Rica. They had a work remote job and cut their living expenses in half by moving to another country with a much lower cost of living. This is also geoarbitrage.

Domestic

Implementing a domestic geoarbitrage strategy will likely be easier than an international approach, especially if you are in the United States, because your options are almost endless. It includes moving neighborhoods, cities, and states to save money.

Domestic Geoarbitrage Highlights:

- Within the country

- Good savings potential

- Easier to execute

International

Moving internationally has more of an adventurous ring to it, as well as a higher potential for savings. Though, it will also take more work to execute.

International Geoarbitrage Highlights:

- Great savings potential

- More adventurous

- High probability for stress and complications

Steps to Execute a Geoarbitrage Strategy

There are typically two types of people seeking out geoarbitrage:

- People looking to save for early retirement or achieve financial independence

- People who are retired and want to make their savings last longer

While those are the two most common motivators, there are a ton of other reasons that you might be seeking out geoarbitrage. Some folks are just trying to get out of debt, and others are just generally frugal people.

No matter what your case is, these are the steps you should take before pulling the trigger on a move.

1. Choose Your Locations

First things first, choose a couple of locations that interest you. There are a couple of ways you could go about this:

Start with locations that interest you and then filter to the lowest-cost options. For example, if you love to surf (yes, another surfing example), then start with coastal cities and filter for the most affordable ones.

Alternatively, you could start with some low-cost options and then look further into the ones that interest you. You will have to sift through a few that are an obvious “no” with this approach, but it’s a good way to brainstorm a lot of ideas of places where you will naturally spend less money.

2. Do the Math

Once you have a few locations in mind, it’s time to do the math.

Find out exactly how much you could save by moving to one of the new areas. The cost of living calculators I mentioned above should help with this step.

3. Visit!

Once you have a top choice or two, I’d recommend visiting.

There is no better way to ensure you’re making a smart move. Plus, things on paper do not always translate to reality as you might think, so it’s best to spend a few hundred bucks to make a trip before investing even more time and money into moving.

4. Move and Enjoy

Last, enjoy the process!

Whether your financial goals include becoming financially independent, paying off debt faster, or extending your retirement longer, geoarbitrage is usually a tactic that leads to a happier lifestyle overall.

How Geoarbitrage Can Supercharge Your Investments

For those of you seeking financial independence, geoarbitrage is just the first step. The second step is to invest your savings and supercharge your investments.

This is assuming that you already have an emergency fund and student loan debt, credit card debt, and other types of high-interest debt paid off. If not, you should probably tackle that before investing.

If you’re ready to start investing, let’s go back to the Chicago example of Person A who moved neighborhoods to save $200 a month in their budget.

It would be worth $72,000 after 30 years if they only put that money into a savings account. That assumes any interest gains from the account are offset by inflation.

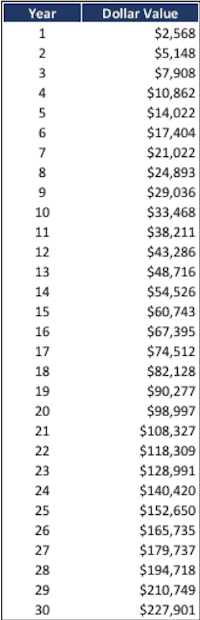

However, if that money was invested in index funds, it’d look something like this:

With a 7% annual real return, you’d have almost $230,000 after 30 years! That’s a lot of extra retirement savings thanks to compounding growth.

If you invested that money in a retirement account like a Roth IRA, you’d get to keep all of it and avoid those pesky taxes too.

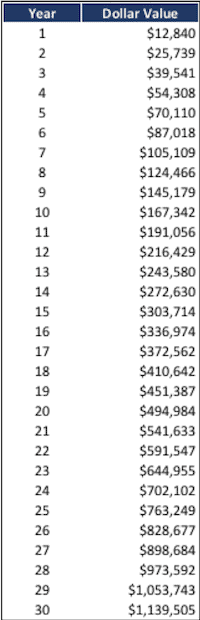

Now, let’s look at Person B, who saved $1,000 in monthly expenses by moving to Costa Rica:

Through investing these geoarbitrage savings, they’d be left with a nest egg of over $1 million after 30 years!

Not bad.

Geoarbitrage is Not For Everyone

Geoarbitrage can be a great strategy for those seeking financial freedom and for retirees looking to extend their retirement. Though, it’s not for everyone.

If you love where you live and it’s a high cost of living area, of course, you can stay there. Like everyone, you should have a sound budgeting, investing, and overall financial plan, but you certainly don’t have to move!

It’s simply an option to explore.

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.