There are a lot of good reasons for you to learn how to stop spending money.

Well, maybe not how to stop spending money altogether, but learning how to spend less in certain areas can help you reach your financial goals. Whether that is to save more, invest more, or better prepare for retirement.

Regardless of the reason, deciding to try to spend less money is a great first step to improving your budget and personal finances overall.

The Problem with Overspending

Overspending is a common problem in the US today. According to Debt.org, total consumer debt is nearing $14 trillion, and the average American carries over $8,000 in credit card debt.

Those are two daunting numbers, and overspending is partially to blame for them.

To put it into context, $14 trillion of consumer debt means that the average American household is carrying about $110,000 in debt!

Overspending Definition: Spending more money than intended and more money than you have.

In my mind, there are two main issues that enable overspending:

- Social media and other news outlets have normalized overspending and confused the difference between being rich and being wealthy

- There are many consumer tools, including credit cards, that make it very easy to go into debt

Combined, the two points above increased the desire to overspend and made it easier to overspend at the same time.

Below we’ll walk through some ideas to help you stop spending money and become a more fiscally responsible person.

How to Stop Spending Money: 10 Ideas to Try

1. Start with a Budget

The first and best tip to stop overspending is to develop a budget. Even if it is just a high level budget.

Create a High Level Budget

A high level budget involves three major buckets:

- Income

- Expenses

- Savings

You need to have an understanding of the money you have coming in (income), how much you are spending (expenses), and how much money is left over to save and invest (savings).

If you are not satisfied with how much you are saving every month, or if you aren’t saving anything, you need to either increase your income or decrease your expenses. Or some combination of both.

If you’re not sure where to start with decreasing expenses, that’s when you need to opt for a more detailed budget.

Create a Detailed Budget

Creating a detailed budget involves tracking every expense.

Yes, every single expense.

There are some apps that can help with this, or a good old fashioned pen and paper will do too. Tracking every dollar that you spend will tell you exactly where your money is going and provide ideas on where you can cut back on spending.

No matter which budgeting route you take, it’s usually the first step to reigning in your spending. It’s hard to cut back on spending or improve your personal finances if you don’t know where your money is going in the first place.

2. Automatically Lower Monthly Expenses

Another option that you have besides cutting out expenses is to lower your current expenses.

For example, you might be able to negotiate lower monthly bills for your phone, internet, cable, and more.

And if you’re worried about having to call all of these providers and negotiate on your own, don’t be, because there are services out there that can do it for you. My favorite is Trim, but you can also check out:

Trim will contact your service provides on your behalf and negotiate a lower payment for your current service. According to its website, Trim has saved its users over $40 million so far!

Trim gets paid by taking a portion (33%) of the money they saved for you, but they only get paid if they are successful.

If Trim saves you $100 annually, you will pay Trim $33.

However, if Trim is unsuccessful in saving money, you owe them nothing! There is no downfall to giving them a try and seeing what you could potentially save.

Plus, Trim does more than just lower your monthly bills, they can also find and cancel unwanted subscriptions (like Netflix or a gym membership) and help you track your budget. You can check out our full review on Trim here or get started with Trim today.

3. Assign a Value to Purchases

Another practice to help you spend less money is to assign a value to every purchase.

I’m not talking about the price of something, but rather, how much you value it.

The idea is not straightforward and may take some time to implement, but in practice, anything you value more than the price is something that could be considered a good purchase.

For example, if you want a new bike and would value it at $500, but the bike only costs $250, it would be considered a good purchase. If the bike had a price of $1,000, you’d probably want to stay away.

Another, easier way to get started with this idea is to calculate what your hourly earnings are. If you make $10 an hour, using the same bike example, you would have to ask yourself if that $250 bike is worth 25 hours of work to you.

Sometimes it’s easier to assign value in terms of hours worked instead of absolute dollars.

The watch out with this idea is that you still cannot buy everything you value. The concept simply helps you make better purchases and buy the things you value the most.

4. Rethink Sales

When it comes to buying things on sale, you have to win the mental battle of framing the sale the right way.

Retailers want you to think about “how much you saved.”

Though, you need to stay focused on “how much you spent.”

Staying focused on the cost rather than the savings is how you make sure you think about sales the right way.

For example, of course, something that was originally $100 and is now $50 looks like a screaming deal. I mean, it’s 50% off!

The key is to still use tip #3 from above and ask yourself, regardless of the original price, is this item worth $50?

If yes, then great, you can consider making the purchase. If the answer is no, then you should pass on it, no matter how big the sale is. Just remember, if you make the purchase, you didn’t save $50, you spent $50!

The same goes for buy now and pay later apps that can breakdown a large upfront cost into smaller payments.

5. Try a No Spend Challenge

The ultimate way to stop spending money is to complete a no spend challenge.

A no spend challenge comes in different shapes and sizes, but the general idea is to only spend money on essential items over a given time period.

For example, you could do a no spend challenge for:

- One day

- A week

- A month

- Three months

- A full year! (this might be a bit extreme)

During that time period, you would be allowed to spend money on essential items like your rent or mortgage, utilities, gas for your car, loan repayments, and groceries.

However, you would need to cut out any non-essential spending, which includes things like eating out at restaurants, buying coffee, new clothing, movies, shopping, and any other discretionary spending.

While a no spend month is generally not a sustainable practice or good idea for the long term, it is a good way for many people to hit the “reset button” and get spending habits back under control. Perhaps you’ll break bad habits along the way, too.

Plus, you’ll instantly save some money by not spending on unnecessary things for a short time period!

6. Pay Yourself First

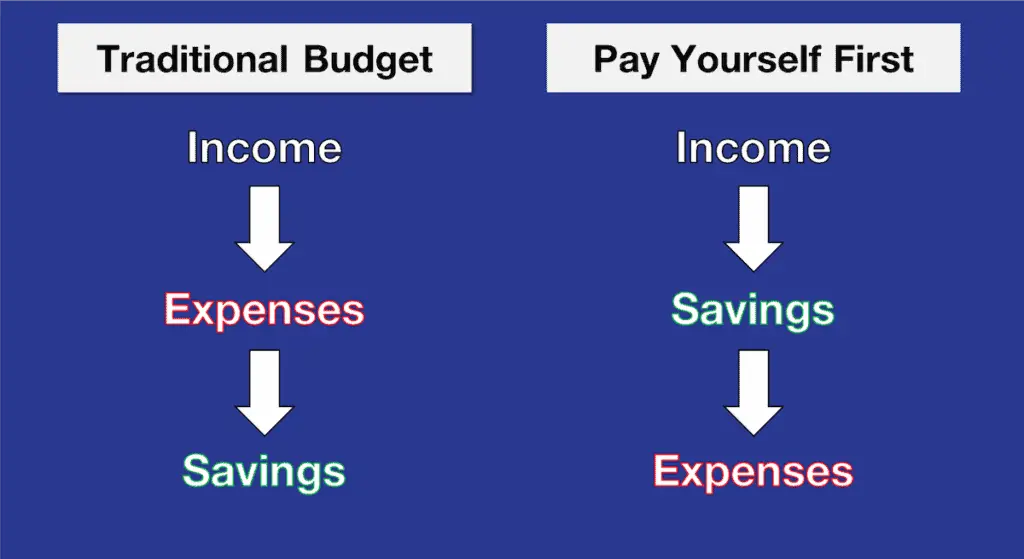

Embracing a pay yourself first mindset involves flipping around the three budgeting buckets we mentioned earlier.

With a traditional budget, you receive income, pay expenses, and save the rest.

With a pay yourself first mindset, you receive income, save money, and use the rest to pay expenses.

This mindset shift helps ensure you are prioritizing saving and investing for your future, and make your expenses fit within those plans.

7. Wait 30 Days

Another trick to help make sure you only spend money on things you value is to wait 30 days before purchasing any non-essential item.

Going back to the bike example, instead of making the $250 purchase immediately, you would wait 30 days before you spend money on it.

If after 30 days you still really want the bike, it’s a good indication that you would value the bike long term and that it would be a good purchase.

If after 30 days you no longer want the bike, well, then you just saved yourself an unnecessary $250 purchase!

8. Avoid Bad Debt

An obvious but useful tip is to avoid bad debt and only spend money on things you can afford.

To be clear, “bad” debt includes things like credit card debt and high interest personal loans. It does not include mortgages and most student loans or car payments.

In order to avoid bad debt, you’ll be forced to only spend on things you can afford. Just because your credit card has a $1,000 credit limit doesn’t mean you should take advantage of all of it.

Some people might recommend to stop using credit cards altogether and only use cash. I don’t, because I love the perks that credit cards offer, but they must be used responsibly and paid off in full every month in order to fully benefit from them.

9. Focus on “The Big Three” Expenses

If you’re struggling to find success in spending less money on small expenses, you might need to focus on the big three expenses, which include:

- Housing

- Transportation

- Food

Lowering any three of these expenses requires a lot of work, but will also provide the largest savings if you are successful.

When it comes to lowering your home expenses, you could look into downsizing or geoarbitrage.

With transportation, the cheapest thing you could do is avoid owning a car. By using public transportation, biking, or walking, you not only save on a car payment, but also on car insurance, car maintenance, and parking.

The third biggest expense for a lot of people comes from food and beverage. Of course, the easiest way to stop spending money here is to go to the grocery store more often and go to restaurants less often. You can also take it one step further by creating a meal plan and shopping list to make sure you stick to your budget at the grocery store.

10. Challenge Yourself to do More

Last, if you really need to stop spending, you should challenge yourself to do more. Whether it’s cooking, cleaning, doing yard work, mowing the lawn, fixing things up, painting, or anything else, you can save a lot of money by doing things yourself and not outsourcing the work.

I understand that not everyone is a handyman and that some of these everyday tasks might be impossible for you, but you might surprise yourself with what you are capable of doing to stop spending and save yourself money.

What to do With the Extra Money You Have

When you stop spending money, you end up giving yourself options for what to do with extra money that is now in your pocket.

Below are three good ideas for places to put your newfound money.

Pay Off Bad Debt

First, you should pay off bad debt if you have it.

We talked about this earlier, and bad debt would include credit card debt, personal loan debt, and in general any debt with an interest rate of over 5-7%.

The threshold between good and bad debt is usually drawn around 5-7% because that is the assumed future return of investing your money.

If you have $100 on hand, it would be better spent paying off debt with a 15% interest rate because that is higher than what you can expect the market to return for you on average. On the flip side, if you have a 3% mortgage, you’re better off making your standard monthly payments and investing your extra money (rather than paying down the mortgage faster) with the hope of making a better return than 3% on average.

Build an Emergency Fund

Once your bad debt is eliminated, you should focus on building an emergency fund.

An emergency fund typically consists of 3-6 months’ worth of expenses saved in a high yield savings account (a type of bank account). The intent of this fund is to cover unexpected expenses like a surprise medical bill or car payment, or keep you covered for a short time period in case you lose your job.

Invest in Index Funds

Of course, you could also invest your money.

Investing in index funds is a great way for new investors (and experienced investors for that matter) to start preparing for retirement and reach their long-term financial goals.

Summary: How to Stop Spending Money

There are many different strategies, tips, and tricks you can try to stop spending money, but the first and most important step to take is to get an understanding of your budget.

It’s hard to curb a bad spending habit if you don’t know how bad it is or where the money is going.

From there, you’ll be able to put some of these ideas to work to help you stop spending and save more money!

Just Start Investing is a personal finance website that makes investing easy. Learn the simple strategies to start investing today, as well as ways to optimize your credit cards, banking, and budget. Just Start Investing has been featured on Business Insider, Forbes, and US News & World Report, among other major publications for its easy-to-follow writing.