One of the best ways to improve your personal finances is to increase your income. Today we’ll be reviewing the three types of income, including examples of what they are and their pros and cons:

- Earned Income

- Capital Gains Income

- Passive Income

Your income can be diversified, just like an investment portfolio.

The more income sources you have, the less impacted you will be if one of those income streams dries up. Similar to how when one part of your investment portfolio is struggling, other assets can pick up the slack.

Increasing your income is also a great way to improve your budget. Unlike cutting expenses, increasing your income has no limit. In theory, you can keep growing it and growing it with no end.

With that, let’s dive further into the three main types of income, starting with the most popular type of income – earned income.

1. Earned Income

Earned income is also known as active income and involves trading your time for money. This is the type of income you get for working at your job, whether it’s part-time, full-time, paid by the hour, or salaried.

The paycheck you receive on a weekly, bi-weekly, or monthly basis counts as earned income. In the language of the Internal Revenue Service (IRS), any earnings found on a Form W-2 would count here.

Earned Income Definition: Money you receive for working at a company or completing a job or task.

Earned income is the most common type of income, but it has some major limitations. For one, it’s usually taxed the heaviest, meaning you keep less of what you earn.

Second, it typically involves trading your time for money. Yes, you can get raises and earn more money per hour (or year), but generally, there is limited upside to what you can earn with this specific income type.

Earned Income Examples

Below are some common examples of earned income:

- Working a Full-Time Job: Whether hourly or salaried.

- Working a Part-Time Job: Whether hourly or salaried.

- Working as a Contractor, Consultant, or Freelancer: Working in an hourly or fee-based manner for another company or client.

- Working Odd Jobs: This includes things like mowing lawns, giving sports lessons, and painting fences.

- Taking Surveys: Even taking online surveys through companies like Swagbucks and Survey Junkie counts as active income.

Earned Income Pros and Cons

Pros

It’s Easy: It is not always easy to earn an income from a job, but it is the most accessible form of income to earn out of the three main income types. It is also is the fastest to make, as you usually receive payment for your work within a couple of weeks.

Consistent Income: Barring any unexpected layoff, this form of income is also the most consistent and predictable. You can count on your paycheck showing up on time, and you know almost exactly how much money will be on there.

Cons

Requires Your Time: The biggest and most obvious drawback of active income is that it requires time and effort to be earned!

Limited Upside: While it is certainly possible to earn enough money to live on with your earned income (millions of people do it every day), you do have limited upside with this income type. Adding on another type of income is a good way to accelerate your income growth, which we’ll get into below.

Highest Tax Rates: Earned income is also the most taxed form of income, meaning you get to keep less of your hard-earned cash compared to other types of income.

2. Capital Gains Income

Also known as portfolio income or investment income, the most common form of capital gains income is money you receive for selling an investment.

For example, if you purchase a stock for $10 and sell it ten years later for $100, your capital gains income would be $90.

Capital Gains Income Definition: Profit you receive from selling an investment that went up in value.

Note, capital gains income only becomes real income when you sell an asset.

If you kept that $100 stock after ten years and did not sell it, the $90 increase in value would be an unrealized gain. Technically, your net worth has increased since the asset you own is more valuable, but that increase in value does not count as income, and you don’t pay taxes on it until you sell.

Capital Gains Income Examples

Below are some common examples of capital gains income:

- Realized Investment Gains: As mentioned above, the most common form of capital gains income is from selling an investment that went up in value.

- Dividend Income: Another type of capital gains income is dividend income. Dividends are regular payments that a company makes to its shareholders, and most of the time, these payments are treated as capital gains.

Capital Gains Income Pros and Cons

Pros

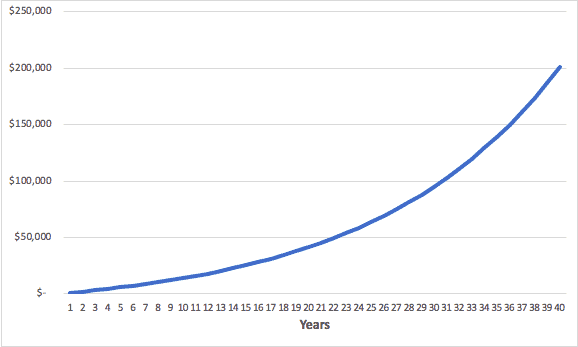

It Can Compound: The most significant benefit to capital gains income is its ability to compound. When you invest your money into appreciating assets, you are putting the money you already earned to work for you. For example, below is how your money would grow if you invested $1,000 per year into an asset that grew at +7% annually.

After 40 years, you would have over $200,000.

The line is curved upward because as your nest egg of investments grows larger, it gets easier to for that money to continue to grow. In this example, the time it took to earn the last $5,000 (~4 months) was much less than the first $5,000 (~4.5 years).

The Tax Consequences are Minimal: The current long-term capital gains tax rate for any asset held more than one year is between 0-20%, which is very low compared to the combined federal and state income tax rates that most Americans pay. However, keep in mind that if you hold an asset for less than a year, it will count as a short-term capital gain and be subject to ordinary income tax.

Cons

You Need Money to Get Started: Unlike earned income, you need money to start taking advantage of capital gains income. Luckily though, you don’t need much, and anyone can start investing with just a few hundred dollars.

3. Passive Income

Passive income is an elusive type of income that has become more prominent in the internet era. It involves making money with no effort on your end – hence the name “passive” income.

I will admit, the name is a little misleading. Usually, there is some effort required to set up and maintain a passive income stream. Though the whole idea of passive income is that you are not directly trading your time for money.

Passive Income Definition: Money you can receive without directly trading your time.

This form of income is also popular among those seeking financial independence or early retirement because of its potential to fund your lifestyle with minimal time commitment from you.

Passive Income Examples

There are countless ways to generate a passive income that anyone can pursue, but below are some of the most popular examples:

- Rental Properties: While it typically requires some work, rental income can be a great recurring stream of passive income. An even more passive real estate investment would be investing in a REIT (real estate investment trust).

- Interest Income: Money you earn from keeping your money in a bank account, like a high yield savings account or prize-linked savings account.

- Side Hustles: Many side hustles can turn into a form of passive income. For example, if your business sells a product, ebook, or course, there are ways to automate the sales process for those already-created products to earn income with minimal effort.

Don’t feel limited by this list! There may be a form of passive income out there that no one has thought of yet.

Passive Income Pros and Cons

Pros

It’s Passive: Of course, the biggest pro to passive income is the fact that it’s passive. Its biggest selling point is that you can earn money while you sleep!

Cons

Still Takes Time to Set Up: Most forms of passive income are not 100% passive all the time. They typically take a lot of time to set up and require some time to maintain.

Small at First: While passive income certainly has a lot of potentials to grow, it usually starts small. Meaning you will need to nurture your passive income or create multiple passive income streams before it has the potential to outgrow your earned income.

Income and Net Worth

Income has a direct correlation with net worth.

I like to classify net worth as your financial pulse – it tells you how close you are to retirement and how healthy your overall finances are at any point in time.

Typically, the higher your income, the higher your net worth. Or, better said, the higher your income, the higher potential you have for a higher net worth.

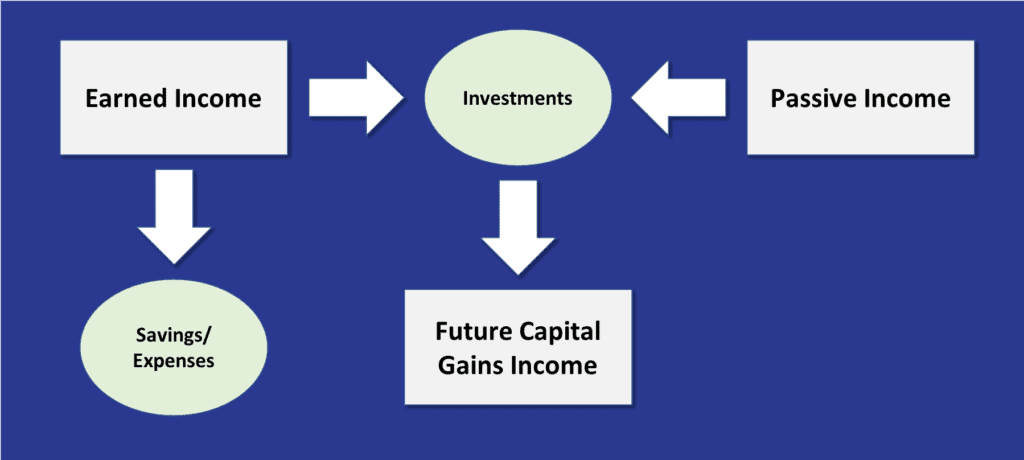

The key is to leverage and utilize the above types of income for their strengths. For example, starting with these three steps can go a long way to build your income and eventually your net worth:

- Start by focusing on your earned income. Make sure you have a consistent stream of income here that you can count on. If you can, work to get raises to increase this type of income over time as well.

- Put some of your earned income into investments that will eventually yield capital gain income. Of course, you should balance this with building an emergency fund and paying down debt, but it’s an important step to growing your income and net worth.

- Finally, work on building passive income streams with any free time you have. This is not a necessary step, but it can help your income grow if you get creative and find other ways to earn money. At the very least, make sure you are storing your emergency fund and savings in a high-yield savings account.

Putting it All Together: Gross Income

Your gross income is all the money that you earn in one year, including all of the types of income mentioned above. While it’s smart to diversify your types of income to mitigate the risk of one declining, ultimately, your gross income is the one number that matters.

From there, you pay taxes, and what is left is called net income.

For example, if you make $40,000 in gross income in one year and pay $10,000 in taxes, your net income is $30,000.

Net Income = Gross Income – Taxes

As we get into tax implications below, it’s also important to understand your adjusted gross income, or AGI.

Your AGI is what the IRS uses to determine how much money to tax (can be found on form 1040). Fortunately, there are items you can deduct from your income to make your taxable income, or AGI, lower. This includes things like 401(k) contributions and HSA contributions.

Going back to the same example above, if you earn $40,000 and make $4,000 in 401k contributions, then your AGI would be $36,000. Instead of being taxed on an income of $40,000, you’d only be taxed on your $36,000 AGI.

Tax Implications

Different types of income also have different tax consequences. Below is generally what can be expected, but be sure to check the IRS website or consult with a certified tax expert to answer any questions:

Earned Income: Subject to federal and state taxes, as well as social security and medicare taxes. This is the most heavily taxed income source on average.

Capital Gains Income: Capital gains income will either be taxed at 0%, 15%, or 20%, depending on how long you held the asset that is getting taxed and what tax bracket you sit in for the year.

Passive Income: The tax implications vary the most in this type of income stream. Depending on the specific type of passive income (whether it’s business income, interest income, etc.), you could get taxed similar to earned income or capital gains income.

Summary: Types of Income

The key to making the most of the three types of income is to balance diversification and gross income.

Suppose earned income and capital gains income are working together to provide enough gross income for you and your family. In that case, it might not be necessary to diversify and attempt to earn passive income.

However, if you currently only make money through earned income and are struggling to build up an emergency fund or pay down debt, looking to diversify and build multiple income streams may be beneficial, along with attempting to increase your earned income.

Remember, there is no limit on the amount of money you can make. So go take advantage of these types of income and start growing your net worth today!

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.